Buy Recommendation for Reliance Industries: 2025 Business Analysis, Growth Drivers & Risk Overview:

Educational disclosure: This page is an analytical review based on publicly available information and market observations. It does not constitute investment advice.

Market Context (Non-Advisory):

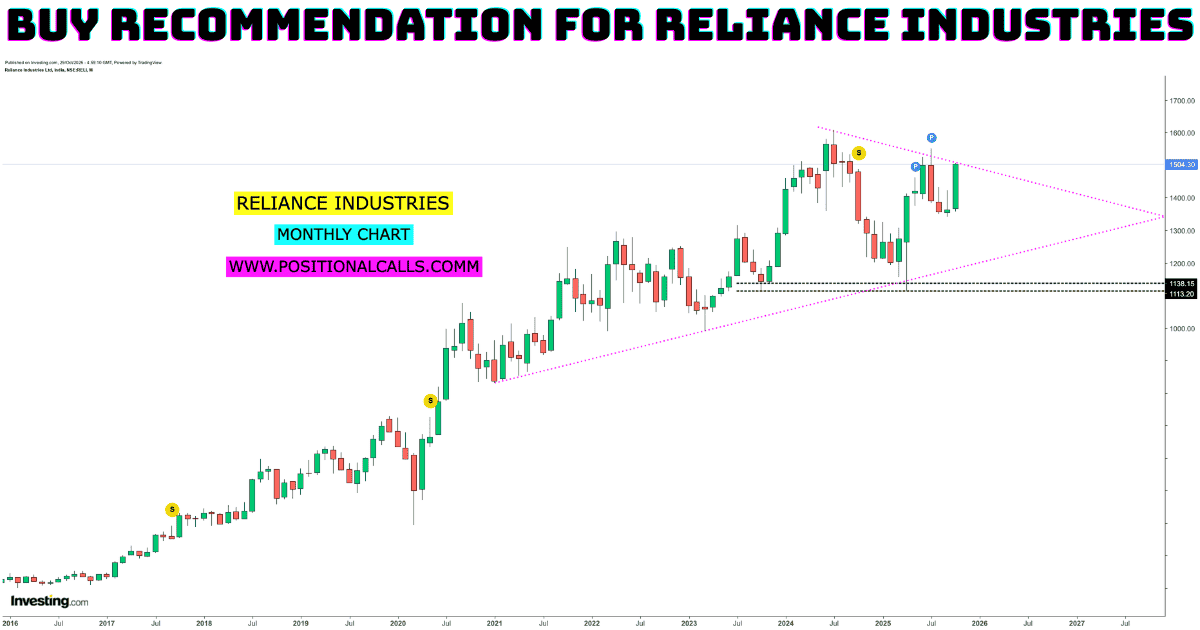

Reliance Industries observed trading near ₹1500

Structural demand zone discussed by market participants near ₹1340

Upper reference zone discussed in market commentary near ₹1900+

View referenced in market: short-term to medium-term analytical context

Buy Recommendation for Reliance Industries in 2025: Introduction

Remains one of India’s most systemically important listed companies, with operations spanning energy, petrochemicals, digital services, retail, and emerging new-energy platforms. Due to its index weight and cross-sector exposure, Reliance often reflects broader macroeconomic sentiment as well as domestic consumption trends.

This page presents a non-advisory, institutional-style analysis of Reliance Industries for 2025, focusing on business structure, earnings visibility, growth drivers, valuation context, and key risk factors.

Why Reliance Industries Draws Market Attention in 2025

Diversified Business Model (Structural Strength)

Reliance operates a multi-engine business model that reduces dependency on any single segment:

- Digital (Jio):

Large subscriber base with improving ARPU and expanding digital platforms - Retail:

India’s largest organised retail network benefiting from formalisation and consumption growth - Energy & Petrochemicals:

Strong cash-flow engine supporting capital deployment - New Energy:

Long-term optionality through solar, batteries, and hydrogen initiatives

This diversification supports earnings stability across economic cycles.

Financial Performance & Earnings Visibility (Contextual)

Recent quarters in FY25 reflected stable consolidated revenues, with margin support from operational efficiencies across segments. Street estimates continue to factor in:

- Mid-teens revenue CAGR over the next 3–5 years

- Cash flow strength from legacy energy businesses

- Reinvestment into retail and new-energy platforms without excessive balance-sheet stress

Institutional perspective: Reliance’s valuation often reflects future optionality rather than near-term earnings alone.

Valuation Context & Market Expectations

Market commentary and brokerage discussions for 2025 have broadly referenced valuation zones between ₹1700–₹1900 over a 6–12 month horizon, driven by expectations around retail scale-up, Jio monetisation, and progress in energy transition initiatives.

These levels represent market expectations, not assurances, and remain sensitive to execution quality and macro conditions.

Buy Recommendation for Reliance Industries in 2025: Key Growth Drivers to Monitor

- Digital ecosystem expansion: Integration across telecom, payments, commerce, and content

- Retail margin normalisation: Store expansion, private labels, and supply-chain efficiency

- New-energy execution: Timelines, capital allocation discipline, and policy incentives

- Free cash flow generation: Funding growth without over-leveraging

Risk Factors & Constraints

Despite its scale, Reliance faces identifiable risks:

- Regulatory risk: Telecom pricing, environmental norms

- Commodity volatility: Refining and petrochemical margin sensitivity

- Execution risk: Complexity of large-scale retail and energy projects

- Valuation sensitivity: Elevated expectations can amplify downside on earnings misses

Analytical Observations (Not Trading Advice)

Market participants often discuss accumulation interest near long-term demand zones and supply pressure near previous resistance levels. Index-linked flows and institutional positioning can influence short-term price behaviour independent of fundamentals.

These observations are descriptive only and should not be interpreted as actionable recommendations.

Buy Recommendation for Reliance Industries in 2025: Frequently Asked Questions (FAQ)

Is Reliance Industries considered a defensive stock?

Reliance offers relative stability through diversification but remains exposed to macro, regulatory, and commodity cycles.

What differentiates Reliance from other large-cap companies?

Its combination of energy cash flows, consumer platforms, digital scale, and new-energy optionality at a single-group level.

Is new energy already contributing materially to earnings?

Currently limited; it represents long-duration optionality rather than near-term profitability.

Authoritative External Reference:

For official filings, disclosures, and market data, refer to: NSE India – Reliance Industries

Related Internal Read:

Tech Mahindra Share Price Target 2026: Market Structure, Q3 Results & Risk Analysis

Conclusion

Reliance Industries continues to function as a structural heavyweight in Indian equities, combining cash-generating legacy businesses with long-term growth optionality. Market focus in 2025 remains on execution progress, capital allocation discipline, and policy direction rather than short-term price movements.

Readers should continuously track official disclosures, quarterly results, and sector developments while evaluating suitability based on individual risk tolerance.