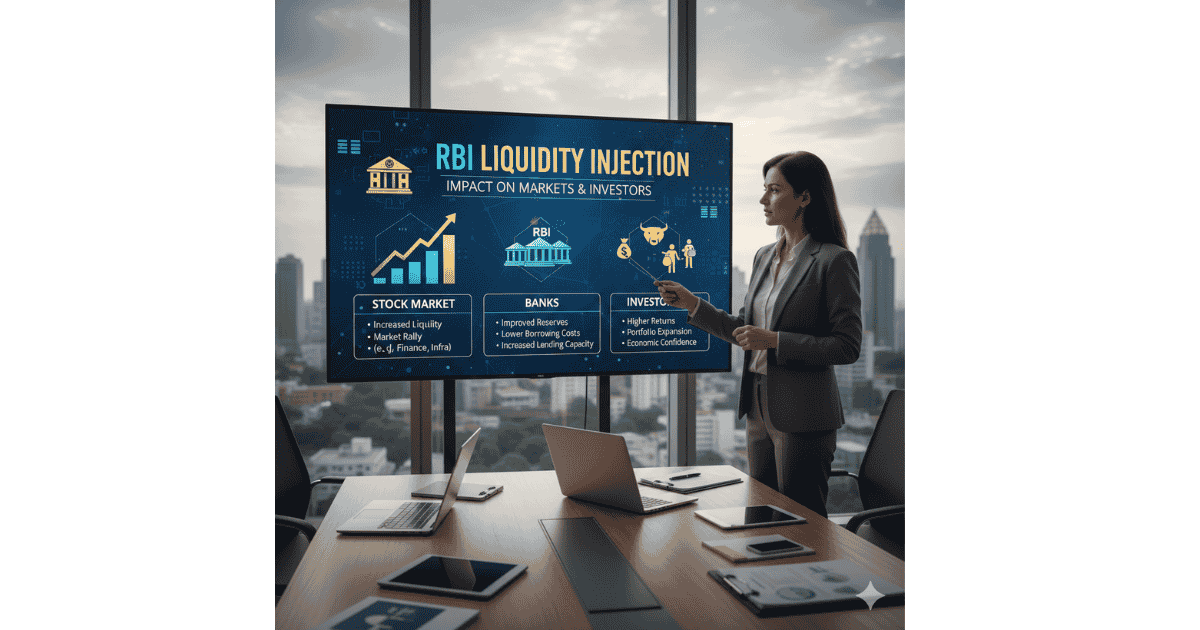

RBI Liquidity Injection: ₹2 Lakh Crore Boost to Banks, Rupee Pressure & Stock Market Impact

RBI liquidity injection into banks explained. This report covers reasons behind RBI’s ₹2 lakh crore liquidity boost, impact on bank stocks, rupee volatility, bond yields, stock market reaction, investor sentiment and future outlook.

• Banking system liquidity deficit narrowed from ~₹2.3 lakh crore to ~₹0.9–₹1.2 lakh crore

• USD/INR trading near ₹83.0–₹83.7 range (volatile)

• 10Y G-Sec yield hovering near 7.20%–7.35%

• Bank stocks showing mixed reaction (support + volatility)

• Market sentiment: Cautiously supportive, not bullish

📊 RBI Liquidity Injection: Market Impact Dashboard

| Indicator | Current Status | Impact Level |

|---|---|---|

| Banking System Liquidity | Deficit narrowing 📉→📈 | High |

| USD/INR | ₹83.0–₹83.7 (Volatile) ⚠️ | Medium-High |

| 10Y Bond Yield | 7.20%–7.35% 📊 | Medium |

| Nifty Bank Index | 46,500–48,800 Range | Medium-High |

| FPI Flows | Net Outflows (₹3,000–₹8,000 Cr) | Medium |

| Bank Stocks Sentiment | Neutral | Moderate |

| Market Volatility | High | High |

🏦 RBI Liquidity Injection: Tools & Breakdown

| RBI Instrument | Approx Amount | Purpose |

|---|---|---|

| OMO (Bond Purchases) | ₹60,000 – ₹80,000 Cr | Lower yields & inject liquidity |

| Forex Swap Auctions | ₹80,000 – ₹1,00,000 Cr | Ease dollar liquidity & rupee pressure |

| Repo / VRR Operations | ₹30,000 – ₹50,000 Cr | Short-term liquidity support |

| MSF / Standing Facility | ₹10,000 – ₹20,000 Cr | Emergency liquidity buffer |

| Total Liquidity Injection | ₹2,00,000 Cr+ | System-wide support |

🤖 RBI Market Intelligence Engine

🧾 Why Did RBI Inject Massive Liquidity into Banks?

RBI announced liquidity injection amid rupee weakness, rising bond yields, tight banking liquidity and global risk aversion.

- 📉 Rupee weakness due to strong US dollar

- 📊 Rising government bond yields

- 🏦 Liquidity deficit in interbank markets

- 🌍 Global monetary tightening cycle

- 📉 Persistent FPI outflows

⏳ RBI Liquidity Injection Timeline

| Phase | Event |

|---|---|

| Phase 1 | USD/INR weakens & bond yields rise |

| Phase 2 | Liquidity deficit crosses ₹2 lakh crore |

| Phase 3 | RBI announces ₹2 lakh crore liquidity measures |

| Phase 4 | Bank stocks react & markets partially stabilise |

🏭 Sector-wise Impact

| Sector | Impact | Outlook |

|---|---|---|

| Banking | Positive but volatile | Cautiously supportive |

| NBFCs | Moderate positive | Neutral |

| IT & Exporters | Mixed (rupee benefit) | Stock-specific |

| Infra & Metals | Limited impact | Neutral |

⚖️ Risks vs Opportunities for Investors

| Opportunities | Risks |

|---|---|

| Short-term rally in bank stocks | Rupee depreciation risk |

| Improved credit growth | Global risk-off sentiment |

| Lower systemic liquidity stress | Inflation & rate uncertainty |

🧠 Investor Psychology: What Markets Are Pricing In

- 📊 Liquidity support = short-term relief

- ⚠️ Rupee weakness keeps volatility elevated

- 🏦 Bank stocks outperform only if credit growth accelerates

- 💣 Long-term outlook depends on inflation & global rates

🔮 What Happens Next? (Scenario Analysis)

| Scenario | Rupee | Bank Stocks | Market Impact |

|---|---|---|---|

| Bullish | Stabilises | Rally | Positive |

| Base Case | Range-bound | Sideways | Neutral |

| Bearish | Weakens | Correction | Negative |

🧾 RBI Liquidity Injection: Quick News Summary

• Rupee remains under pressure amid global volatility.

• Bank stocks in focus after RBI intervention.

• Bond yields remain elevated.

• Investors track inflation, FPI flows and RBI policy stance.

🏆 Final Market Verdict

RBI’s liquidity injection is a strong short-term stabiliser for Indian markets and banking stocks. However, rupee pressure and global uncertainty mean volatility will remain elevated.

Current Market Sentiment:

Market Stability Index: /10

Conclusion: This policy move reflects both stress and support in India’s financial system.