Should You Buy Biocon Shares?

Biocon Limited, a leading biopharmaceutical company based in India, has recently captured investor interest. The company’s stock price has steadily risen, and analysts offer a mix of recommendations. This blog delves into Biocon’s fundamentals, growth prospects, and potential risks to help you decide about buying Biocon shares.

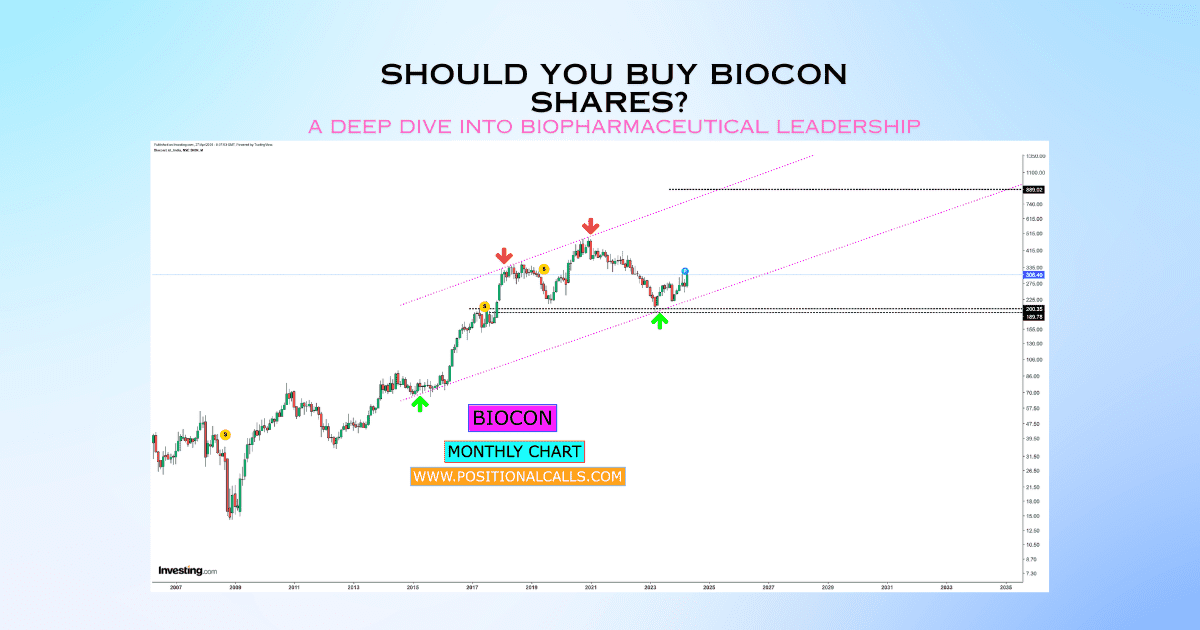

BIOCON SHARE TRADING BETWEEN 300-310

SUPPORT 200

EXPECTING TARGET NEARLY RS 900

Should You Buy Biocon Shares? : A Legacy of Innovation in Biopharma

Established in 1978, Biocon has carved a niche in the Indian biopharmaceutical landscape. They specialize in developing, manufacturing, and commercializing innovative biopharmaceutical products, including generics, insulins, and novel biologics. The company boasts a strong presence in both domestic and international markets.

Should You Buy Biocon Shares? Recent performance and analyst opinions

Biocon’s stock price has exhibited positive momentum, recently reaching a new 52-week high. This uptrend coincides with the successful integration of Viatris, a significant partnership that bolsters Biocon’s product portfolio and market reach.

Financial analysts present a diverse range of recommendations. Some, Positiional Calls a “buy” recommendation with a target price exceeding Nearly Rs. 900. Conversely, others maintain a “hold” stance, citing factors like recent reductions in mutual fund holdings.

Factors to Consider Before Buying Biocon Shares

Strengths:

- Robust Product Portfolio:

Biocon boasts a diversified product portfolio encompassing biosimilar insulins, generic injectables, and novel biologics. The Viatris integration further strengthens this offering. - Research & Development (R&D) Focus:

Biocon prioritizes R&D, consistently investing in developing next-generation biopharmaceuticals. This focus on innovation positions the company for future growth. - Strong Financials:

Biocon has healthy finances, including positive cash flow generation and a strong balance sheet.

Weaknesses:

- Profitability Concerns:

While Biocon generates revenue, some analysts highlight a decline in Return on Capital Employed (ROCE) in recent years, indicating potential inefficiencies. - Regulatory Environment:

The biopharmaceutical industry is subject to stringent regulations. Delays in regulatory approvals can impact product launches and revenue streams. - Biocon faces intense competition from established domestic and global players. Maintaining market share requires continuous innovation and strategic differentiation.

Opportunities:

- Growing Biopharma Market:

The global biopharmaceutical market is projected for significant expansion in the coming years, fueled by rising healthcare needs and an aging population. Biocon is well-positioned to capitalize on this trend. - Focus on Emerging Markets:

Biocon can leverage its expertise and product portfolio to tap into the high-growth potential of emerging markets in Asia and Africa. - Strategic Alliances:

Partnerships like the one with Viatris present Biocon with opportunities to expand its reach, access new markets, and develop groundbreaking therapies.

Threats:

- Macroeconomic volatility:

Global economic headwinds and currency fluctuations can have an impact on Biocon’s profitability and international operations. - Patent Expirations:

The expiration of patents on certain drugs can lead to increased competition from generic manufacturers, potentially eroding Biocon’s market share. - Clinical Trial Risks:

The success of Biocon’s pipeline drugs hinges on the outcome of ongoing clinical trials. Delays or setbacks in these trials can negatively affect the company’s future prospects.

Should You Buy Biocon Shares? Beyond the Bullish and Bearish: A Balanced Perspective

Biocon presents a compelling investment opportunity for those seeking exposure to the growing biopharmaceutical sector. The company’s strong product portfolio, R&D focus, and healthy financials are positive indicators. However, potential investors should be mindful of the competitive landscape, regulatory hurdles, and economic uncertainties.

Should You Buy Biocon Shares? Conducting your due diligence

Before making any investment decisions, thorough due diligence is crucial. Here are a few resources to help you evaluate Biocon:

- Company Website:

Biocon’s website provides comprehensive information about their business operations, financials, and future plans. https://www.globaldata.com/company-profile/biocon-ltd/. - Financial Reports: Scrutinize Biocon’s annual reports and financial statements to gain insights into their financial health and performance.

- Analyst Reports: Research analyst reports offer valuable insights into Biocon’s prospects and potential risks. Consider reports from reputable financial institutions.

- Industry Publications:

Stay up-to-date on biopharmaceutical industry trends and news.

READ MORE: Bajaj Finance, Bajaj Finserv Drag Sensex Lower: Unpacking the Impact on Indian Markets

Conclusion

Biocon is a leading player in the Indian biopharmaceutical industry with a promising future. The company’s strengths in innovation, product portfolio, and financial performance make it an attractive investment proposition. However, potential investors should acknowledge the inherent risks associated with the industry and conduct thorough research before