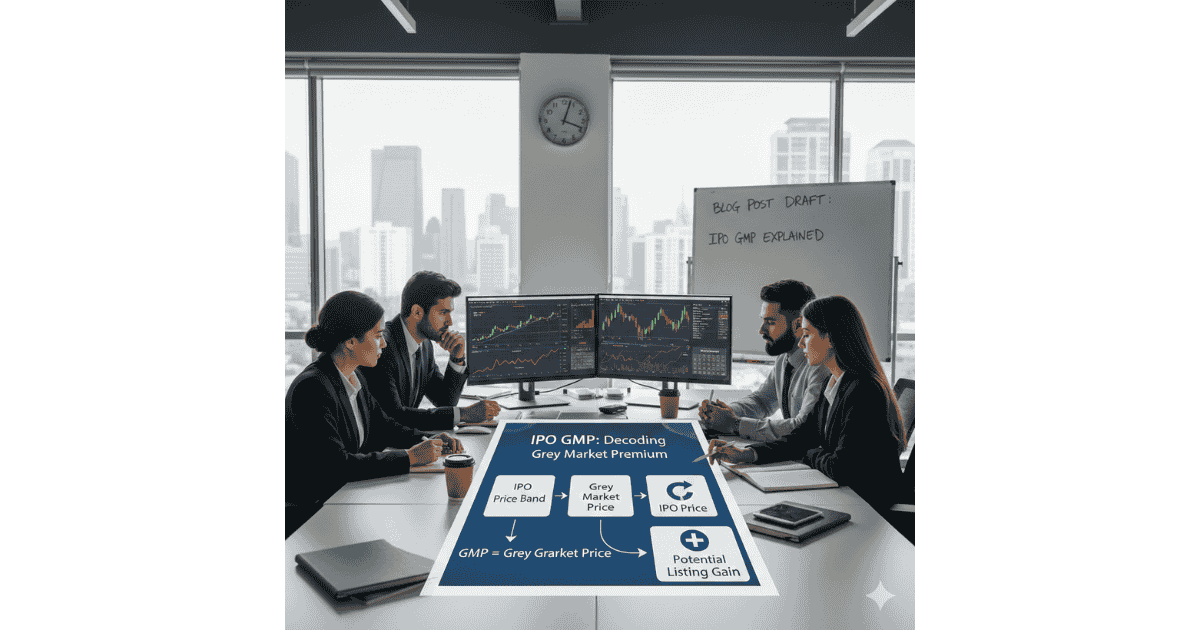

What Is IPO GMP? Meaning, How It Works & Why It Changes Daily

IPO GMP is one of the most searched IPO-related terms, yet it is often misunderstood. Investors frequently see IPO GMP numbers during an issue period but are unsure what they actually indicate.

This page explains the IPO GMP meaning, how it works, and why it changes — in a clear, non-advisory, institutional manner.

What Is IPO GMP? (Simple Meaning)

IPO GMP stands for Initial Public Offering Grey Market Premium.

It refers to the unofficial premium at which an IPO share is traded in the grey market before the company is listed on the stock exchange.

In simple terms:

IPO GMP shows how much extra buyers are willing to pay for an IPO share before listing.

Example: IPO GMP Explained

- IPO issue price: ₹100

- Grey Market Premium (GMP): ₹30

This means the IPO share is being informally traded at ₹130 (₹100 + ₹30) before listing.

Important: IPO GMP is not the listing price. It is only an indicator of demand and sentiment.

What Is the Grey Market?

The grey market is an unofficial market where IPO shares and applications are traded before listing.

- Operates outside recognised stock exchanges

- Not regulated by SEBI

- Transactions are trust-based

- Prices depend on demand and market sentiment

Because it is unofficial, IPO GMP data is not published by stock exchanges.

IPO Grey Market Premium: How IPO GMP Works

- An IPO opens for subscription

- Investor demand builds or weakens

- Grey market participants quote a premium

- GMP changes daily based on sentiment

IPO GMP remains dynamic until the listing day.

Why Does IPO GMP Change Every Day?

IPO GMP changes because market conditions and investor sentiment change daily.

- IPO subscription data (QIB, NII, Retail)

- Overall stock market movement

- Company or sector-related news

- Global market cues

- Time remaining for listing

This is why searches like “IPO GMP today” increase during active IPO periods.

IPO GMP Meaning: Is IPO GMP Official or Reliable?

No. IPO GMP is:

- Not official

- Not regulated

- Not guaranteed

It can be used only as:

- A short-term sentiment indicator

- A proxy for IPO demand

- A reference point — not a decision tool

Think of IPO GMP as a market mood indicator, not a forecast.

Does High IPO GMP Guarantee a Good Listing?

No. Absolutely not.

There have been many cases where:

- High IPO GMP resulted in weak listings

- Low IPO GMP resulted in strong listings

Listing performance depends on:

- Overall market conditions

- Valuation comfort

- Institutional participation

- Listing-day sentiment

Is IPO GMP Legal in India?

Grey market activity is not illegal, but it is:

- Unregulated

- Risky

- Not protected by law

Retail investors do not need to participate in the grey market to apply for IPOs.

IPO GMP vs IPO Fundamentals

| IPO GMP | IPO Fundamentals |

|---|---|

| Short-term sentiment | Long-term business strength |

| Unofficial | Official disclosures |

| Highly volatile | Relatively stable |

| Emotion-driven | Data-driven |

Frequently Asked Questions (FAQ)

What is IPO GMP in simple terms?

IPO GMP is the unofficial extra price buyers are willing to pay for an IPO share before it is listed.

Is IPO GMP official or regulated?

No. IPO GMP is not regulated or published by stock exchanges or SEBI.

Does high IPO GMP guarantee listing gains?

No. IPO GMP only reflects sentiment and does not guarantee listing performance.

Why does IPO GMP change daily?

IPO GMP changes due to demand, subscription data, market movements, and news flow.

Should retail investors rely on IPO GMP?

IPO GMP should be used only as a reference indicator, not as a decision-making tool.

Final Takeaway

IPO GMP is not a prediction tool.

It is simply a snapshot of market sentiment before listing. Use it to understand interest levels — not to expect guaranteed outcomes.