Adaniensol:

Adani Energy Solutions Limited is the largest private sector power transmission company in India. It is part of the Adani Group, a diversified conglomerate with interests in infrastructure, energy, and resources. ADANIENSOL India’s renewable energy revolution is in full swing, and at the forefront stands Adani Energy Solutions Limited (ADANIENSOL), a subsidiary of the Adani Group. With ambitious expansion plans, aggressive acquisitions, and a focus on clean energy solutions, ADANIENSOL has captured the imagination of investors. But, before you dive headfirst into this potentially lucrative stock, let’s delve deeper into the company’s strengths, challenges, and whether it deserves a “Buy” recommendation in 2024.

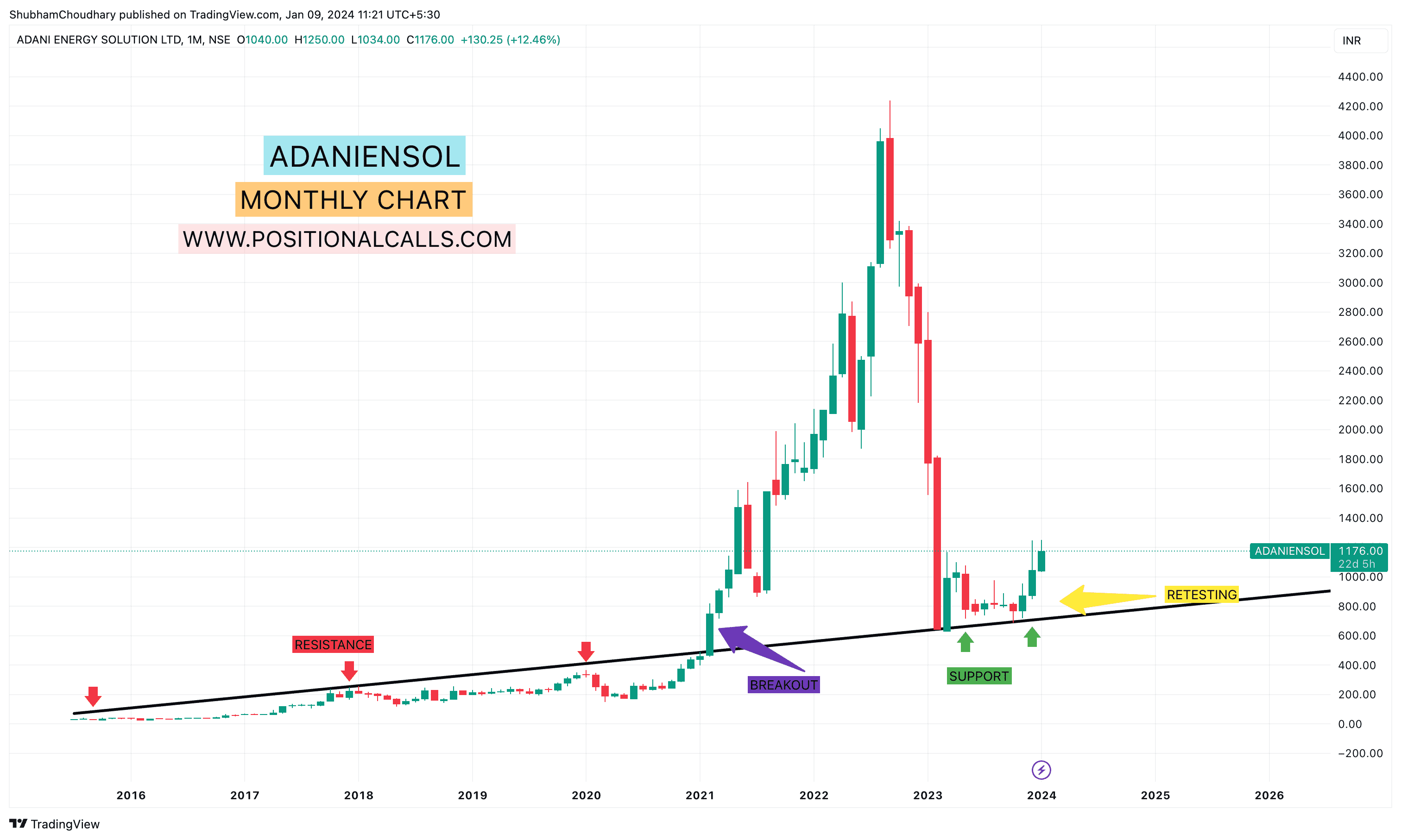

ADANIENSOL TRADING BETWEEN 1170-1175

SUPPORT 600

TARGET EXPECTING 4200 6400

ONLY FOR SHORT TO LONG-TERM VIEW

- Business: Power transmission and distribution

- Presence: Across the western, northern and central regions of India

- Market cap: ₹1,29,843 crore (as of January 8, 2024)

- Share price: ₹1,164 (as of January 8, 2024)

- Website: https://www.adanienergysolutions.co/

Adaniensol: Riding the Renewable Wave

- Market Leader in Solar Power:

ADANIENSOL is India’s largest integrated solar power company, boasting a robust portfolio of solar power projects across the entire value chain, from manufacturing and development to generation and distribution. This vertical integration gives them a competitive edge and positions them to capitalise on the booming Indian solar market. - Diversification Play:

ADANIENSOL isn’t just about solar. They’re expanding into other clean energy segments like wind power, hybrid solutions, and storage. This diversification mitigates risk and opens doors to new growth opportunities. - Government Tailwinds:

India’s ambitious renewable energy targets and supportive policies provide a fertile ground for ADANIENSOL’s growth. The government’s focus on clean energy aligns perfectly with the company’s vision, creating a favourable regulatory environment.

Adaniensol: Challenges on the Horizon

- Debt Concerns:

ADANIENSOL’s rapid growth has been fueled by debt, raising concerns about its financial sustainability. The company needs to manage its debt burden effectively to maintain investor confidence. - Competition:

The renewable energy space in India is getting crowded, with established players and new entrants vying for market share. ADANIENSOL must differentiate itself through innovation and cost efficiency to maintain its competitive edge. - Execution Risks:

Successfully integrating acquired assets and executing ambitious expansion plans can be challenging. Any hiccups in project execution could derail growth and impact investor sentiment.

Adaniensol: The Verdict: Buy, Hold, or Sell?

Analysts are generally bullish on ADANIENSOL, with a consensus “Buy” recommendation. The strong market outlook for renewable energy and andOL’s leadership position and diversification strategy paints a promising picture. However, the debt burden and execution risks warrant caution.

Adaniensol: For Aggressive Investor

If you have a high-risk tolerance and a belief in the long-term potential of renewable energy, ADANIENSOL could be a compelling buy. The stock’s recent price correction presents an attractive entry point.

Adaniensol: For Cautious Investor

If you’re more of a cautious investor, you should wait until the company has proven that its growth plans are successfully implemented and has addressed its debt issues. You can also explore other renewable energy stocks with lower risk profiles.

Adaniensol: Key Takeaways-

- ADANIENSOL is a leading player in India’s renewable energy space with solid growth prospects.

- The company’s diversification, market leadership, and supportive government policies are attractive factors.

- However, debt concerns and execution risks need to be carefully considered.

Depending on your risk appetite, ADANIENSOL could be a “Buy” or a “Hold” for 2024.

Read More: Jyoti CNC Automation Limited IPO: Revving Up for Growth?

Adaniensol: Beyond the Buy Recommendation

This blog is about more than just whether you should buy ADANIENSOL. It’s about understanding the company’s potential and the risks involved. Do your research, analyse financial statements, and consult with financial advisors before making investment decisions. Remember, the stock market is volatile, and even the best recommendations have no guarantees.