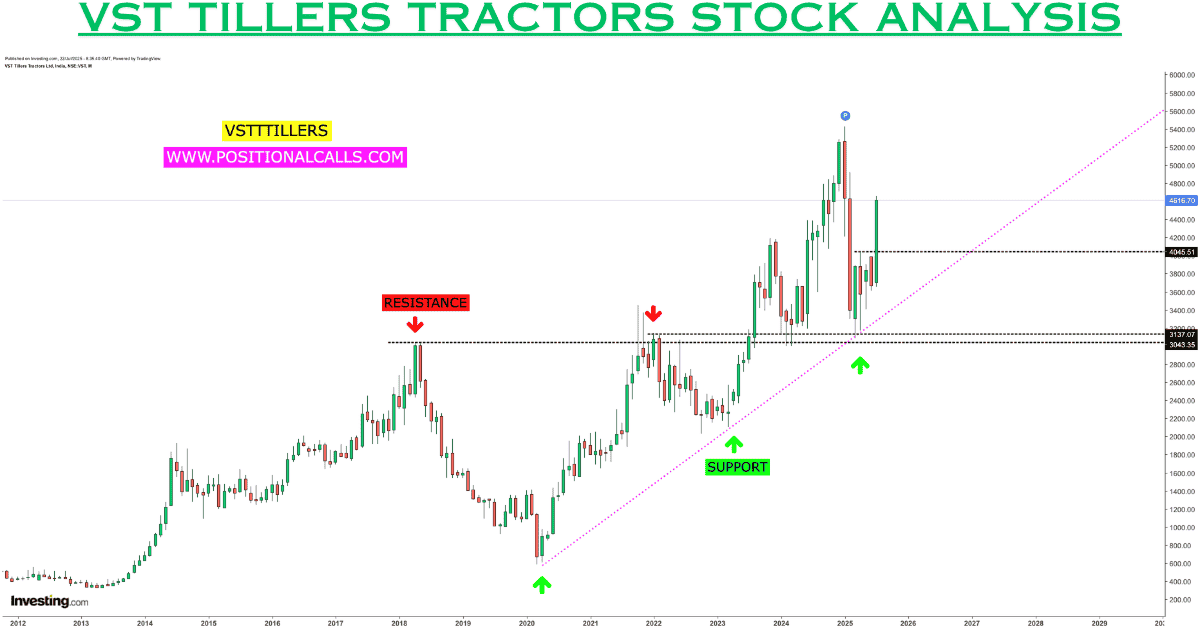

VST Tillers Tractors Stock Analysis –

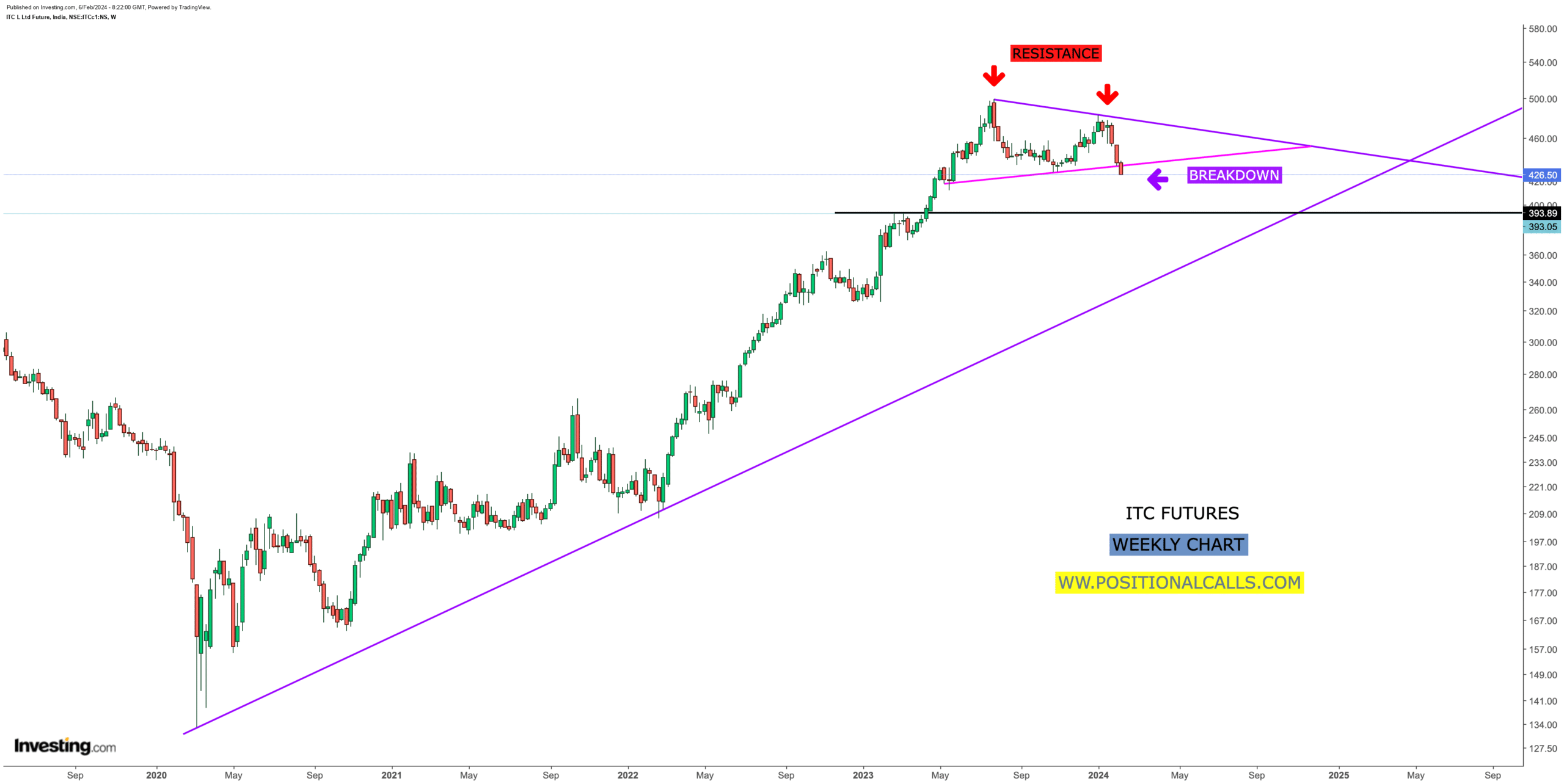

STOCK TRADING BETWEEN: 4580 – 4590

SUPPORT: 3200

TARGET: 6800-6850

VIEW: 3-4 QUARTER

VST Tillers Tractors Stock Analysis: Introduction: VST Tillers—The Small-Cap Agri Leader Gaining Market Momentum

India’s agricultural equipment sector is set for explosive growth as rural mechanization accelerates, and VST Tillers Tractors Ltd. (NSE: VSTTILLERS) is the undisputed leader to watch. With a market presence spanning over five decades and a strategic focus on power tillers and compact tractors, VST Tillers offers a rare combination of market leadership, robust financials, and multi-year growth tailwinds.

VST Tillers Tractors Stock Analysis: Market Leadership & Product Strength: VST Tillers’ Competitive Edge

Dominant Market Share and Trusted Brand

VST Tillers controls around 70% of India’s organized power tiller market, a sector on the frontlines of India’s impending agri-revolution. Their compact tractor business, although facing some recent headwinds, remains a vital part of the rural mechanization story.

Key points:

- Leadership:

Largest manufacturer of power tillers in India. - Distribution:

Extensive all-India dealer network, ensuring top-tier rural reach. - Innovation:

Focus on R&D and new product launches to maintain a technological edge.

Recent Sales Performance—Sustained Growth

The company exhibited exceptional sales momentum in 2025.

- June 2025:

Sales nearly doubled year-over-year (+93% YoY), propelling the stock up 6% in a single session. - May 2025:

VST Tillers posted a 41% YoY surge driven by a 54% increase in power tiller sales, with year-to-date (April–May) unit sales up 58% overall.

VST Tillers Tractors Stock Analysis: Sales Overview Table

| Month | Total Units Sold | Power Tillers | Tractors | YoY Growth (Total) |

|---|---|---|---|---|

| May 2025 | 3,486 | 3,047 | 439 | +41% |

| June 2025 | Not stated | Not stated | Not stated | +93% |

Source: HDFC Sky, 2025

VST Tillers Tractors Stock Analysis: Financial Performance: Resilient and Investor-Friendly

Strong Top-Line, Mixed Profit Trends

VST Tillers achieved record net sales of Rs 301.43 crore in March 2025—the highest in five quarters. Operating profit (PBDIT) touched Rs 40.37 crore, also a five-quarter high. However, profit after tax (PAT) stood at Rs 24.42 crore, revealing some margin contraction amid increased operational expenditure and flat tractor sales.

Recent Profit & Loss Highlights

| Year Ending Mar 31 | Revenue (₹ Cr.) | Operating Profit (₹ Cr.) | PAT (₹ Cr.) |

|---|---|---|---|

| 2025 | 994.55 | 40.37 (Q4) | 24.42 (Q4) |

| 2024 | 963.12 | Not stated | Not stated |

Source: Moneycontrol, MarketMojo

VST Tillers Tractors Stock Analysis: Debt-Free Status & Liquidity

A hallmark of VST’s resilience is its debt-free balance sheet and strong cash position, with ₹449.4 crore in cash and liquid investments as of September 2024.

- Debt-to-equity:

0.00 for the current year. - Liquidity:

Sufficient reserves to support R&D, geographic expansion, and withstand cyclical downturns.

VST Tillers Tractors Stock Analysis: Dividend & Returns

Consistent dividend payout enhances VST’s attractiveness for both growth and income investors. Its five-year share price CAGR is among the best in the agri-equipment segment.

Investment Rationale—Why Buy VST Tillers in 2025?

1. Rural Mechanization Policies Support Upside

Ongoing government incentives and increased rural credit availability are driving demand for farm mechanization. VST is uniquely positioned to benefit, given its leadership in the tiller market and new subsidy-neutral product launches.

2. Operational Recovery and Export Opportunity

Despite recent margin compression (OPM dropped to 10.2% in 9M FY2025 from 13.1% in FY2024), this results from short-term R&D and product development costs. Export sales—which carry higher margins—are expected to rise, supporting medium-term profit rebound.

3. Smart Diversification and Innovation

VST has begun expanding into adjacent product categories like power weeders and high-tech tractor variants, further reducing regulatory risk and seasonality exposure.

4. Prudent Financial Management

The company’s strong financial risk profile (debt-free, sizable liquidity) and stable promoter backing offer confidence in long-term discipline.

5. Technical & Market Momentum

- Stock soared over 6% following June’s blockbuster sales figures.

- VST shares have outperformed broader indices, demonstrating momentum favored by both institutional and retail investors.

VST Tillers Tractors Stock Analysis: Risks and Mitigation Strategies

Industry Headwinds

- Cyclicality:

Tractor and tiller sales are seasonal, heavily dependent on monsoon and crop cycles. - Subsidy Regulation:

Power tiller demand is influenced by government policy shifts. - Competitive Pressure:

Intense competition limits pricing power, especially in tractors.

Mitigation: VST is intensifying its push for export growth (less dependent on Indian cycles), innovating with subsidy-neutral models, and expanding financial solutions to ease customer purchases.

VST Tillers Tractors Stock Analysis: Action Plan: How and When to Buy VST Tillers

Ideal Buyer Profile

- Long-term investors:

Focused on compounding returns from rural/agricultural transformation. - Dividend seekers:

Benefiting from regular payouts and stable free cash flow. - Risk-averse sectors:

Debt-free and cash-rich midcaps. - Momentum traders:

Riding post-results and sales momentum.

VST Tillers Tractors Stock Analysis: Entry and Holding Strategy

- Track technical support near ₹3,200–₹3,500 for strategic entry.

- Medium- to long-term investment (2–4 quarter) may see above-market returns as export-led growth and rural demand kick in.

- Allocate as part of a diversified portfolio focusing on high-conviction sector leaders.

READ MORE:

GNG Electronics IPO Subscription Status & Allotment Tips: Maximize Your Investment Returns

Conclusion: Why VST Tillers Is a Strong Buy for 2025 and Beyond

VST Tillers Tractors combines resilient fundamentals, enviable market dominance in power tillers, robust sales growth, and a risk-averse, debt-free financial structure. Strategic investments in product development and export market expansion provide clear visibility for future growth. The company’s strong balance sheet and consistent government focus on farm mechanization support long-term re-rating potential.

Investor Takeaway: For those looking to ride India’s rural resurgence, VST Tillers is a prime “buy” for 2025 and beyond—delivering a unique blend of stability, growth, and leadership in a high-potential sector.

Disclaimer: This blog post is for informational purposes only. Stock markets are subject to risks. Consult your financial advisor before investing.

Maximize returns, minimize risk, and capture the upside of India’s agri-mechanization wave—buy VST Tillers Tractors today!