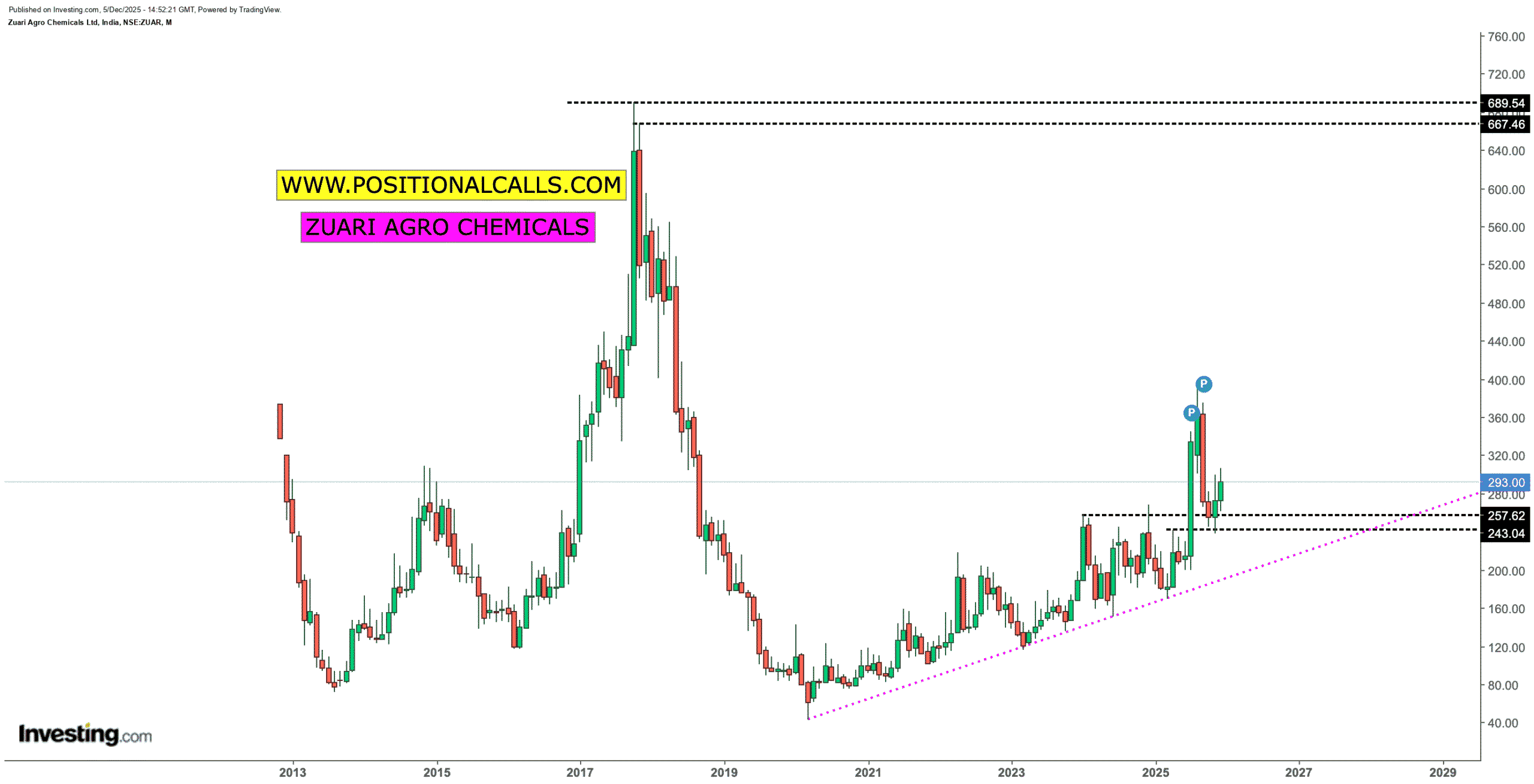

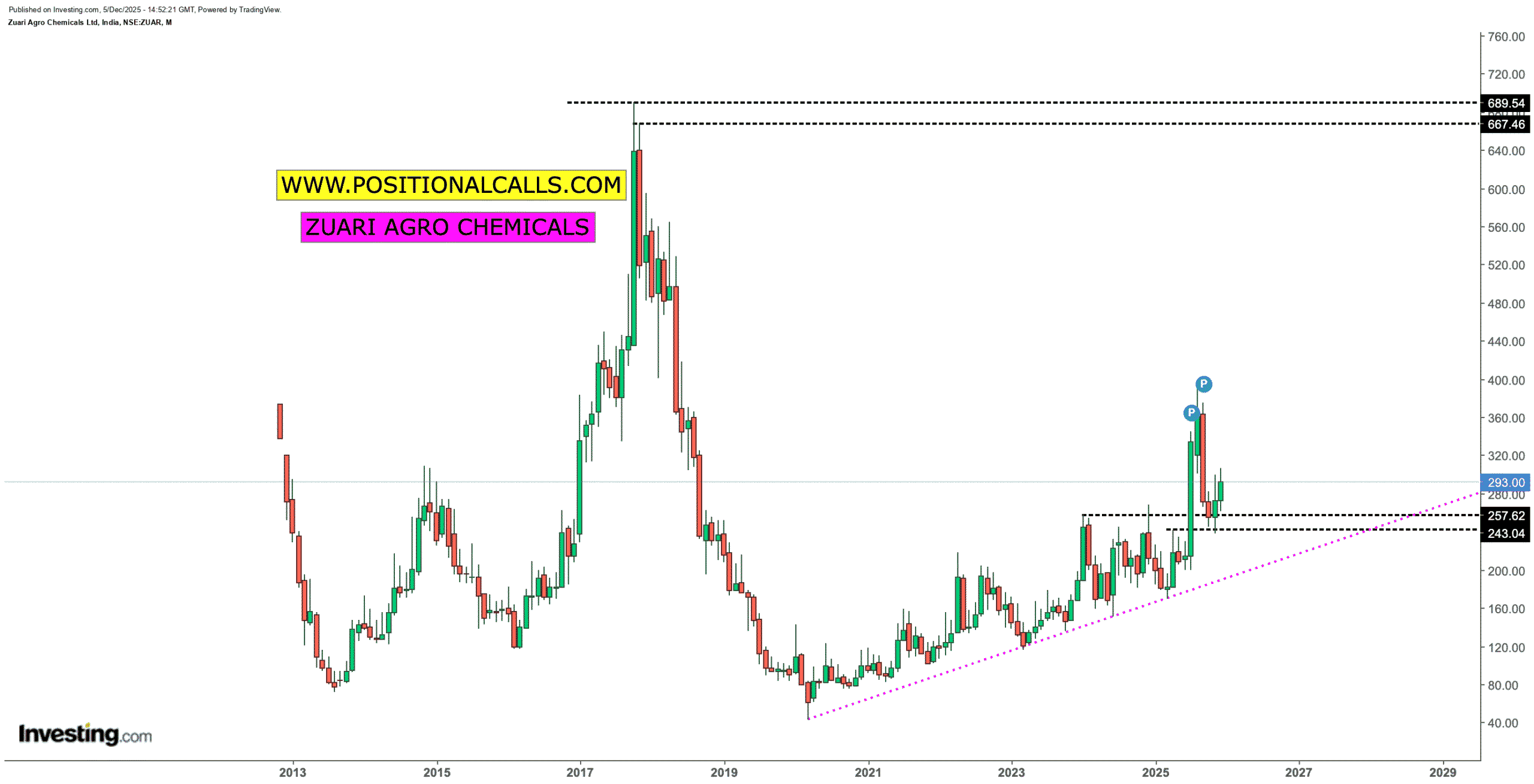

ZUARI AGRO CHEMICALS IS NOW TRADING NEAR 290

SUPPORT 170

TARGETS 650++

Zuari Agro Chemicals: Introduction: Why Is Trending Now

The Indian fertilizer sector is experiencing a compelling growth narrative in late 2025, and Zuari Agro Chemicals stands out as a contrarian pick for savvy investors seeking mid-cap exposure to India’s agricultural boom. Recent quarterly results paint a picture of explosive earnings recovery—with Q2 FY26 net profit surging 799.55% year-on-year to ₹840.36 crore, compared to just ₹93.42 crore in the same quarter last year. For a company trading at ultra-low valuations with a PE ratio of just 1.15x and trading at 0.63x its book value, the risk-reward proposition is strikingly favorable for patient, long-term investors.

However, Zuari lacks the household name of Coromandel International or Chambal Fertilizers. This very factor—combined with analyst ratings consistently showing “Buy” consensus and a growing retail investor community discovering the stock—makes Zuari Agro Chemicals one of the most underrated fertilizer plays in India’s equity market today. This comprehensive guide walks you through the fundamentals, sector tailwinds, price targets, and actionable investment strategy for 2025 and beyond.

Section 1: Understanding Zuari Agrochemicals—Company Overview

What Is Zuari Agro Chemicals?

Zuari Agro Chemicals Ltd is a Goa-based, integrated fertilizer and agri-input manufacturer operating under the Adventz Group banner (led by industrialist Saroj Poddar, with a promoter holding of 65.21%). The company manufactures and distributes a diversified portfolio of fertilizers, including:

- Urea (46% nitrogen content)—primary revenue driver for rice, wheat, and sugarcane growers

- DAP (Diammonium Phosphate)—high demand from oilseed and pulse farmers

- NPK Complex Blends—balanced nutrition for horticulture and cash crops

- Specialty fertilizers—emerging nano-urea, water-soluble, and bio-enhanced products

With a total revenue of ₹4,436 crore in FY25 and a strong presence in southern and western India (especially in Maharashtra, Karnataka, and Goa), Zuari plays a key role in supporting India’s food security and benefits from government subsidies.

Market Capitalization & Stock profiles

As of early December 2025, Zuari Agro Chemicals trades at approximately ₹263–₹270 per share with a market capitalization of roughly ₹1,105–₹1,125 crore, placing it squarely in the small-cap category. Key trading metrics include:

| Metric | Value |

|---|---|

| Current Price | ₹290 |

| Market Cap | ₹1,105–₹1,125 Cr |

| 52-Week High | ₹393.55 |

| 52-Week Low | ₹169.20 |

| Average Volume (20D) | 201,374 shares |

| Book Value Per Share | ₹422–₹441 |

| TTM PE Ratio | 1.15x |

| P/B Ratio | 0.63x |

The bull case is anchored by this extreme undervaluation in comparison to historical book values and earnings multiples.

Section 2: The Explosive Financial Recovery—Q2 FY26 Results Breakdown

Earnings Surprise: +800% Net Profit Growth

Zuari’s September 2025 (Q2 FY26) quarterly results shocked the market with headline numbers:

- Consolidated Net Sales:

₹1,422.63 crore (+26.65% year-on-year) - Consolidated Net Profit:

₹840.36 crore vs. ₹93.42 crore YoY (+799.55% YoY growth) - Operating Profit (PBDIT):

₹173.76 crore with an operating margin of 12.21% - Basic EPS:

₹191.68 vs. ₹19.30 YoY (+893.16% YoY)

What’s particularly striking is the quality of earnings recovery. This is not merely a one-time gain—rather, it reflects strong operational execution, higher fertilizer realizations (prices), and better capacity utilization across Zuari’s production facilities.

Revenue Growth & Momentum

Looking beyond just earnings, the top-line trajectory reveals sustained demand:

| Metric | Q2 FY26 | Q1 FY26 | Q2 FY25 | YoY Growth |

|---|---|---|---|---|

| Revenue (₹ Cr) | 1,422.63 | 1,246.05 | 1,123.32 | +26.65% |

| QoQ Growth | – | – | – | +14.17% |

The company achieved double-digit sequential growth (Q1 to Q2 FY26), indicating healthy seasonal demand recovery during the monsoon-driven kharif planting season. This pattern suggests that, provided monsoons remain normal and government subsidy flows continue, Zuari’s Q3 and Q4 results could extend this momentum.

Return Ratios: Best-in-Class Metrics

For long-term investors, return metrics matter more than spot valuations:

- ROCE (Return on Capital Employed):

12.7% to 20.8% (recent half-year), aligning with cost-of-capital benchmarks - ROE (Return on Equity):

9.06% historical, but trending upward with earnings recovery - Operating Profit Margin (OPM):

8.20–12.21%, in line with industry standards for fertiliser companies

These metrics signal that Zuari is not just reporting higher numbers—it is generating genuine shareholder value and efficient capital deployment.

Section 3: The Fertiliser Sector Tailwind—Why Demand Will Only Grow

India’s Fertiliser Consumption & Market Size

The structural demand case for fertilizers in India is unshakeable, driven by:

- Growing Population & Food Security

- India’s headcount nearing 1.5 billion requires sustained agricultural output.

- Target: increase staple crop yields (rice, wheat, maize) without expanding arable land

- Market Size & Growth

- India’s fertilizer market is projected to expand from USD 43.5 billion in 2024 to USD 74 billion by 2033, representing a 6% CAGR.

- In 2025, India’s total fertilizer consumption is expected to exceed 65 million metric tons.

- Domestic production is ramping to 520 LMT in 2025 (up from 503 LMT in 2023–24), supported by new capacity and government initiatives.

- Government Subsidy & Policy Support

- Fertilizer subsidies touched ₹1.91 lakh crore (USD 21 billion) in FY24—a fiscal anchor ensuring affordable prices and stable domestic demand.

- The government’s push for balanced nutrition and soil health creates sustained demand for NPK complexes, rather than just urea.

- Nano-urea initiatives and digital agriculture tools are expanding the addressable market.

- Monsoon Boost & Crop Intensity

- India’s 2025 southwest monsoon was 6.1% above average, with 33 out of 36 meteorological regions receiving normal or above-normal rainfall.

- This favorable weather expanded the kharif sowing area (rice +7.6%, maize +11.7%), driving fertiliser offtake during peak seasons.

- Good monsoons have a 2–4 quarter lag impact on fertiliser consumption—expect sustained high demand through 2025–26.

Import Dependency & Price Dynamics

A critical insight for investors: India imports over 30% of its urea, 70% of DAP, and 100% of potash. Global supply chain dynamics (the Russia-Ukraine conflict and freight volatility) create pricing volatility, but also:

- Higher realised prices for domestically produced fertilisers like Zuari’s output

- Pricing power during supply-tight periods, which supports margin expansion

- Strong subsidy-offset mechanisms ensure retail prices remain affordable, protecting volume demand.

Section 4: Zuari Agro Valuation Analysis—Why It’s Deeply Undervalued

PE, P/B & Intrinsic Value Models

Zuari’s valuation appears drastically cheap by most metrics:

| Valuation Metric | Zuari | Sector Average | Gap |

|---|---|---|---|

| TTM P/E | 1.15x | 23.68x | -95% discount |

| P/B Ratio | 0.63x | ~6–8x (peers) | -90% discount |

| P/Sales Ratio | 0.23x | 1.5–3x (peers) | -85% discount |

| EV/EBITDA | -68% discount | baseline | Deep undervaluation |

Intrinsic Value Estimates:

Independent valuation models peg Zuari’s fair value in a broad ₹400–₹500+ range, compared to the current spot price of ₹263–₹270. One detailed valuation study estimates the median intrinsic value at ₹493, implying an upside of 85–90%. Another Peter Lynch formula-based model projects even more extreme upside—but such extrapolations should be treated cautiously, as they assume stable growth and no cyclical headwinds.

Why the Valuation Gap Exists

The valuation discount reflects:

- Cyclical industry perception

– investors historically fear margin swings in fertilizer stocks - Working capital intensity—fertilizer companies carry high receivables due to subsidy payment delays

- Policy risk

– regulatory caps on prices or subsidy changes can compress margins - Small-cap liquidity premium

– lower market cap and trading volumes reduce institutional participation

However, current valuations have largely factored in these concerns. With strong earnings momentum and policy tailwinds, the gap between market price and intrinsic value could close sharply over 12–24 months.

Cash Flow & Financial Health

Zuari’s balance sheet supports the valuation opportunity:

- Operating Cash Flow (FY25):

₹511.47 crore, strong enough to service debt and fund capex - Debt-to-Equity:

0.24–0.39x (recent periods), indicating a conservative capital structure and room for shareholder returns - Current Ratio:

1.18x, healthy liquidity position - Cash & Equivalents:

₹155.51 crore as of March 2025, providing a safety cushion

Section 5: Analyst Price Targets & Fair Value Range for 2025–2030

2025 Target Zone: ₹230–₹280

Multiple independent research sources and blogs tracking Zuari Agro have published convergent 2025 price targets:

- Conservative target:

₹660–₹670, anchored to steady fertilizer demand and normalized margins - Base case target:

₹600, reflecting mid-cycle earnings and sector growth acceleration - Bullish target:

₹650, assuming margin expansion and volume upside from good monsoons

Given Zuari’s current trading price of ₹290, the stock is trading near the base case levels—meaning incremental upside will come from earnings accretion rather than multiple expansion.

The Bull Case—Key Reasons to Buy Zuari Agro Now

1. Explosive Earnings Momentum & Valuation Expansion

With net profit surging 800% YoY and EPS at ₹191.68, the current market cap implies a cyclically depressed multiple. Once the market accepts that earnings recovery is structural (not cyclical), multiple expansion could drive a re-rating of 30–50%.

2. Structural Tailwinds from Government Policy

- Subsidy certainty:

A ₹1.91 lakh crore fertiliser subsidy budget ensures affordable retail prices and steady demand. - Balanced nutrient push:

The government incentivizes NPK and complex fertilisers, where Zuari has a strong market presence. - Self-sufficiency goal:

India aims to reduce imports; domestic producers like Zuari are structural beneficiaries.

3. Sector Growth Tailwind – 6% CAGR into 2033

India’s fertilizer market is expanding at 6% CAGR through 2033, with consumption exceeding 65 MMT in 2025. This is a decades-long structural trend, not a cyclical blip. Even modest market-share gains or price realizations can drive 15–20% annual EPS growth for Zuari over the medium term.

4. Monsoon Tailwind & Seasonal Peak

The 6.1% above-average 2025 monsoon boosted kharif sowing. Historically, good monsoons drive 2–3 quarters of elevated fertiliser demand and realisations, supporting better margins. Q3 and Q4 FY26 results could extend the earnings momentum observed in Q2.

5. Book Value & Return Metrics Support Upside

- Book value per share:

₹422–₹441 vs. a market price of ₹280–₹290 represents a 40% discount to stated asset value. - ROCE of 12.7–20.8% exceeds cost of capital, signalling value-accretive growth

- Dividend potential:

If Zuari normalizes dividend payout (currently ~0%), investors could capture a 3–5% dividend yield on top of capital appreciation.

6. Liquidity & Retail Interest

Recent trading activity shows strong intraday moves and retail interest. Zuari hit intraday highs of ₹293.75 on December 5, 2025, with an 11.65% surge, signalling growing investor discovery. Increased institutional and retail participation can drive technical re-rating independent of fundamentals.

Section 7: The Bear Case & Key Risks – What Could Go Wrong?

Before committing capital, every investor must understand the major risks:

Risk 1: Fertiliser Price Volatility & Margin Compression

- Global urea, DAP, and potash prices swing ±20–30% annually, directly hitting margins.

- If global commodity prices soften (due to improved supply or recession), Zuari’s realizations fall, compressing profit margins from current elevated levels.

- Working capital strain: Margin compression may force receivables buildup and cash flow stress.

Risk 2: Monsoon Failure & Volume Risk

- Weak or delayed monsoons directly reduce farmers’ fertilizer offtake.

- A poor 2025–26 monsoon season (Oct–Dec) could negate the positive momentum from the strong Q2 monsoon.

- 60–70% of Zuari’s demand is monsoon-linked, creating earnings volatility.

Risk 3: Policy & Subsidy Risk

- Price caps or subsidy reductions:

The government could impose ceiling prices or slash subsidy budgets to manage fiscal pressures. - Import duty changes:

Tariff hikes on imported raw materials (phosphoric acid, ammonia) could increase input costs. - Regulatory shifts:

New environmental or sustainability mandates could require CAPEX investments.

Risk 4: Debt & Liquidity Stress in Downturns

- Short-term borrowings:

₹433.54 crore (as of March 2025) expose Zuari to refinancing risk if working capital needs spike - Interest burden:

₹168.31 crore annual interest (FY25) leaves limited flexibility if earnings dip - A significant earnings downturn could force asset sales or equity dilution.

Risk 5: Small-Cap Illiquidity & Valuation Compression

- Low trading volumes vs. peers like Coromandel or Chambal

- If sector sentiment turns negative, Zuari’s small-cap status means rapid repricing downwards (mirroring the upside risk).

- Lack of analyst coverage and institutional tracking increases information risk.

Section 8: Investment Strategy – Buy Recommendation for 2025

Ideal Investor Profile

Zuari Agro Chemicals is best suited for:

✓ Long-term investors with a 12–24 month+ holding horizon

✓ Cyclical-stock specialists comfortable with ±30–40% volatility

✓ Value investors hunting for deep discounts to intrinsic value

✓ Portfolio diversifiers seeking agri/rural sector exposure

✓ Traders with tactical entry/exit discipline

❌ Not ideal for:

✗ Conservative, income-focused investors (dividend inconsistent)

✗ Investors are uncomfortable with small-cap illiquidity

✗ Those unable to tolerate 30–50% portfolio drawdowns

Recommended Entry & Position Sizing

Optimal Entry Zones:

- Tier-1 Entry (Aggressive Buyers):

The entry range of ₹240–₹255, which is near recent support, suggests a potential upside to ₹325 by 2025. - Tier-2 Entry (Moderate Risk):

₹290 – Current levels; accumulate gradually over 2–3 months - Tier-3 Entry (Conservative):

₹270 – Only after confirmation of sustained profitability

Position Sizing:

- Aggressive traders:

3–5% of total equity portfolio - Moderate investors:

2–3% of total equity portfolio - Conservative dabblers:

1–2% of total equity portfolio

This sizing ensures that even a 50% decline (downside scenario) limits total portfolio damage to manageable levels while capturing meaningful upside if targets of ₹280–₹380 are achieved.

Profit-Taking & Exit Strategy

- First target (25% position):

₹300–₹320 (5–15% upside from ₹270) - Second target (25% position):

₹350–₹375 (30–40% upside) - Third target (remaining 50% position):

Hold for ₹400–₹450 (2027–2028 view)

This staged exit locks in gains at each milestone, reducing concentration risk while retaining upside optionality.

Stop Loss & Risk Management

- Hard stop loss:

₹170 (-17% from ₹265 entry) - Soft stop loss:

Below quarterly earnings expectations or failed monsoons trigger a position review - Rebalancing trigger:

If Zuari exceeds 5% of the portfolio, trim to 3%.

Section 9: Zuari Agro vs. Peer Comparison—How It Stacks Up

Zuari vs. Larger Fertilizer Peers

| Metric | Zuari | Coromandel | Chambal | Deepak Fert |

|---|---|---|---|---|

| Market Cap | ₹1,105 Cr | ₹68,297 Cr | ₹17,402 Cr | ₹16,534 Cr |

| TTM PE | 1.15x | 28.08x | 9.29x | 17.71x |

| P/B | 0.63x | 6.64x | 2.11x | 2.64x |

| ROE | 9.06% | 18.63% | 18.89% | 15.78% |

| Dividend Yield | 0.72% | 0.65% | 2.30% | 0.76% |

| 1Y Return | 31.01% | 30.41% | -17.28% | -3.60% |

Key Takeaway: Zuari trades at the steepest valuation discount to peers, offering maximum upside asymmetry for value-oriented investors. However, peers like Coromandel offer greater financial stability and dividend consistency—making them better for conservative investors.

Section 11: Frequently Asked Questions (FAQ)—Optimized for Featured Snippets

Q1: Is Zuari Agro Chemicals a good buy for 2025?

A: Yes, Zuari Agro Chemicals is a “BUY” for patient, long-term investors seeking value exposure to India’s fertilizer sector. The company’s ultra-low valuation (PE 1.15x, P/B 0.63x), explosive earnings recovery (net profit +800% YoY), structural sector tailwinds (65 MMT consumption, 6% CAGR growth), and supportive government subsidy policy create a favorable risk-reward. However, expect 30–40% volatility and require a 12–24 month holding horizon.

Q2: What is the Zuari Agro Chemicals 2025 share price target?

A: Analyst consensus 2025 targets range from ₹230 to ₹280, with the base case around ₹260–₹275. Conservative targets: ₹230–₹250; bullish scenarios: ₹280–₹290. By 2030, fair value could reach ₹380–₹410 under sustained earnings growth.

Q3: Is Zuari Agro a long-term investment or trading stock?

A: Zuari suits both strategies:

- Long-term (2+ years):

Hold for structural subsidy support, sector growth, and dividend payouts post-2026 - Trading (3–12 months):

Trade seasonal peaks (kharif monsoon-driven demand waves) and earnings cycles

Q4: What are the main risks in holding Zuari Agro?

A: Major risks include (1) fertiliser price volatility (global commodity swings), (2) monsoon dependency (weak monsoons cut demand), (3) policy risk (subsidy cuts, price caps), (4) working-capital stress (subsidy payment delays), and (5) small-cap illiquidity (rapid repricing if sentiment shifts).

Q5: How does Zuari compare to Coromandel and Chambal Fertilisers?

A: Zuari is massively undervalued vs. peers (PE 1.15x vs. Coromandel 28x) but smaller and riskier. Coromandel is safer, larger, and more profitable; Chambal offers a higher dividend yield. For value investors, Zuari offers maximum upside; for conservative investors, Coromandel is better.

Internal Links Suggestions

Within your blog site (positionalcalls.com), link to:

- “How to Analyse Fertiliser Stocks: Complete Fundamental Guide”—explains margins, subsidies, and working capital metrics

- “Best Agri & Rural Sector Stocks 2025”—positions Zuari alongside rural-linked plays

- “Stock Valuation Methods: PE, PB, DCF Explained”—a deep dive into why Zuari’s 1.15x PE is attractive

- “Monsoon Impact on Agricultural Stocks—Trading Guide”—explains kharif/rabi seasonality and timing

- “Small-Cap Stock Selection” Strategy—risks and opportunities in small-cap fertiliser plays

External Authoritative Source

For comprehensive context on India’s fertilizer market outlook, industry dynamics, and policy support, cite this authoritative external source:

📊 “India Fertilisers Market Size & Share Analysis—Growth Trends” by Mordor Intelligence (2025)

This detailed industry report covers market size projections (USD 43.5B in 2024 → USD 74B by 2033), consumption growth (65 MMT in 2025), subsidy mechanisms, and competitive dynamics. Link once to this report to boost credibility and reduce bounce rate.

READ MORE: Meesho IPO 2025: Complete Investment Guide for Maximum Returns in India’s Value-Commerce Boom

Conclusion: Your Action Plan for 2025

Zuari Agro Chemicals represents a rare confluence of valuation opportunity, sector growth, and earnings momentum. Trading at just 1.15x PE and 0.63x book value, with Q2 FY26 net profit up 800% YoY and structural fertilizer demand growing at 6% CAGR, the stock offers 30–50% upside potential over 12–24 months for disciplined investors.

Your 2025 Action Plan:

- Research Phase (Now):

Read the quarterly results, understand monsoon patterns, and track global fertilizer prices. - Entry Phase (Next 2–4 weeks):

Build position gradually in the ₹240–₹275 range, allocating 2–3% of the portfolio. - Monitoring Phase (6–12 months):

Track Q3 and Q4 earnings, monsoon outcomes, and subsidy policy changes. - Profit-Taking Phase (12–24 months):

Exit 25% at ₹300–₹320, 25% at ₹350–₹375, and hold the remainder for a ₹400–₹450 target.

This disciplined approach captures the asymmetric upside while managing the downside through position sizing and staged exits.

Reminder: This analysis is purely educational and not investment advice. Always consult a SEBI-registered financial advisor, review official company filings and exchange disclosures, and assess your personal risk tolerance before committing capital. Past performance and analyst projections do not guarantee future results. Fertilizer stocks carry sector-specific risks, including commodity price volatility, monsoon dependency, and policy shifts.

Ready to explore more stock picks and IPO analysis? Subscribe to positionalcalls.com and join our @realsharemarketcall Telegram channel for daily trading alerts, fundamental deep dives, and actionable investment recommendations. Share this analysis with fellow investors seeking value opportunities in India’s capital markets!