KSB Ltd. Stock: Decoding the Investment Potential with Fundamental & Technical Analysis

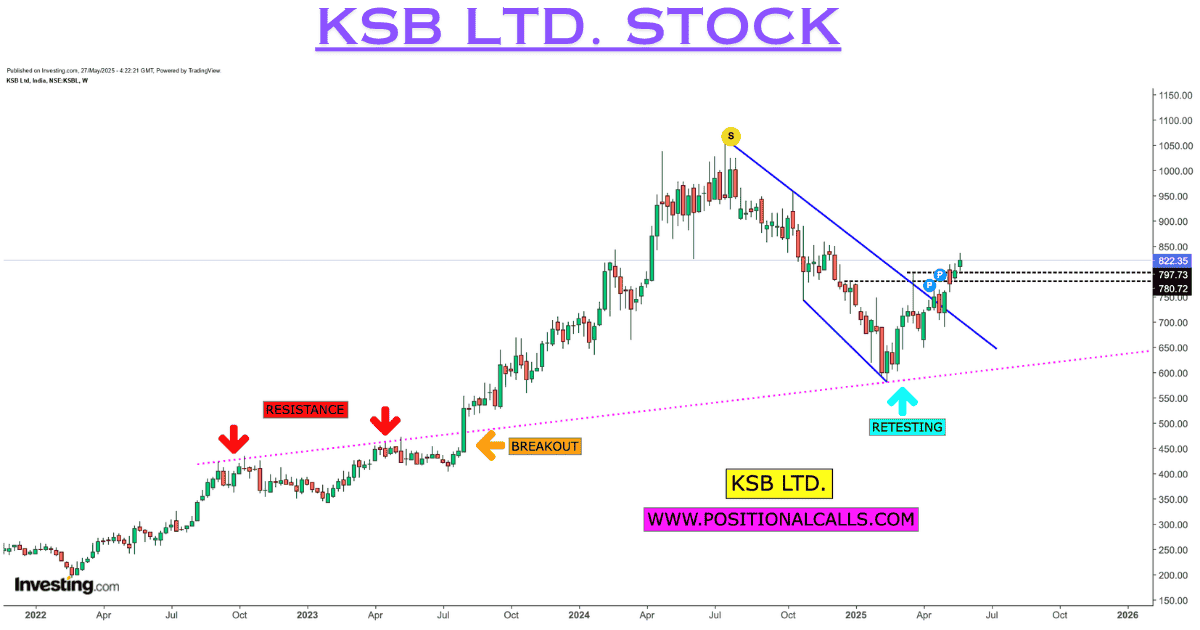

Buy KSB LTD. In Dips Now : 820 – 830

Support : 650 – 640

Target Expecting: 1300, 1800

View: Short To Long Term

Disclaimer: This detailed blog post is for informational and educational purposes only and should not be considered financial advice. Investing in the stock market involves substantial risk, and it is imperative to conduct your own comprehensive research and consult with a SEBI-registered financial advisor before making any investment decisions.

In the ever-evolving landscape of Indian equities, pinpointing companies with robust fundamentals, burgeoning growth prospects, and compelling technical indicators is the cornerstone of prudent investment strategy. Today, our focus is on KSB Limited (NSE: KSB), a titan in the industrial machinery and capital goods sector. A global leader in pumps, valves, and systems, KSB offers sophisticated solutions across a spectrum of critical industries. This exhaustive analysis aims to provide a strong buy stock recommendation for KSB, integrating in-depth fundamental analysis with crucial technical indicators to empower informed investment decisions and visibility among serious investors.

KSB Ltd. Stock: The KSB Advantage: A Deep Dive into Fundamental Strength

KSB Limited, a subsidiary of the German KSB SE & Co. KGaA, boasts a legacy of over six decades in India. Its diversified product portfolio and widespread presence make it a resilient player in the industrial equipment manufacturing domain.

1. Business Model & Market Leadership:

KSB’s core strength lies in its comprehensive range of products, including industrial pumps, submersible pumps, effluent treatment pumps, and a wide array of industrial valves. Their services extend to critical applications in power, oil and gas, building services, water treatment, and general industry. This broad market exposure acts as a significant de-risking factor, ensuring steady demand. The company’s commitment to innovation, backed by its in-house R&D, ensures it stays at the forefront of advanced engineering solutions and precision fluid management systems. Recent ventures into green technologies like solar-powered pumping systems further cement its future-ready positioning.

2. Consistent Financial Performance:

A Bedrock of Value A review of KSB’s financial health reveals a compelling growth narrative, making it an attractive proposition for long-term wealth accumulation.

- Revenue Trajectory:

KSB has consistently grown its revenue. For the quarter ending March 31, 2025, the company reported sales of INR 595.40 crore, a healthy increase over previous periods. Annually, revenue has climbed steadily from INR 1,208.12 crore in December 2020 to INR 2,533.09 crore in December 2024. This upward trend underscores strong demand for their mission-critical industrial components. - Profitability & Margins:

The company maintains healthy operating profit margins, demonstrating efficient cost management. The operating profit for Q1 CY2025 stood at INR 67.70 crore. Net profit has also shown robust growth, rising from INR 97.34 crore in December 2020 to INR 240.90 crore in December 2024. This consistent profitability is a key indicator for quality stock selection. - Return Ratios:

KSB’s Return on Capital Employed (ROCE) and Return on Equity (ROE) figures are respectable, reflecting effective capital utilization. ROCE was reported at 24.3% and ROE at 18.03% for the trailing twelve months (TTM) as of March 2025. Such efficiency is characteristic of high-performing industrial stocks. - Debt-Free Status:

A significant highlight is KSB’s virtually debt-free balance sheet (debt-to-equity ratio of 0). This strong financial position provides immense flexibility for future expansion and cushions against economic downturns, appealing to risk-averse investors. - Dividend History:

KSB has a commendable record of consistent dividend payouts, enhancing its appeal for income-generating portfolios. The company declared a final dividend of INR 4 per share for FY2025.

3. Growth Catalysts & Future Outlook:

KSB is strategically positioned to capitalize on India’s burgeoning economic growth and governmental impetus.

- Infrastructure Boom:

India’s aggressive infrastructure development, including projects in water supply, irrigation (like the PM-KUSUM scheme for solar water pumping systems), power generation (including nuclear), and industrial expansion, directly translates into increased demand for KSB’s products. Large orders, such as those for nuclear pumps, underscore its role in strategic national projects. - Diversification & New Avenues:

KSB is actively venturing into high-growth segments like domestic, building services, and water & wastewater (WWW) solutions. Their focus on sustainable solutions and smart technologies (e.g., IoT-enabled pumps) aligns with global industry trends and positions them for future growth in ESG-compliant investments. - Strong Order Book:

A healthy order book provides revenue visibility. The company’s management has expressed confidence in continued strong order intake and sales growth. - Promoter Confidence:

The high promoter holding (nearly 70%) signals strong confidence from the management in the company’s long-term prospects.

KSB Ltd. Stock: Technical Analysis: Charting the Path for KSB Ltd.

While fundamental analysis provides a long-term view, technical analysis offers insights into short- to medium-term price movements and potential entry/exit points.

1. Price Action and Trends:

KSB stock has demonstrated a generally bullish trend over the past few years, reflecting its fundamental strength. While there might be occasional corrections, the overall trajectory has been upward. The stock’s 52-week high is around INR 1,060, and the 52-week low is INR 582.25. As of late May 2025, the stock is trading around the INR 800-815 range.

2. Moving Averages (MAs):

- Short-Term (5-day, 10-day, 20-day MA):

Recent technical data suggests the stock is currently hovering around or slightly above its short-term moving averages. A close above these averages generally indicates short-term bullish momentum. - Medium-to-Long Term (50-day, 100-day, 200-day MA):

KSB’s stock price has largely remained above its key medium-term and long-term moving averages (50-day SMA, 100-day SMA, 200-day SMA), which is a strong bullish signal. This suggests that the uptrend is intact on a larger timeframe. Consistent trading above the 200-day EMA is often considered a hallmark of strong growth stocks.

3. Relative Strength Index (RSI):

The 14-period RSI for KSB is currently in a neutral zone (around 50-55). This indicates that the stock is neither overbought nor oversold, providing room for potential upward movement without immediate reversal risks. An RSI trending upwards from the neutral zone would signal increasing buying pressure.

4. Moving Average Convergence Divergence (MACD):

The MACD indicator is a momentum oscillator. A bullish crossover (MACD line crossing above the signal line) typically indicates buying opportunities, while a bearish crossover suggests selling pressure. Recent data for KSB indicates a ‘buy’ signal from MACD, reinforcing the potential for an upward move.

5. Support and Resistance Levels:

- Support Levels:

Identifying key support levels is crucial for risk management. Strong support for KSB can be observed around INR 750-780, representing previous consolidation zones. - Resistance Levels:

Immediate resistance might be encountered around the INR 830-850 range, with the 52-week high of INR 1,060 serving as a significant long-term resistance level. A decisive breakout above these levels, supported by high volumes, could signal a fresh leg in the rally.

6. Volume Analysis:

Analyzing trading volumes alongside price action is essential. Consistent trading volumes, especially during upward price movements, signify strong investor conviction. Any sharp rallies on low volumes should be viewed with caution.

Technical Outlook Summary:

Overall, KSB’s technical chart suggests a healthy bullish structure. While some short-term volatility is expected, the long-term trend remains positive. The stock is trading above key moving averages, and momentum indicators are either neutral or providing buy signals. This confluence of factors makes KSB an attractive proposition from a technical standpoint for growth-oriented investors.

KSB Ltd. Stock: Peer Comparison and Valuation Insights

While KSB demonstrates strong individual merits, it’s prudent to compare it with its peers in the industrial pumps and valves sector. Key competitors include Kirloskar Brothers, Shakti Pumps, and Elgi Equipments.

- Valuation Metrics:

KSB is currently trading at a P/E ratio of around 55-57 and an EV/EBITDA of approximately 35-36. While these figures are on the higher side compared to the industry average, they are often justified for companies with superior growth prospects, strong brand equity, and consistent profitability. Investors should consider if the premium valuation aligns with their investment horizon and expected returns. - Growth Premium:

The market often assigns a premium to companies with robust balance sheets, consistent earnings growth, and a dominant market position. KSB’s ability to secure large orders, innovate, and expand into new segments justifies its valuation to a certain extent.

KSB Ltd. Stock: Risks to Monitor for a Balanced Perspective

No investment is without risk. For KSB, key considerations include:

- Economic Downturn:

A significant slowdown in industrial activity or infrastructure spending in India could temper demand for KSB’s products. - Commodity Price Volatility:

Fluctuations in raw material prices could impact margins, although KSB’s strong pricing power and operational efficiency help mitigate this. - Intensified Competition:

The market for industrial pumps and valves is competitive. While KSB is a leader, new entrants or aggressive strategies from existing players could pose challenges. - Global Economic Headwinds:

While domestic demand is a strong driver, a global economic slowdown could impact KSB’s export revenues.

READ MORE: Invest Smart: NSE Adds 4 Key Stocks to F&O from June 27 – Get Ready!

Conclusion: A Compelling Buy for Long-Term Growth

Integrating both fundamental and technical analyses, KSB Limited emerges as a highly recommended stock for investors seeking exposure to India’s robust industrial and infrastructure growth story. Its dominant market position, consistent financial performance, strategic growth initiatives, debt-free balance sheet, and positive technical indicators collectively paint a bullish picture.

For investors with a medium- to long-term investment horizon and a moderate risk appetite, KSB offers a compelling opportunity for capital appreciation and sustainable dividend income. The current valuation, while appearing stretched, is often a reflection of the market’s confidence in KSB’s future earnings potential.

Recommendation: BUY KSB Limited with a focus on long-term value creation. Accumulate on dips to optimize entry points.

Before making any investment decision, it is paramount to:

- Perform Your Own Due Diligence:

Thoroughly review KSB’s latest annual reports, quarterly results, and management discussions. - Understand Your Risk Profile:

Ensure that this investment aligns with your personal financial goals and risk tolerance. - Consult a Financial Expert:

Seek personalized advice from a SEBI-registered financial advisor.

By strategically investing in fundamentally sound companies like KSB, investors can effectively position their portfolios to benefit from India’s structural growth drivers.