KICL Share Buy Recommendation 2025:

Kalyani Investment Company Limited (NSE: KICL, BSE: 533302) has become an increasingly discussed name in the financial markets in 2025. As an investment holding company under the Bharat Forge Group, KICL primarily invests in securities, including equity shares, mutual funds, and debt instruments. With growing attention on value-based holding companies, investors are questioning whether KICL presents a favorable buy recommendation this year.

This in-depth guide analyzes whether KICL stock is worth adding to your portfolio, supported by its price targets, technical trends, financial performance, and future outlook for 2025 and beyond.

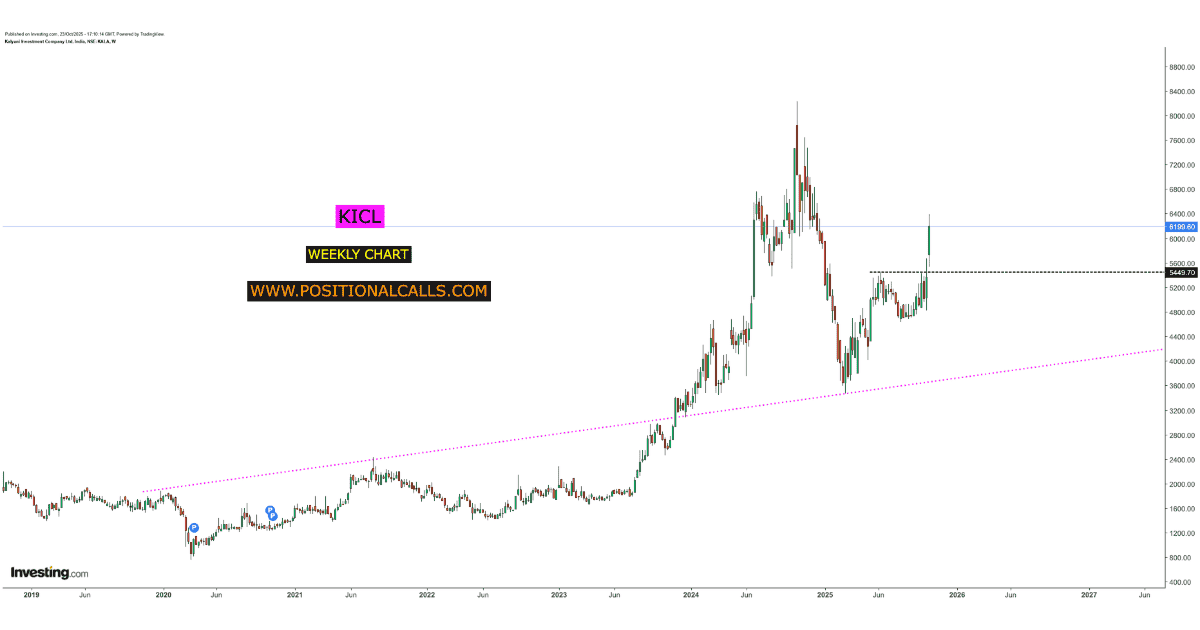

KICL TRADING NEAR 6100

SUPPORT 4600 – 4000

Target Expecting:-

Target 1:

₹7400

Target 2:

₹9800

KICL Share Buy Recommendation 2025: Overview

Kalyani Investment Company Ltd (KICL) operates as a non-banking financial company (NBFC), focusing mainly on long-term investments in group companies and select external entities. The broader Bharat Forge Group ecosystem strongly influences its performance, indirectly contributing to India’s manufacturing and capital goods boom.

Key highlights:

- Promoter holding:

74.97%, as of September 2025. - Industry:

Asset Management & Financial Services - Market Cap:

₹20.94 billion - P/E Ratio:

29.27x (TTM) - Earnings Per Share (EPS):

₹58.81

KICL Share Buy Recommendation 2025: Performance and 2025 Target

Recent forecasts show KICL trading near ₹6199 levels as of October 2025, with bullish technical momentum above key moving averages. Technical and fundamental forecasts provide a positive outlook despite short-term volatility.

Advanced technical price action model:

- Target 1:

₹7400 - Target 2:

₹9800 - Stop Loss Zone:

₹4000 – 4600 range

This range indicates upside potential of 7–9% by Q4 2025 with key stop-loss management, suggesting a medium-term buying opportunity for momentum traders and long-term investors.

KICL Share Buy Recommendation 2025: Financial Performance Breakdown

KICL’s recent quarterly reports reveal a mix of results, where revenue increased by 20% YoY, but profitability dipped due to associate losses.

| Metric | Q1 FY2025 | YoY Change |

|---|---|---|

| Total Income | ₹57.82 crore | +20% |

| Profit After Tax | ₹20.76 crore | -30% |

| EPS | ₹4.76 | ↓ from ₹6.80 |

On an annual basis, the company continues maintaining strong margins:

- Gross Margin:

100% - Operating Margin:

93.67% - Profit Margin:

over 93%

Despite reduced profits in the short term, strong operational efficiency and stable cash equivalents make KICL resilient in volatile market cycles.

KICL Share Buy Recommendation 2025: Why KICL May Be a Smart Buy in 2025

1. Deep Value Opportunity

Trading at just 0.31x book value, KICL offers an undervalued play in the NBFC-investment segment despite strong backing from group companies like Bharat Forge.

2. Portfolio of Premium Holdings

The company’s major assets include stakes in Hikal Ltd and other Bharat Forge subsidiaries, providing long-term capital appreciation potential as India’s industrial growth accelerates.

3. Strong Promoter Confidence

A consistently high promoter shareholding of ~75% reflects trust and operational stability.

4. Macroeconomic Tailwinds

As India’s NBFC and manufacturing sectors expand, aligned companies like KICL stand to benefit from capital market revival and dividend inflows.

5. Technical Confirmation

KICL’s position above the 25-day and 50-day moving averages signals sustained bullish sentiment with potential for a 12–15% medium-term upside.

KICL Share Buy Recommendation 2025: Risks to Watch Before Buying KICL

While KICL appears fundamentally sound, investors should monitor:

- Associate Company Volatility:

Losses in subsidiaries like Hikal can affect consolidated profit lines. - Low Liquidity:

Thin trading volumes may cause higher price fluctuations during market corrections. - Book Value Gap:

A wide gap between intrinsic and market value could persist unless underlying investments unlock value.

Short-Term vs. Long-Term Investment Outlook

| Horizon | View | Key Action |

|---|---|---|

| Short-Term (3–6 months) |

Bullish momentum | Accumulate on dips around ₹5,400–₹5,100 |

| Medium-Term (1 year) |

Upside potential 10–15% | Hold with stop loss below ₹4600 |

| Long-Term (3+ years) | Multi-bagger potential via Bharat Forge exposure | 9800+ SIP-style investing recommended |

Experts tracking holding companies predict that KICL’s share price could touch ₹7000–₹7400 levels by late 2026, supported by dividend gains and improved group company valuations.

Actionable Tips for Investors

- Buy Zone:

₹5,100–₹5,400 range, aligning with technical support - Target 2025:

₹7400+ (short-term)/₹9800+ (long-term). - Stop Loss:

₹4000 – 4600 - Portfolio Allocation:

5–7% of the total equity portfolio for moderate-risk investors. - Hold Duration:

12–24 months to leverage compounding effects of NBFC asset growth

If held with long-term patience, KICL can act as a proxy investment into Bharat Forge’s ecosystem, combining diversification with stability.

Frequently Asked Questions

1. Is KICL a good stock to buy now?

Yes, considering its undervalued P/B ratio, strong promoter backing, and bullish 2025 technicals, KICL can be a worthwhile medium-term buy.

2. What are the key financial indicators for KICL?

93% profit margin, steady EPS growth (₹58+), promoter holding near 75%, and increasing revenue despite temporary profit decline.

3. What is KICL’s price target for 2025?

Analysts estimate a ₹7000–₹7400 range by the end of 2025 depending on market sentiment.

4. How does KICL compare with other NBFC investment companies?

Its risk-adjusted return potential and backing from Bharat Forge offer a unique value play versus peers like Bajaj Holdings or JM Financial.

Related Internal Reads

- Top NBFC Stocks to Watch in 2025

- How to Spot Undervalued Value Stocks in India

- Bharat Forge Group: Long-Term Investment Analysis

Suggested External Reference

For additional financial insights, refer to MoneyControl’s KICL stock analysis page, which provides live financial data, investor updates, and market depth reports.

READ MORE: SKM Egg Products (SKMEGGPROD): The Breakout Muhurat Trading 2025 Pick for Samvat 2082

Conclusion

Kalyani Investment Company Limited presents a compelling case for value-oriented investors in October 2025. With solid fundamentals, robust group backing, and bullish short-term momentum, KICL qualifies as a “buy on dips” candidate for medium- to long-term investors targeting stable returns.

A disciplined entry near technical supports with a holding period of at least one year could yield healthy returns, especially if India’s NBFC and manufacturing expansion continue. Investors seeking financial sector bets should consider allocating a portion of their portfolio to KICL in 2025.