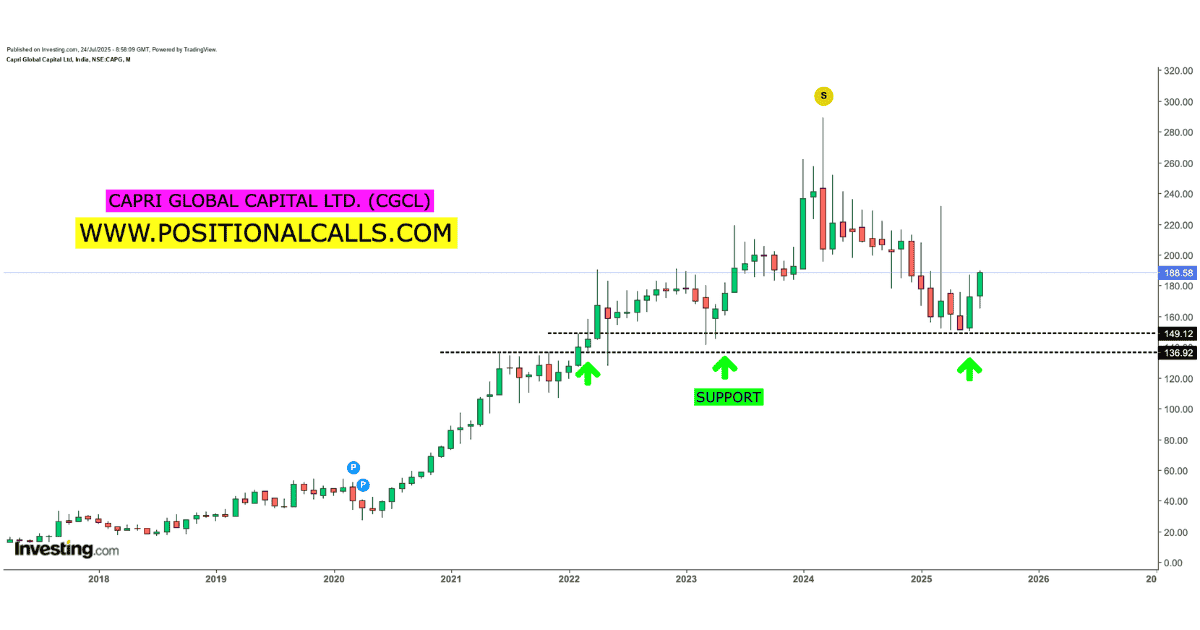

Buy CGCL in 2025

CGCL NOW TRADING BETWEEN 180 AND 185

SUPPORT: 150-160

TARGET: 290

VIEW: SHORT TERM TO MEDIUM TERM

Buy CGCL in 2025: A Comprehensive Analysis

Investors seeking robust opportunities in the non-banking financial sector should draw serious attention to Capri Global Capital Limited (CGCL). With consistent financial performance, ambitious expansion plans, and a resilient business model, CGCL is increasingly viewed as a compelling buy in 2025 by analysts and market observers alike. This comprehensive guide provides a thorough analysis of why CGCL earns a “Buy” recommendation, considering both fundamental and technical factors, and delivers a rigorous resource for discerning investors.

Buy CGCL in 2025: Overview of Capri Global Capital Limited (CGCL)

Capri Global Capital Limited, commonly abbreviated as CGCL, is a leading non-banking financial company (NBFC) in India, specializing in diverse segments such as gold loans, MSME (Micro, Small & Medium Enterprises) loans, housing finance, and construction finance. The company has a market capitalization of over ₹17,500 crore and operates across India with a rapidly growing branch network, reflecting its aggressive growth mandate. CGCL has positioned itself as a significant participant in the Indian financial sector by catering to the credit requirements of underpenetrated markets, a strategy that ensures continued relevance and scalability.

Buy CGCL in 2025: Why a “Buy” Recommendation on CGCL?

1. Strong and Diversified Growth Trajectory

- Asset Under Management (AUM) Growth:

CGCL recorded a consolidated AUM growth of 46% year-on-year, with particular strength in the gold loans segment, which surged by over 130%. This highlights the company’s ability to capitalize on market demand and identify high-growth verticals. - Branch Expansion:

The branch network has expanded significantly, surpassing 1,111 branches—a move poised to drive customer acquisition, improve collection efficiency, and achieve geographical diversification. - Technology and Efficiency:

Investments in technology and operational excellence have yielded remarkable improvements, with collection efficiency reaching around 99%, a critical metric for asset quality and profitability.

2. Sound Financial Health and Risk Management

- Disciplined Risk Management:

CGCL maintains a low delinquency rate and a stable loan-to-value (LTV) ratio of 71%, which underscores prudent underwriting and robust credit checks. - Profitability and Yield:

Despite challenges such as rising cost of funds (9.5%) and pressure on gold loan yields (at about 22%), average profitability remains steady, supported by a diversified income stream and operational efficiencies. - Compliance and Regulation:

The company is proactive in adapting to evolving regulatory guidelines, maintaining compliance and risk mitigation as it pursues aggressive expansion.

3. Positive Analyst Sentiment and Price Targets

- Analyst Consensus:

100% of tracked analysts currently suggest that investors should buy CGCL, reflecting consensus on its potential for future upside. - Share Price and Upside Projection:

As of July 24, 2025, CGCL trades at about ₹181.50. Technical forecasts suggest upward targets in the medium to long term, with resistance levels noted at ₹195 and projections suggesting potential appreciation towards ₹200.62 on the upper side, contingent on market conditions and company performance.

4. Technical Analysis Signals

- Moving Average Signals:

The long-term moving averages provide a buy signal, reinforcing optimism for investors with a medium- to long-term horizon. The 3-month Moving Average Convergence Divergence (MACD) also indicates a buy, supported by trends in momentum. - Short-Term Cautions:

While short-term fluctuations and minor correction signals (such as a recent drop after July 18, 2025) exist, these are typically countered by strong support near the 200-day average and prompt technical rebounds. - Support and Resistance Levels:

- Immediate support:

~₹150 (long-term average) - Major resistance:

~₹290 (short-term average)

- Immediate support:

Buy CGCL in 2025: Industry and Comparisons

- Positioning:

CGCL is considered a high-growth, high-risk NBFC, competing alongside sector majors like Bajaj Finance. What distinguishes CGCL is its lower red flag indicators, a testament to internal controls and risk protocols. - Valuation:

The current PB (price-to-book) ratio is higher than the sector average, suggesting the stock is priced at a premium for its growth but not in the overbought zone. This means savvy investors might acquire shares before a more pronounced re-rating as projected earnings materialize. - Peer Benchmarking:

Despite being smaller than industry behemoths, CGCL’s ability to scale rapidly, maintain asset quality, and innovate in underbanked territories makes it a preferred NBFC niche player.

Buy CGCL in 2025: Risks and Challenges to Monitor

No investment is free from risk, and prudent investors should be aware of

- Volatility:

The stock is nearly 3.6 times as volatile as the Nifty index, underscoring significant price swings. - Rising Cost of Funding:

Increased costs could compress margins, especially if the company cannot proportionally increase loan yields. - Dependence on Gold Loan Growth: While the gold loan segment is currently lucrative, fluctuations in gold prices or regulatory changes could affect profitability.

- Promoter Shareholding:

Promoters recently reduced their holding from 69.87% to 59.95% (June 2025), which warrants observation, though no red flags have been officially raised. - Regulatory Environment:

NBFCs in India frequently encounter shifting regulatory landscapes.

Buy CGCL in 2025: Forward-Looking Strategy and Company Goals

- AUM Target for FY28:

CGCL aims for AUM of ₹50,000 crore by FY28, up significantly from current levels—a target that, if reached, implies exponential growth that should reflect in shareholder returns. - Sustainable Growth:

The company is balancing expansion with regulatory compliance and prudent lending, positioning itself as both aggressive and responsible. - Focus on Underbanked:

By continuously exploring underpenetrated geographies, CGCL reduces portfolio concentration risks and exploits new demand pockets.

Buy CGCL in 2025: Technical and Fundamental Summary Table

| Factor | 2025 Observation | Outlook |

|---|---|---|

| AUM Growth | 46% YoY, Gold Loans +130% | Positive |

| Collection Efficiency | ~99% | Positive |

| Cost of Funding | ~9.5% | Neutral-negative |

| Yield on Gold Loans | ~22% | Slightly negative |

| Analyst Consensus | 100% Buy | Positive |

| Share Price (July 2025) | ₹181.50 | Room for Upside |

| Technical Signals | MACD, MA Buy (long-term); Watch short-term | Positive |

| Volatility | 3.63x Nifty | High Risk |

| Promoter Holding | 59.95% (down from 69.87%) | To Monitor |

Buy CGCL in 2025: Actionable Insights for Investors

- Ideal Investment Style:

Investors with moderate-to-high risk appetite seeking growth through aggressive, expanding financial services providers. - Optimal Entry Zone:

Accumulate near major support levels; consider staggered investment if short-term corrections persist. - Monitor Fundamentals:

Periodically review company segment concentration, cost of funding, and regulatory updates. - Long-Term Horizon Favored:

Given volatility and ongoing expansion, a 2–3 year holding period may yield the best returns.

READ MORE: Shanti Gold International IPO 2025: Dates, Price, Review & Investment Guide

Conclusion

Capri Global Capital Limited (CGCL) presents a strong case for inclusion in well-managed growth portfolios. The company’s impressive expansion, digital initiatives, sound risk metrics, and analyst optimism underpin a solid buy recommendation for 2025 and beyond. Investors should, however, remain vigilant regarding short-term volatility and sector-specific risks, employing prudent capital allocation and ongoing review to maximize long-term value.

As always, consult your financial advisor before making investment decisions. This blog is for informational purposes and represents market opinions as of July 2025.