Voltas Share Price: Hot or Hype? Unveiling Analyst Insights and Beyond

Voltas Share Price:

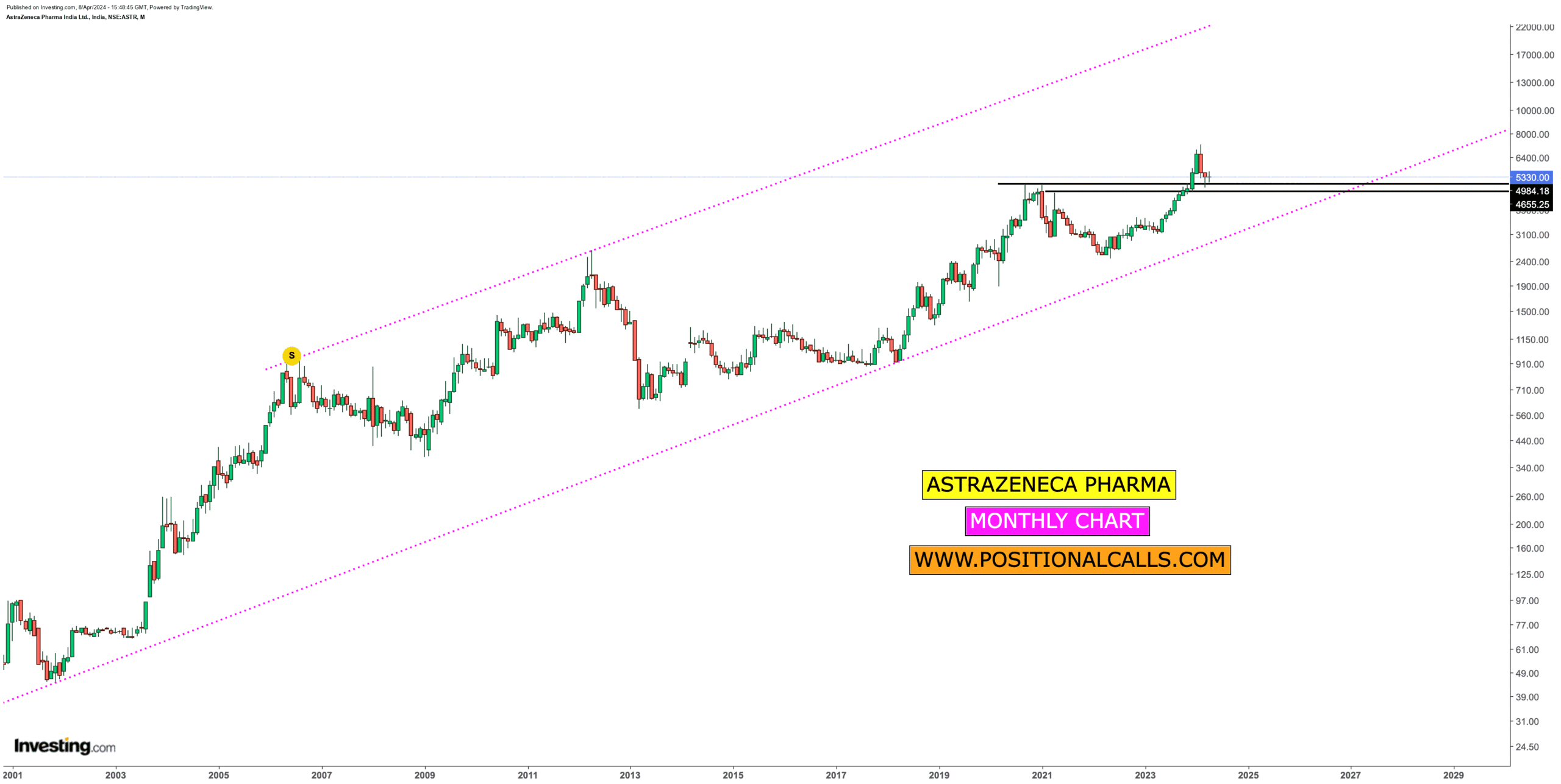

HEAD AND SHOULDER BREAKOUT IN WEEKLY CHART NOW CMP 1080-1090

SUPPORT 810

TARGET 1700++

VIEW SHORT TO MEDIUM TERM

Is Voltas the next multi-bagger in your portfolio? This Indian engineering giant has been making waves in the market, and investors are abuzz with buy recommendations and sky-high target prices. But before you jump on the bandwagon, let’s dive deeper into the facts, figures, and expert opinions to understand if Voltas truly deserves a place on your watchlist.

Voltas Share Price: A Legacy of Excellence

Established in 1918, Voltas boasts a rich heritage in diverse sectors like air conditioning, engineering projects, textiles, and refrigeration. Its dominant position in the air conditioning market (think Voltas AC = Cool Summers!) makes it a household name across India. But Voltas is much more than just ACs. Its diversified business portfolio and strong execution capabilities have consistently drawn the attention of investors seeking long-term value creation.

Voltas Share Price: The Buzz: Buy Recommendations Galore

Several prominent analysts have showered Voltas with buy recommendations, painting a rosy picture for the future. Let’s take a peek into their crystal balls:

- Motilal Oswal:

A bullish target price of Rs 1150, citing a solid recovery in the cooling segment and potential market share gains. - Prabhudas Lilladher:

Projecting net sales growth of 17.5% for the year, driven by robust demand and expanding product portfolio. - Bazaartrend:

We recommend a “Strong Buy” for long-term investors with a stop-loss of Rs 849.92, indicating confidence in the stock’s upward trajectory.

But wait, a word of caution! Analyst recommendations are just one piece of the puzzle.

Voltas Share Price: Beyond the Hype: A Critical Look at Voltas

- Recent financial performance:

While the future looks bright, Voltas’ Q3 FY24 results were mixed, with a decline in total income compared to the previous quarter.

Understanding the reasons behind this dip is crucial before making investment decisions. - Market headwinds:

Rising interest rates and potential inflationary pressures could dampen consumer demand, impacting Voltas’ sales across segments. - Valuation:

With the stock price already near its 52-week high, it’s essential to assess if the current valuation reflects future growth potential or is simply riding a wave of sentiment.

Voltas Share Price: Beyond Analyst Punditry: Your Due Diligence

Please don’t let analyst projections be your sole guiding light. Your investment journey requires your own meticulous research and risk assessment. Here are some crucial factors to consider:

- Voltas’ competitive landscape:

How does it stack against rivals like Bajaj Electricals and Daikin? Understand their strengths and weaknesses to gauge Voltas’ market share potential. - Growth drivers:

What are Voltas’s key initiatives and strategies to fuel future growth? Do you think these plans are realistic and well-defined? - Your risk appetite:

Remember, no investment is without risk. Align your investment horizon and risk tolerance with Voltas’ volatility and long-term growth prospects.Read More:

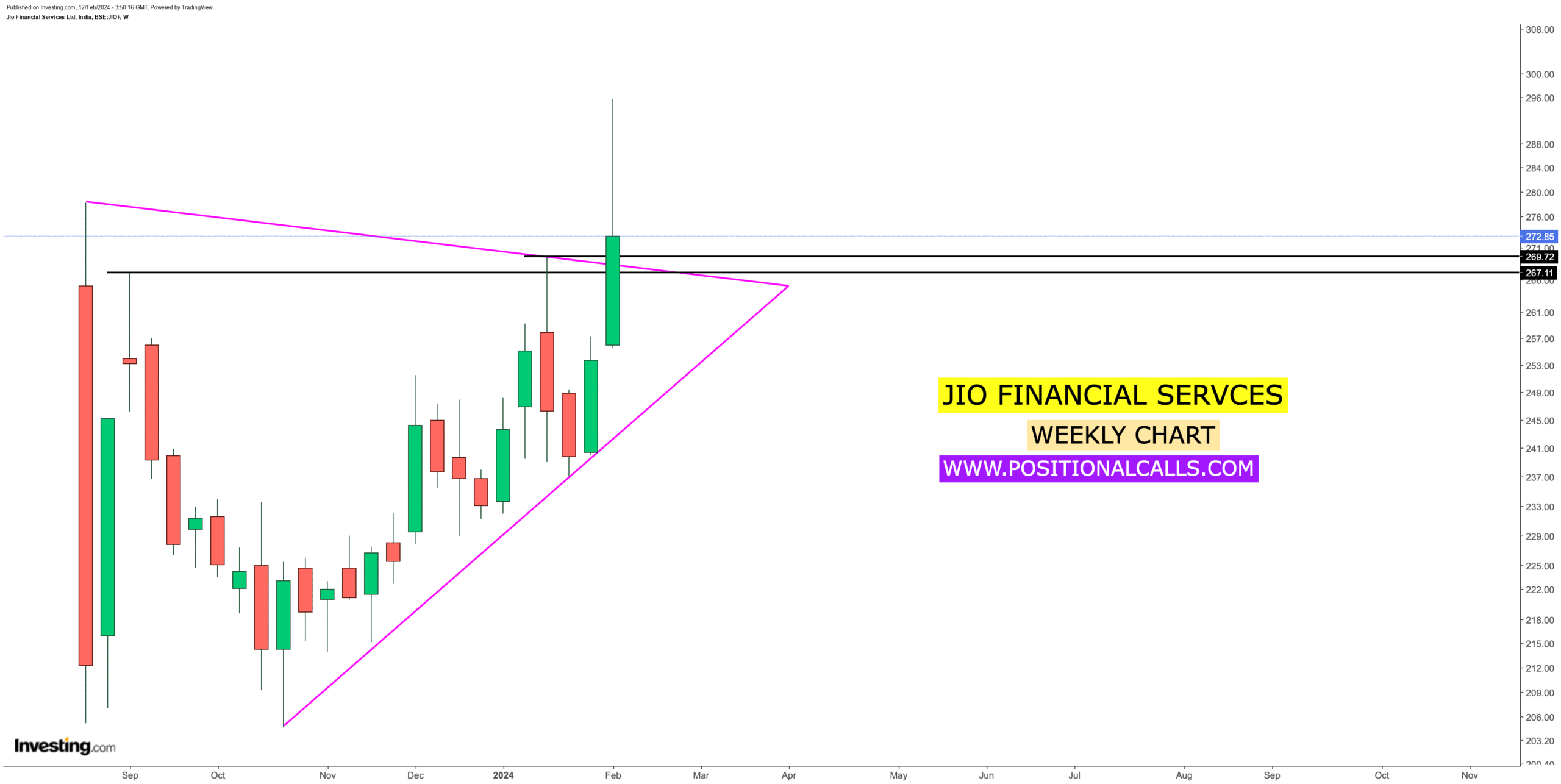

Head and Shoulders: Chart Pattern Dominating High-Pressure Trades

Voltas Share Price: The Verdict: To Buy or Not to Buy?

The answer lies within your analysis and risk appetite. While Voltas presents exciting possibilities, a healthy dose of scepticism and thorough research is essential before placing your bets. Don’t get carried away by the hype; invest with your head, not your heart.

Bonus Tip:

Diversify your portfolio! Put only some of your eggs in the Voltas basket. Spread your investments across different sectors and asset classes to mitigate risk and maximise returns.

Remember, the stock market is a dynamic beast. Stay informed, do your due diligence, and invest wisely!