Buy HITECHGEAR Stock: A Comprehensive Analysis

Investors seeking opportunities in the Indian auto ancillary sector are increasingly turning their attention to Hi-Tech Gears Ltd. (NSE: HITECHGEAR). With a robust legacy, global presence, and promising future projections, HITECHGEAR stands out as a potential buy for discerning investors. This blog provides an in-depth, SEO-optimized analysis of HITECHGEAR, covering its business fundamentals, financial performance, growth prospects, and key reasons supporting a buy recommendation.

Buy HITECHGEAR Stock: Company Overview: The Hi-Tech Gears Ltd.

Hi-Tech Gears Ltd. is a leading manufacturer and supplier of automotive components, serving both domestic and international markets. The company’s journey from a single-source supplier to Hero MotoCorp (formerly Hero Honda) in the late 1980s to a global player with operations in North America and partnerships with industry giants like Daimler and Cummins showcases its evolution and resilience.

Key milestones include:

- Early technology tie-ups with Japanese and American partners.

- Expansion into precision forging, R&D, and robotic systems.

- Multiple awards for manufacturing and export excellence.

- A strong focus on operational excellence and green manufacturing.

Buy HITECHGEAR Stock: Performance: Recent Trends

As of June 2025, HITECHGEAR is trading around ₹650.05, reflecting a 1.25% gain in the past 24 hours. The stock has seen a 7.92% rise over the past week and a 12.33% increase over the last month. However, it has declined by approximately 33% over the past year, primarily due to sectoral headwinds and broader market corrections. Notably, HITECHGEAR reached its all-time high of ₹1,280.45 in April 2024, indicating significant growth potential when market conditions are favorable.

Volatility and Beta

- Volatility:

3.33% - Beta:

1.37 (higher than the market, suggesting greater price swings).

Buy HITECHGEAR Stock: Financial Performance: 2025 Snapshot

Revenue and Profitability

- FY 2025 Revenue:

₹9.39 billion (down 15% from FY 2024) - Net Income:

₹403.6 million (down 65% YoY) - Profit Margin:

4.3% (down from 10% in FY 2024) - EPS:

₹21.49 (down from ₹60.86 in FY 2024)

The decline in revenue and profitability in FY 2025 reflects industry-wide challenges, including softer demand and input cost pressures. However, HITECHGEAR maintains a “flawless balance sheet” and continues to pay dividends, underlining its financial stability.

Buy HITECHGEAR Stock: Key Financial Ratios

- PE (TTM):

22.26 (moderate valuation) - Price/Book:

2.30 - Price/Sales:

1.08 (very good) - Piotroski F Score:

7.0 (very good, indicating strong financial health) - Debt to Equity:

0.64 (manageable leverage) - Altman Z Score:

4.07 (very good, low bankruptcy risk)

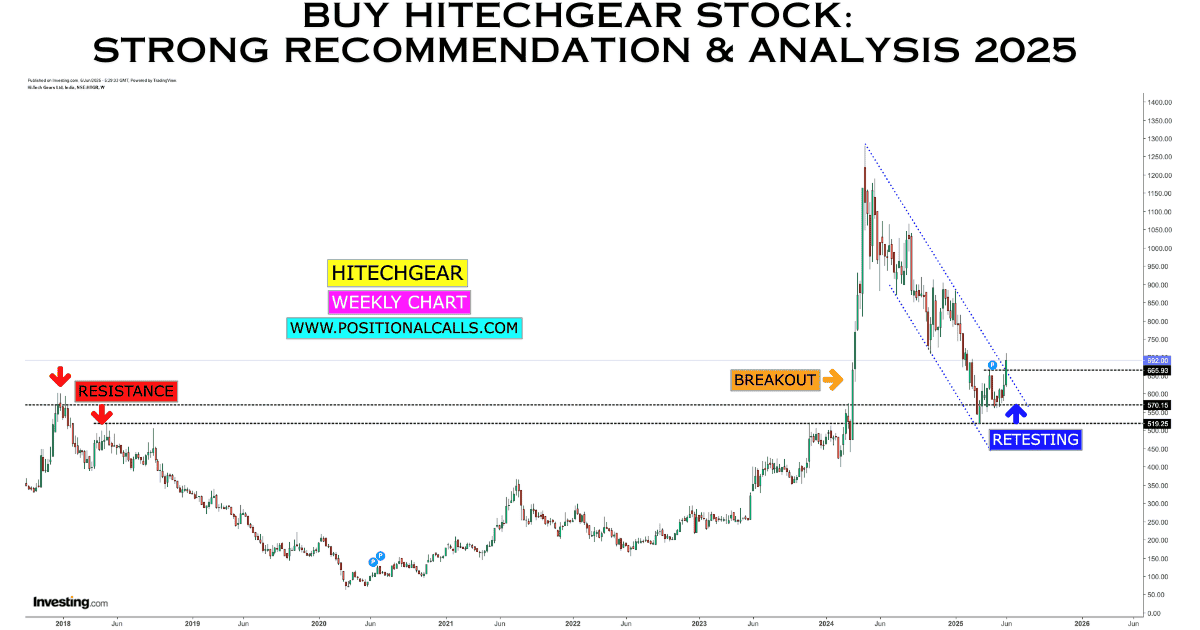

Buy HITECHGEAR Stock: Technical and Fundamental Analysis

Technical Outlook

- TSR Strength Index:

Mild Bearish (short-term) - Growth Index:

Low Growth Stock (recently) - Value Index:

Good Value - Profitability Index:

Low Profitability (recent dip) - Stability Index:

Mild Stability

Long-Term Returns

- 5-Year Return:

736.17% - 10-Year Return:

106.82% - Outperformed Nifty 50 over 5 and 10 years.

Despite recent corrections, the long-term trajectory remains positive, supported by strong fundamentals and sectoral tailwinds.

HITECHGEAR Share Price Target: 2025 and Beyond

According to market forecasts:

- HITECHGEAR TRADING BETWEEN:

₹700 – 710 - HITECHGEAR STOCK SUPPORT:

₹560 - HITECHGEAR STOCK Target:

FIRST TARGET – ₹1280 (BULLISH SCNERIO)

SECOND TARGET – ₹ 1750 (BULLISH SCNERIO) - TIME PERIOD/VIEW FOR TARGET :

4-5 QUARTER

These targets suggest a potential upside of over 100% from current levels if favorable macroeconomic and industry trends persist. The outlook for 2026 and beyond remains robust, with projections indicating continued growth and new highs.

Buy HITECHGEAR Stock: Growth Drivers and Investment Rationale

1. Global Expansion and Diversified Clientele

HITECHGEAR’s expansion into North America and partnerships with leading OEMs (original equipment manufacturers) provide revenue stability and growth opportunities.

2. Technological Leadership

Continuous investment in R&D, automation, and green manufacturing enhances operational efficiency and positions the company for future mobility trends.

3. Strong Balance Sheet

Low debt, healthy liquidity ratios, and a high Piotroski F-score indicate prudent financial management and resilience during downturns.

4. Attractive Valuation

With a price-to-sales ratio of 1.08 and a moderate PE, HITECHGEAR offers good value, especially for long-term investors seeking exposure to the auto ancillary space.

5. Sectoral Tailwinds

The Indian auto sector is poised for recovery, driven by rising vehicle demand, electrification, and increased localization of components. HITECHGEAR is well-positioned to benefit from these trends.

Buy HITECHGEAR Stock: Risks and Considerations

- Short-term Profitability Pressure:

FY 2025 saw a significant drop in profit margin and EPS due to lower revenues and industry headwinds. - Volatility:

With a beta of 1.37, the stock is more volatile than the broader market, which may not suit risk-averse investors. - Mild Bearish Technicals:

Short-term technical indicators suggest some caution, but long-term fundamentals remain intact.

READ MORE: NSE Investment Opportunities: Top Stocks Poised for Explosive Returns on June 6, 2025

Conclusion: Buy Recommendation on HITECHGEAR Stock

HITECHGEAR offers a compelling investment opportunity for those seeking exposure to the Indian auto ancillary sector. Despite recent profitability challenges, the company’s strong balance sheet, global presence, and technological edge support its long-term growth prospects. With price targets indicating significant upside potential for 2025 and beyond, HITECHGEAR merits a buy recommendation for investors with a medium- to long-term horizon.

Key Takeaways:

- Strong historical returns and sector outperformance.

- Attractive valuation and solid financial health.

- Clear growth trajectory with global and domestic drivers.

- Short-term risks are outweighed by long-term prospects.

As always, investors should conduct their own due diligence and consider their risk tolerance before making investment decisions.

For more insights on the best stocks to buy now, stock market trends, and investing strategies, stay tuned to our blog and subscribe for regular updates!