Shadowfax IPO Trade Strategy – Apply or Avoid? Listing Outlook & Risk Analysis

This page provides a structured, professional Shadowfax IPO trade strategy based on fundamentals, venture-market signals, valuation expectations, sentiment indicators, and listing probability models.

• IPO Type: Mainboard IPO (Expected)

• Sector: Logistics & E-commerce Infrastructure

• Investor Sentiment: Cautiously Positive

• Market Reaction: Mixed valuation vs growth debate

• Risk Level: Medium–High (Tech-Logistics Startup)

• Listing Outlook: Highly dependent on valuation and QIB demand

🚨 Latest Update — PositionalCalls Intelligence Desk

Market Movement:

• Shadowfax IPO continues to attract strong attention in the startup and unlisted market due to rapid growth in India’s logistics and hyperlocal delivery ecosystem.

Investor Sentiment Shift:

• Sentiment has shifted from Neutral → Cautiously Positive as investors expect Shadowfax to benefit from India’s booming e-commerce and quick-commerce demand.

Market Reaction:

• Institutional investors are expected to focus on profitability trajectory, while retail investors may react strongly to valuation and peer comparison with Delhivery and other logistics players.

Sector Signal:

• Logistics and quick-commerce companies are emerging as a key IPO theme in India, driven by digital consumption and last-mile delivery demand.

Why this matters:

• In recent tech IPOs, valuation discipline and QIB participation have been the biggest drivers of listing performance.

Data patterns from recent tech and logistics IPOs suggest that Shadowfax’s listing performance will depend less on hype and more on valuation comfort and institutional demand. If priced aggressively, the IPO may face listing volatility despite strong growth narratives. If priced reasonably, it could emerge as a high-interest listing candidate.

Is Shadowfax the next big logistics IPO story or a high-risk tech bet? Can strong growth offset profitability concerns? Here is a data-driven trade strategy analysis.

📌 Shadowfax IPO Snapshot (Verified & Updated)

| Parameter | Details |

|---|---|

| Company Name | Shadowfax Technologies Limited |

| Business Model | Last-mile logistics & hyperlocal delivery platform |

| Sector | Logistics & E-commerce Infrastructure |

| IPO Type | Mainboard IPO (Expected) |

| IPO Status | Pre-DRHP / Expected Filing in 2026 |

| Expected Issue Size | ₹2,000 – ₹3,500 Crore (Market Estimates) |

| Expected Valuation | ₹8,000 – ₹12,000 Crore (VC Estimates) |

| Price Band | To be announced |

| Lot Size | To be announced |

| IPO Timeline | Expected in 2026–2027 |

| Listing Exchange | NSE & BSE (Expected) |

| Investor Focus | Retail + NII/HNI + QIB |

🏢 Shadowfax Business & Growth Overview

| Metric | Status |

|---|---|

| Founded | 2015 |

| Core Business | Hyperlocal logistics & e-commerce deliveries |

| Key Clients | Flipkart, Meesho, Amazon sellers, D2C brands |

| Revenue Trend | High growth trajectory |

| Profitability | Loss-making / Near break-even |

| Business Moat | Network scale, last-mile reach, tech platform |

📊 Shadowfax Financial Snapshot (Indicative)

| Metric | Approx Status |

|---|---|

| Revenue Growth | 25% – 40% CAGR (Estimated) |

| EBITDA Margin | Negative to Low Positive |

| Net Profit | Loss-making (Startup Phase) |

| Unit Economics | Improving |

| Cash Burn | Moderate |

📊 Fundamental vs Sentiment Conflict Model

| Scenario | Meaning | Strategy |

|---|---|---|

| Strong Fundamentals + High Sentiment | Institutional confidence | Apply |

| Weak Fundamentals + High Sentiment | Speculative hype | Listing trade only |

| Strong Fundamentals + Low Sentiment | Long-term value | Wait & accumulate |

| Weak Fundamentals + Low Sentiment | High risk | Avoid |

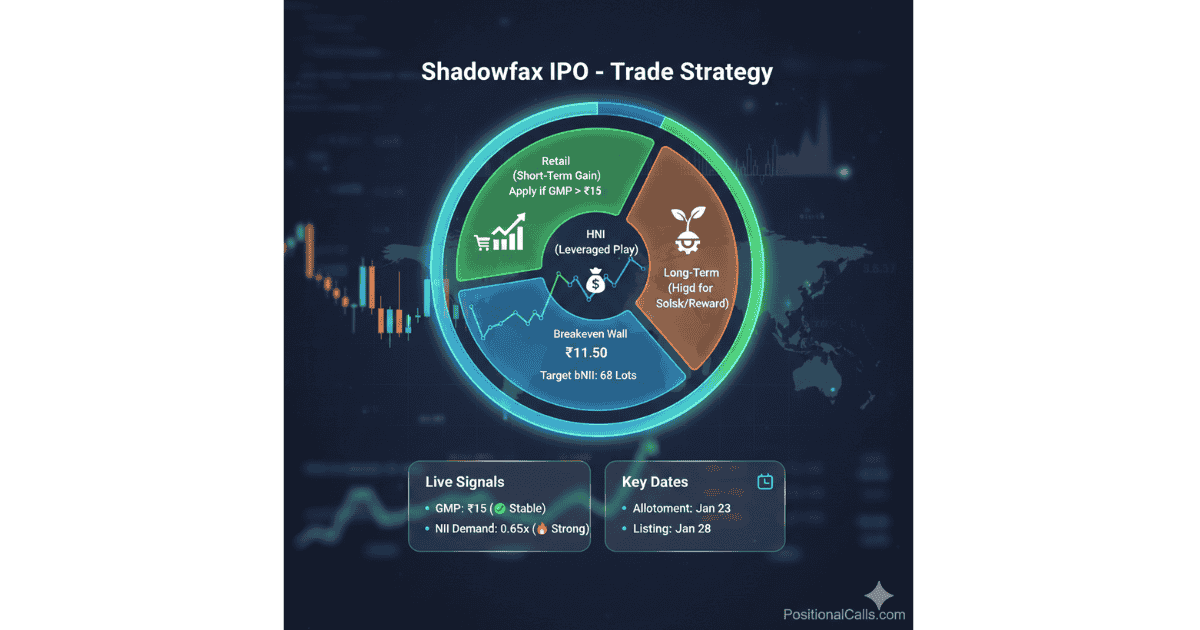

📊 Shadowfax IPO Trade Strategy Framework

| Indicative Sentiment / GMP | Action | Rationale |

|---|---|---|

| Very Strong Demand | Strong Apply | High probability of premium listing |

| Moderate Demand | Apply (Speculative) | Listing gains possible |

| Selective Demand | Selective Apply | Limited upside |

| Weak Demand | Avoid | Flat listing risk |

👥 Retail vs HNI vs QIB Strategy Matrix

| Investor Category | Trigger Condition | Action |

|---|---|---|

| Retail | Reasonable valuation + positive sentiment | Apply |

| NII / HNI | NII subscription ≥ 5x | Aggressive Apply |

| QIB | Visible institutional participation | Strong Apply Signal |

📊 Listing Scenario Model (Probability-Based)

| Scenario | Expected Listing Gain | Probability |

|---|---|---|

| Bullish | +25% to +50% | 30% |

| Neutral | +5% to +20% | 50% |

| Bearish | -5% to +5% | 20% |

🏆 Peer Comparison (Logistics Startups)

| Company | Business Model | IPO Status |

|---|---|---|

| Shadowfax | Hyperlocal logistics | Pre-IPO |

| Delhivery | Logistics & supply chain | Listed |

| ElasticRun | B2B logistics | Unlisted |

| XpressBees | E-commerce logistics | IPO Expected |

⚠️ Shadowfax IPO Risk Management Rules

• Avoid applying if valuation looks stretched compared to peers.

• Do not rely only on hype or social media sentiment.

• Prefer listing trade over long-term holding unless profitability improves.

• Monitor QIB participation — it is the real signal in tech IPOs.

📊 Shadowfax IPO Risk–Reward Scorecard

| Business Potential | 8.2 / 10 |

| Growth Visibility | 8.5 / 10 |

| Profitability Strength | 4.5 / 10 |

| Valuation Risk | High |

| Overall IPO Risk Level | Medium–High |

🔎 Final Apply vs Avoid Decision Matrix

| Condition | Decision |

|---|---|

| Reasonable valuation + strong QIB demand | Apply |

| High valuation + moderate demand | Selective Apply |

| Overvaluation + weak demand | Avoid |

Shadowfax IPO represents the new-age logistics IPO cycle where growth potential is strong but valuation discipline will decide listing success.

Disclaimer: Shadowfax IPO details are based on market estimates, startup ecosystem data, and public information. GMP and sentiment indicators are unofficial and speculative. This content is for educational purposes only and does not constitute investment advice.

Read More: Shadowfax IPO — Live GMP, Subscription, Allotment & Listing Analysis