TATAINVEST Stock Analysis: Unlocking Wealth

In the dynamic landscape of the Indian stock market, opportunities for long-term wealth creation often lie in companies with robust foundations and diversified portfolios. Among these, Tata Investment Corporation (TATAINVEST) stands out as a compelling prospect for astute investors. As a well-established non-banking financial company (NBFC) within the revered Tata Group, TATAINVEST offers a unique gateway to participate in the growth of various Tata entities without directly investing in each.

This comprehensive guide provides a strong buy recommendation for TATAINVEST, presenting a detailed technical and fundamental analysis to support your investment thesis. If you’re searching for the best stocks to buy now, long-term investment opportunities, or high-growth stocks in India, TATAINVEST deserves your attention.

TATAINVEST Stock Analysis: Why Tata Investment Corporation? The Core Investment Thesis

Tata Investment Corporation (TATAINVEST), listed on both the NSE (TATAINVEST) and BSE (501301), is essentially a holding company. Its primary objective is to invest in a diverse portfolio of Tata Group companies, primarily in equities and equity-related securities. This structure provides inherent advantages for wealth management and portfolio diversification:

- Diversification:

By investing in TATAINVEST, you gain exposure to a basket of established and emerging Tata companies across various sectors, including IT, automotive, steel, power, consumer goods, and more. This intrinsic diversification mitigates single-stock risk. - Access to Tata Ecosystem:

The Tata Group is a powerhouse of innovation and market leadership. TATAINVEST offers a consolidated way to benefit from the collective success and future potential of this conglomerate, making it a true blue-chip stock play. - Professional Management:

The investments are managed by experienced professionals, reducing the need for individual investors to conduct extensive research on each Tata Group company. - Potential for Value Unlocking:

Periodically, the underlying assets of TATAINVEST might trade at a discount to their intrinsic value, presenting opportunities for significant capital appreciation.

Fundamental Analysis: The Bedrock of Sustainable Growth

A deep dive into the fundamental analysis of TATAINVEST reveals several promising indicators for long-term wealth creation:

- Strong Parentage & Legacy:

Being a part of the Tata Group, TATAINVEST inherits a legacy of ethical business practices, strong corporate governance, and a commitment to long-term value creation. This instills a high degree of confidence among blue-chip investment seekers. - Asset Base and Holdings:

TATAINVEST’s value is directly linked to the performance of its underlying investments. The company holds significant stakes in various listed and unlisted Tata companies. A consistent track record of prudent investment decisions and the ability to identify high-growth opportunities within the Tata ecosystem are paramount. Investors should monitor the market capitalization of its key holdings and how they contribute to TATAINVEST’s net asset value (NAV). - Financial Performance & Profitability:

- Revenue and Profit Growth:

While TATAINVEST’s primary income comes from dividends and gains on its investments, consistent growth in these areas is crucial. Reviewing historical revenue and profit growth trends provides insights into its operational efficiency and the overall health of its portfolio. Recent data indicates the company has delivered substantial profit growth, with a 1-year profit growth of 17.85% and a 3-year CAGR of 37.66%. - Return Ratios:

Key ratios like Return on Equity (ROE) and Return on Capital Employed (ROCE) indicate how efficiently the company is using its shareholders’ capital and its overall capital to generate profits. While some recent reports point to a lower ROE (1.16%) and ROCE (1.19%), it’s important to understand that for a holding company, these metrics can be influenced by the unrealized gains/losses on its investment portfolio, which may not always reflect in immediate profits. A longer-term perspective on these ratios, alongside the performance of its underlying assets, is essential. - Debt-to-Equity Ratio:

A healthy debt-to-equity ratio indicates financial stability. As a holding company, TATAINVEST typically manages its debt conservatively, operating with minimal leverage, which enhances shareholder value.

- Revenue and Profit Growth:

- Valuation Metrics:

- Price-to-Earnings (P/E) Ratio:

Current reports indicate a P/E of 115.31, which suggests a premium valuation. While a higher P/E might suggest an expensive valuation, it could also reflect market expectations of future growth and the quality of its underlying assets. - Price-to-Book (P/B) Ratio:

A P/B ratio of 1.06 suggests it’s trading close to its book value. For holding companies, the P/B ratio is often compared to the discount/premium at which the company trades relative to its net asset value (NAV). - Dividend Yield:

TATAINVEST has a history of paying dividends, making it attractive for dividend investing and passive income seekers. A consistent dividend payout reflects a healthy financial position and a commitment to shareholder returns.

- Price-to-Earnings (P/E) Ratio:

- Shareholding Pattern:

The stability of the promoter shareholding (currently at 73.38%) indicates strong confidence from the parent group. Observing institutional (DII and FII) and public holding patterns can also provide insights into investor sentiment.

TATAINVEST Stock Analysis: Technical Analysis: Decoding Market Signals for High-Growth Stocks

While fundamental analysis provides a long-term perspective, technical analysis helps in identifying optimal entry and exit points for high-growth stocks like TATAINVEST.

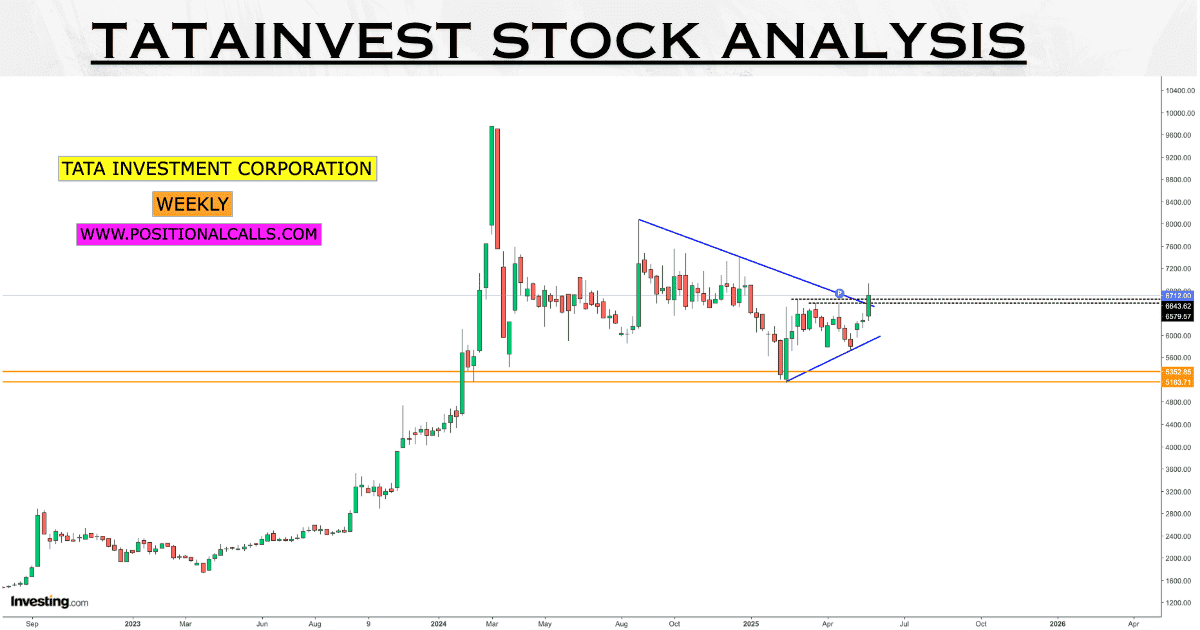

Current Price Action and Momentum:

As of May 30, 2025, Tata Investment Corporation Ltd. trading at ₹6700. The stock has shown resilience and bullish momentum, trading above key resistance levels with strong support zones identified. Recent technical analysis indicates a decisive breakout backed by strong volumes after consolidating in a broad range for the past 5-6 months, suggesting renewed bullish momentum.

Key Technical Indicators:

| Indicator | Value | Signal |

|---|---|---|

| RSI (14-day) | 57.56 | Neutral/Bullish |

| MACD | 27.09 | Bullish |

| Stochastic Osc. | 68.31 | Mild Bullish |

| ADX | 14.46 | Mild Trend |

| Williams %R | -8.85 | Bullish |

| Supertrend | 6266.21 | Mild Bullish |

| Parabolic SAR | 5735.00 | Bullish |

- Moving Averages:

The stock is trading above its 10, 20, 50, 100, and 200-day moving averages, indicating a sustained uptrend. The 5-day, 50-day, and 200-day moving averages all suggest a “buy” outlook. A recent report suggests that the stock found support at the 10-day SMA, indicating sustained upward momentum. - Oscillators:

- Relative Strength Index (RSI):

The daily RSI has confirmed a range shift above the 60 level after a prolonged period, signaling strong bullish momentum. - Moving Average Convergence Divergence (MACD):

The MACD is maintaining a position above the zero line, suggesting sustained momentum. - Average Directional Index (ADX):

The daily ADX (14) has crossed the 20 mark and is currently near 22, indicating a developing trend, with momentum likely to pick up further.

- Relative Strength Index (RSI):

- Support and Resistance Levels:

Immediate support is at ₹5730 and ₹5700, while resistance is seen at ₹7400. Recent reports suggest a target price of Rs 9800 with a stop loss at Rs 5700. - Volume Analysis:

A surge in trading volume alongside price appreciation strengthens the conviction of a breakout. The recent decisive breakout was backed by strong volumes.

TATAINVEST Stock Analysis: Investment Recommendations and Strategy

Considering both the fundamental strength and the emerging bullish technical indicators, TATAINVEST presents a compelling buy recommendation for investors with a medium- to long-term horizon.

For Short-Term Traders (Swing Trade Opportunity):

- Entry Strategy:

Traders may look to accumulate the stock in the ₹6,100–₹6,200 range (which aligns with recent expert recommendations). This strategy aligns with value investing principles, waiting for opportune entry points. - Target Price:

A target price of ₹9800+ has been suggested by analysts within a 3-6 month timeframe, offering nearly 45% upside potential. - Stop-Loss:

A strict stop-loss at ₹5,700 is recommended to protect capital against adverse price movements. - Risk-Reward Ratio:

Favorable, given the strong support and bullish momentum.

“Tata Investment is bouncing from a strong demand zone, setting up for a high-probability swing trade opportunity.”

For Long-Term Investors:

- Accumulation Zone:

Any dip towards ₹6,000–₹6,200 can be used for accumulation. Consider a staggered buying approach to mitigate risk. - Investment Horizon:

1–3 years for optimal returns, leveraging the company’s growth and dividend payout potential. - Long-Term Potential:

Given its diversified portfolio and the growth trajectory of the Tata Group, TATAINVEST holds significant long-term growth potential. While specific long-term targets are harder to predict, the inherent value of its underlying assets and the strategic vision of the Tata Group offer a strong upside.

Risk Management:

- Market Volatility:

As with all equity investments, market corrections can impact short-term performance. Be prepared for short-term fluctuations and maintain a long-term perspective. - Diversification:

Remember that even a strong stock recommendation should be part of a well-diversified portfolio. Do not over-allocate to any single stock. - Portfolio Concentration:

While diversified, the company’s returns are linked to the performance of its underlying investments. - Regulatory Changes:

Changes in NBFC regulations or taxation of investment income could affect profitability.

READ MORE: Vodafone Idea Q4 Results: Is a Turnaround on the Horizon? In-depth Financial Review

Conclusion: A Strategic Bet on the Tata Legacy

Tata Investment Corporation (TATAINVEST) offers a compelling proposition for investors seeking exposure to the diversified and resilient Tata ecosystem. Its strategic positioning as a holding company, coupled with sound fundamental metrics and positive technical signals, paints a promising picture. While past performance is not indicative of future results, the inherent strengths of the Tata brand and TATAINVEST’s well-managed portfolio make it a notable contender for those aiming for significant capital appreciation and sustainable wealth creation in the Indian stock market.

“Tata Investment is gearing up for a massive move—are you in?”

Actionable Recommendation:

Add TATAINVEST to your watchlist and consider a phased investment approach to maximize returns while managing risk. Invest smart, diversify wisely, and leverage the power of compounding with Tata Investment Corporation Ltd.—a cornerstone for any robust investment portfolio.

Frequently Asked Questions:

Is Tata Investment Corporation Ltd. a good stock to buy now?

Yes, technical and fundamental analysis both support a strong buy recommendation for TATAINVEST, especially for long-term investors and those seeking high-quality stocks in their portfolio.

What is the target price for TATAINVEST?

Short-term targets are set at ₹9800+, with long-term potential for further growth as the company’s portfolio appreciates.

What are the risks of investing in TATAINVEST?

Market volatility, portfolio concentration, and regulatory changes are key risks. However, the company’s strong fundamentals and diversified holdings mitigate these risks for long-term investors.

As always, conduct your own due diligence and consult with a SEBI-registered financial advisor before making any investment decisions. The information provided here is for educational and informational purposes only and should not be construed as definitive financial advice.