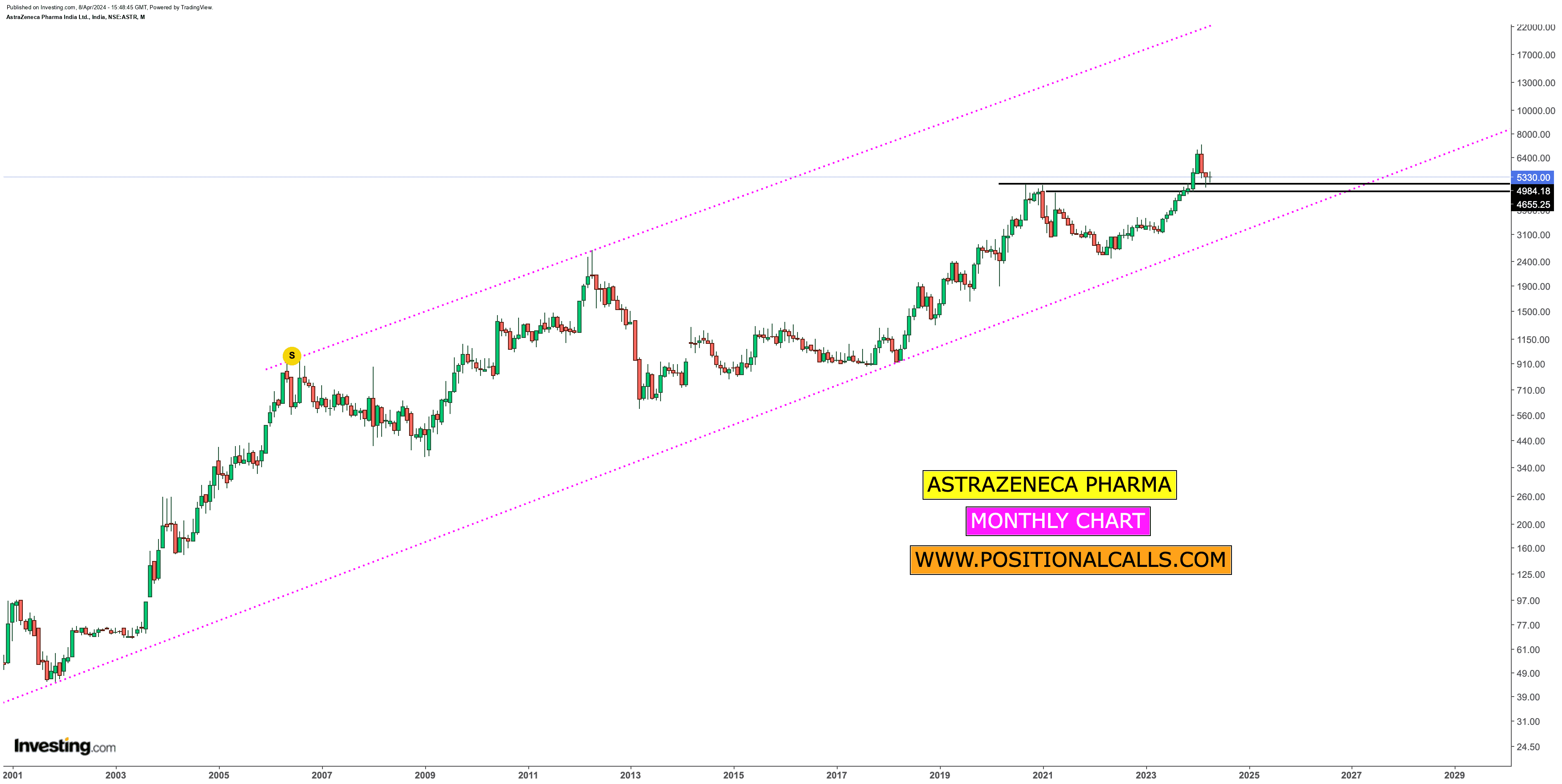

AstraZeneca Stock Looking Good Now 5300-5330

Support 4600

Target Expecting 8715++

View Swing To Short Term

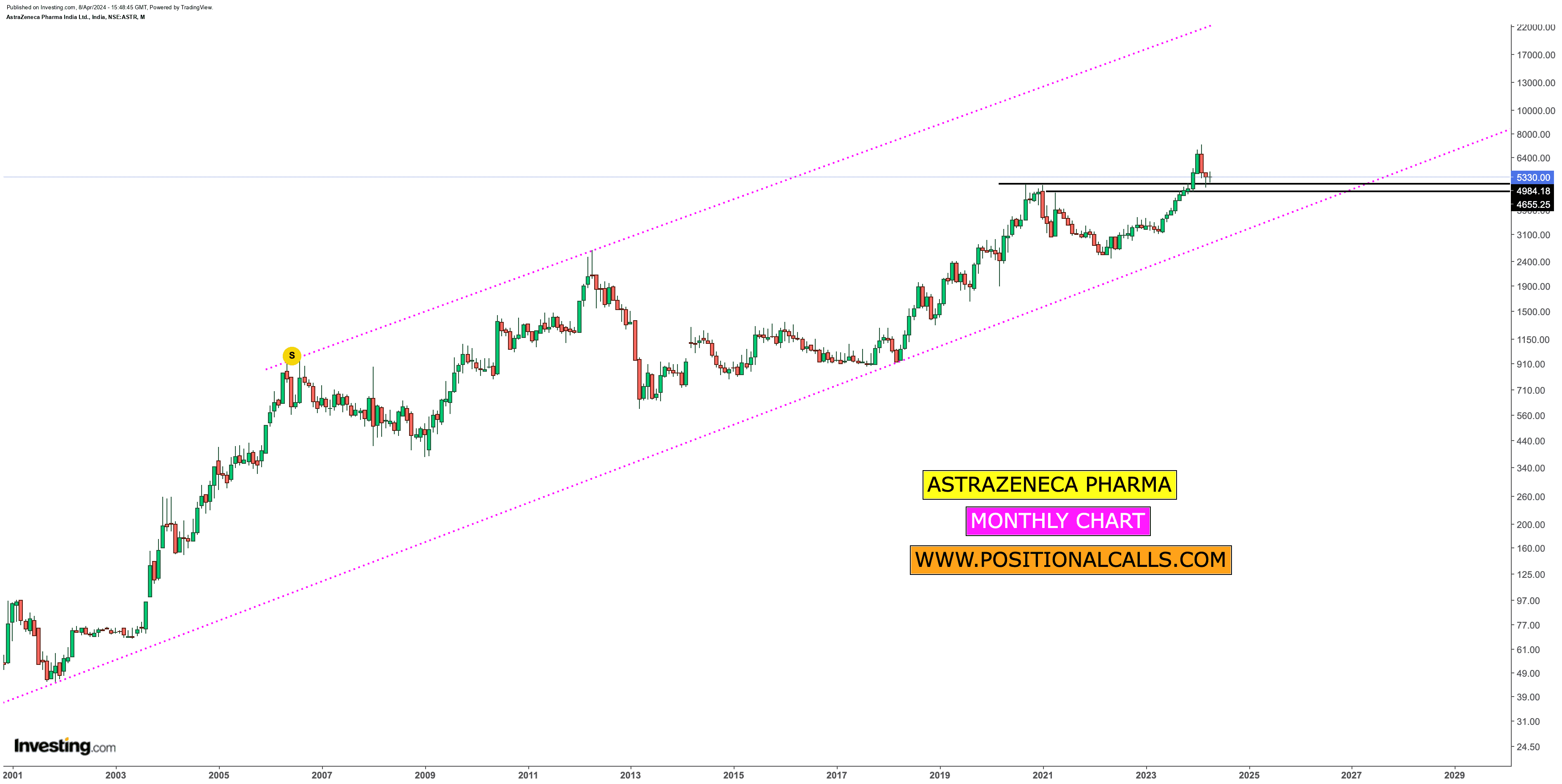

AstraZeneca Stock Looking Good Now 5300-5330

Support 4600

Target Expecting 8715++

View Swing To Short Term

Unlocking Potential in the Pharmaceutical Frontier

AstraZeneca Stock: Introduction

AstraZeneca Stock: Introduction

Investing in the stock market is akin to navigating a complex maze. Amidst the myriad options, AstraZeneca Pharma Ltd. (NSE: ASTRAZEN) stands out as a compelling choice. In this comprehensive blog, we delve into the reasons why AstraZeneca shares deserve a place in your investment portfolio. Buckle up as we explore this pharmaceutical giant’s technical and fundamental aspects.

Strong Fundamentals: A Pillar of Strength

AstraZeneca Stock: Robust Financial Performance

AstraZeneca’s financials paint a promising picture. Let’s dissect the key metrics:

- Earnings Per Share (EPS) Growth:

AstraZeneca has witnessed impressive annual EPS growth, reflecting its ability to capitalise on market opportunities. This consistent upward trajectory bodes well for shareholders. - Profit Margin: A healthy profit margin indicates efficient cost management and pricing power.

AstraZeneca’s margins remain robust, bolstering investor confidence.

Strategic Positioning

AstraZeneca’s diversified portfolio spans therapeutic areas such as oncology, cardiovascular, respiratory, and immunology. Notable drugs include:

- Tagrisso (osimertinib)

is a targeted therapy for non-small cell lung cancer (NSCLC) that has demonstrated remarkable clinical results. As NSCLC cases surge globally, Tagrisso’s market potential remains substantial. - Imfinzi (Durvalumab)

is an immunotherapy drug targeting multiple cancers, including bladder and lung cancer. Its efficacy and safety profile make it a strong contender in the immuno-oncology space.

AstraZeneca Stock: Technical Insights: Riding the Momentum

Price Movement and Momentum

- AstraZeneca’s stock has surged by 262% over the past five years, outperforming the broader market. Recent gains in the last quarter of 16% indicate positive momentum.

- The stock’s current price is ₹5330, with a 52-week high of ₹7,220.95. This upward trajectory suggests investor confidence.

Technical Analysis

- Moving Averages:

AstraZeneca’s moving averages indicate a neutral trend. Traders should closely monitor price movements. -

Support and Resistance Levels:

Key levels include ₹4600(support) and ₹8715 (resistance). These levels guide trading decisions.

AstraZeneca Stock: Risks and Considerations

- Market Volatility:

Like any investment, AstraZeneca shares are subject to market fluctuations. Stay informed and exercise patience. - Regulatory Challenges:

The pharmaceutical industry faces regulatory hurdles. Monitor developments closely.Read More: Krystal Integrated Services IPO: A Comprehensive Dive for Potential Investors

Conclusion

AstraZeneca’s strong fundamentals, strategic positioning, and technical momentum make it an appealing investment choice. However, always conduct thorough research and consult a financial advisor before making any investment decisions. Remember, investing involves risks, but AstraZeneca’s journey is one of innovation, resilience, and patient-centricity—qualities that resonate with long-term investors.

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. Always conduct your research and consult professionals before investing.