As Diwali 2025 approaches, investors are scanning the markets for stocks that promise more than just festivity-fueled optimism. In the upcoming Muhurat Trading session on October 21, 2025, one small-cap stock with strong fundamentals and smart momentum is capturing market attention—SKM Egg Products Export (India) Ltd (NSE: SKMEGGPROD).

This Tamil Nadu-based food processing exporter has quietly transitioned from being a niche agricultural processor to one of India’s most profitable FMCG agribusiness hybrid plays, exporting value-added egg products worldwide. With record earnings growth, rising promoter confidence, and strong export demand tailwinds, SKM Egg Products emerges as a prime Muhurat Trading 2025 pick.

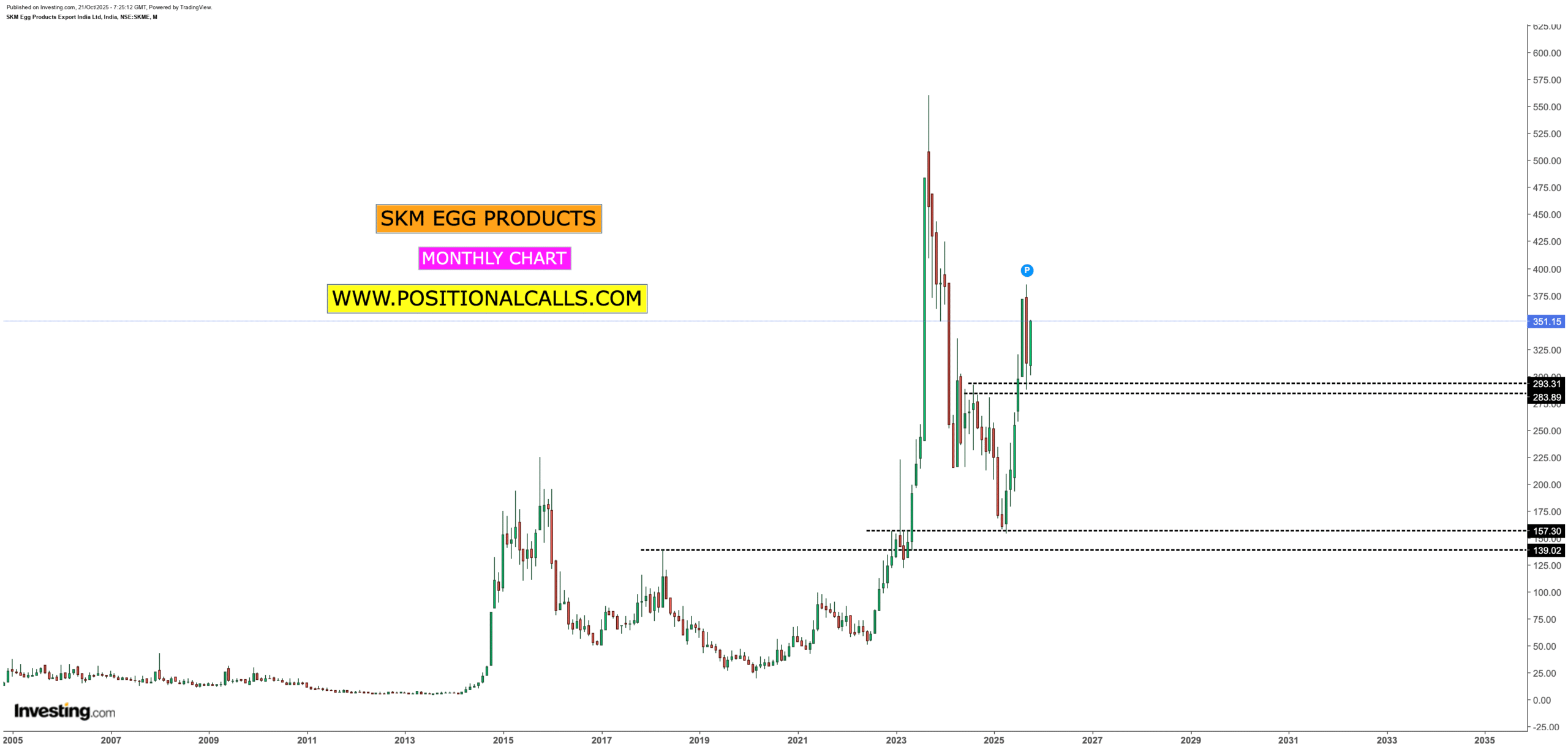

SKMEGG PRODUCTS TRADING AT 350

SUPPORT 285 – 280

TARGET 560, 800+

SKM Egg Products (SKMEGGPROD): Company Overview: The Underdog With Global Reach

Founded in 1995, SKM Egg Products operates one of Asia’s largest egg-processing facilities with a capacity of 1.8 million eggs per day. It produces a range of dehydrated egg powders, bakery mixes, and liquid egg products primarily for export markets such as Japan, the EU, and the Middle East.

The company creates specialized blends for bakery and food industries, including mayonnaise, cheesecake, pasta, and confectionery manufacturers, giving it a consistent export edge even during domestic consumption slowdowns.

SKM Egg Products (SKMEGGPROD): Key Metrics (as of October 2025):

| Metric | Value |

|---|---|

| Market Cap | ₹873 crore |

| P/E Ratio | 22.5x |

| EPS (TTM) | ₹14.7 |

| Promoter Holding | 57.4% |

| Dividend Yield | 0.45% |

| 52-Week Range | ₹154 – ₹385 |

The company’s fundamentals position it as a high-efficiency, export-driven FMCG stock, a category that typically commands premium valuations in festive bull markets.

SKM Egg Products (SKMEGGPROD): Financial Performance: Sharp Turnaround Story

According to MarketsMojo data, SKM Egg Products reported a profit before tax of ₹17.67 crore in the latest quarter, an increase of 118% year-over-year, with profit after tax at ₹16.28 crore (+88%). Its operating profit-to-interest ratio stands at 7.6x, showing remarkable debt servicing ability.

Revenues also climbed 49% YoY to ₹173.6 crore in Q1 FY25-26, signaling an impressive rebound from subdued March results.

Quarterly Highlights (Apr–Jun 2025):

-

Revenue:

₹173.65 crore (up 49% YoY) -

Net Profit:

₹16.28 crore (+88% YoY) -

EBITDA Margin:

15.2% -

Debt/EBITDA Ratio:

0.98x (low leverage)

This financial turnaround reflects effective cost management, improving product realizations in key markets, and greater efficiency in plant operations.

Muhurat Trading 2025: Why SKMEGGPROD Stands Out

1. Promoter Confidence and Institutional Accumulation

The promoter stake increased to 57.39% in 2025, reflecting growing insider optimism. Historically, sustained promoter accumulation ahead of Diwali signals medium-term re-rating momentum.

2. Value Repositioning Amid FMCG Peer Premiums

While larger FMCG stocks like Britannia and Patanjali Foods trade at 35–42x earnings, SKMEGGPROD still trades at ~23x, despite comparable margin improvements. This undervaluation relative to peers creates a clear value arbitrage opportunity.

3. Export-Led Resilience and Global Tailwinds

Demand for egg-based ingredients in Europe and Japan remains steady, driven by protein-rich functional foods and bakery sector expansion—especially notable amid the global fitness and high-protein consumption trend.

4. Festive Season Consumption Boost

October has historically yielded positive returns in 9 of the last 17 years for SKMEGGPROD, with an average monthly gain of 11.9%, making the stock a momentum-backed Diwali trade.

Growth Catalysts for Samvat 2082

a. Rising Protein Consumption & Export Demand

Global markets are witnessing a shift towards natural protein additives, with India poised as a cost-competitive exporter. SKM is leveraging this shift through capacity expansion and premium clients in confectionery and health nutrition segments.

b. Stable Debt Metrics, Growing Margins

Debt control (Debt/EBITDA < 1) and margin expansion reflect sustainable operating efficiency, reducing financial risk exposure.

c. Capacity Utilization & Product Diversification

New value-added product lines in egg protein hydrolysates and sports nutrition formulations are expected to drive volume growth through FY26–27.

d. Low Competition Advantage

India’s egg processing industry remains small, with only a few organized players. SKM’s long-term exports, FDA-compliant plant, and proven supply chain provide near monopoly in India’s egg powder export category.

Key Ratios and Valuation Snapshot (as of October 20, 2025)

| Indicator | SKM Egg Products | Industry Average |

|---|---|---|

| P/E (TTM) | 23.49x | 28.5x |

| P/B | 3.06x | 4.21x |

| ROE (TTM) | 16.3% | 12.7% |

| Debt/EBITDA | 0.98x | 2.4x |

| Net Margin | 9.4% | 6.1% |

Valuation models estimate an intrinsic fair value near ₹139, but the stock trades at ~₹351, reflecting market optimism for sustained earnings momentum into FY26.

Muhurat Trading 2025 Strategy

During the 1:45 PM–2:45 PM Muhurat Trading window, SKMEGGPROD fits the “positional buy” narrative — not a speculative short-term play but a high-quality small-cap compounding story.

Suggested Plan:

-

Entry Zone: ₹330–₹355

-

Target Zone (6–12 months): ₹450–₹500

-

Stop Loss: ₹310 (technical support)

-

Investment Rationale: Export demand, strong profitability, promoter confidence

For long-term portfolios, a staggered entry through small tranches during festive week could yield favorable risk-adjusted returns through FY26.

Common Questions Answered

Q1: Why is SKM Egg Products trending for Muhurat Trading 2025?

Because of its strong turnaround story, improved financial ratios, and low competition in the premium food ingredient segment.

Q2: Is SKMEGGPROD suitable for long-term investing?

Yes. With healthy ROE, expanding export demand, and promoter-driven growth, it fits a growth-oriented value portfolio.

Q3: Does SKM Egg Products pay dividends?

Yes. The company announced a ₹1.50 dividend per share in 2025, maintaining a consistent payout policy.

Technical View—Momentum Aligns with Fundamentals

As per current candlestick analysis, the stock has formed a bullish continuation pattern supported by strong volume spikes above ₹340. Momentum oscillators like RSI (~62) suggest ongoing accumulation within a sustainable uptrend channel.

Short-term resistance lies near ₹365–₹372, while a close above ₹385 could open the next momentum leg toward ₹420.

External Authority Reference

For authoritative metrics and real-time updates, refer to the NSE India official listing for SKMEGGPROD at:

NSE SKM Egg Products Export (India) Limited.

Related Internal Links

-

Best Muhurat Trading Stock Picks for Diwali 2025

-

Top Indian FMCG Export Stocks Under ₹500

-

Samvat 2082: Sectoral Strategy for Small-Cap Investors

READ MORE: Muhurat Trading 2025: Timings, Stock Market Secrets, and Winning Strategies for Samvat 2082

Conclusion

SKM Egg Products Export (India) Ltd isn’t just another small cap—it’s a high-margin, export-driven FMCG play that blends India’s agribusiness roots with modern consumer trends. As investors celebrate Diwali 2025 and look for stocks that combine tradition with performance, SKMEGGPROD stands out as a symbol of sustainable profitability and long-term growth.

With steady promoter conviction, strong quarterly results, and a bullish technical setup, SKM Egg Products could be the golden egg in your Muhurat portfolio this year.