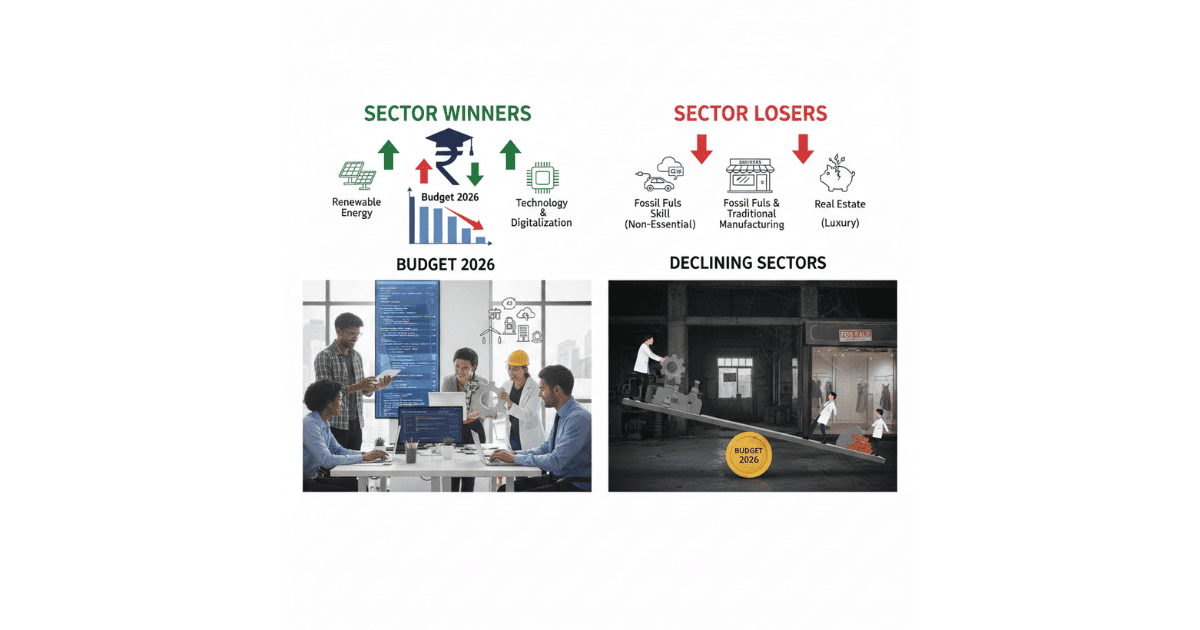

Budget 2026: Sector Winners and Losers as Capex, Rail, and Defence Drive Allocation

The Union Budget 2026 reinforces infrastructure-led growth, targeted manufacturing incentives, and fiscal discipline, shaping capital flows across key sectors of the economy.

Budget 2026 sector winners and losers analysis highlights the government’s continued focus on infrastructure spending, manufacturing incentives, and fiscal consolidation. The allocation patterns indicate a structural bias toward capital expenditure, defence, railways, and energy transition themes, while consumption-linked subsidies and certain discretionary segments may see relatively slower allocation growth.

From an institutional capital-flow perspective, budgetary priorities often determine sectoral leadership cycles, influencing earnings visibility, order inflows, and valuation re-rating across multiple industries.

Budget 2026 Snapshot

- Fiscal focus: Capex-led growth

- Key allocation themes: Infrastructure, railways, defence, manufacturing

- Institutional bias: Capital goods, PSU, and infra-linked sectors

- Subsidy trend: Gradual rationalisation

- Macro objective: Growth with fiscal discipline

Table of Contents

- Key Budget Highlights

- Macro Fiscal Direction

- Infrastructure and Capital Expenditure

- Railways and Logistics

- Defence and Manufacturing

- Energy and PSU Sector

- Banking and Financials

- Consumption and Rural Demand

- IT and Services

- Capital-Flow Impact

- Valuation Context

- Key Risks

- Outlook

Key Budget Highlights

- Continued emphasis on infrastructure spending.

- Railways and logistics remain key allocation areas.

- Defence manufacturing receives sustained support.

- Fiscal consolidation path maintained.

- Manufacturing incentives continue under production-linked schemes.

Macro Fiscal Direction

The Union Budget 2026 reflects a calibrated fiscal approach, balancing growth-oriented capital expenditure with fiscal consolidation targets. The government continues to prioritise long-term infrastructure investment while gradually rationalising revenue expenditure.

Fiscal discipline remains a central theme, with deficit targets aligned to medium-term consolidation goals. This approach aims to maintain sovereign credit stability while supporting economic expansion through targeted spending.

Institutional investors typically view fiscal discipline as a positive signal, as it helps maintain macroeconomic stability, control inflationary pressures, and support long-term investment cycles.

Infrastructure and Capital Expenditure

Infrastructure remains the core pillar of the government’s growth strategy. Capital expenditure allocations continue to prioritise roads, urban infrastructure, railways, and logistics networks.

- High allocation toward national highways and expressways.

- Urban infrastructure spending continues to rise.

- Logistics and multi-modal connectivity projects receive support.

- State-level capex incentives drive local infrastructure spending.

Infrastructure spending typically creates multiplier effects across the economy, supporting sectors such as cement, steel, capital goods, and construction companies.

Budget 2026 sector winners and losers: Railways and Logistics

Railways remain one of the largest beneficiaries of capital expenditure in Budget 2026. Investments focus on network expansion, electrification, freight corridors, and high-speed passenger infrastructure.

- Freight corridor expansion improves logistics efficiency.

- Electrification reduces operating costs.

- Passenger infrastructure upgrades continue.

- Station redevelopment projects support urban growth.

Railway capex typically drives order inflows for engineering, construction, and equipment suppliers, making the sector a key beneficiary of budgetary allocations.

Defence and Manufacturing

Defence spending continues to focus on indigenisation and domestic manufacturing capabilities. The government’s emphasis on self-reliance supports local defence manufacturers and supply chains.

- Higher allocation toward domestic procurement.

- Continued support for defence production schemes.

- Modernisation of armed forces equipment.

- Expansion of indigenous manufacturing capacity.

Defence capital expenditure typically supports public sector defence companies as well as private-sector suppliers across the manufacturing value chain.

Budget 2026 sector winners and losers: Energy and PSU Sector

Energy allocations reflect a dual focus on conventional energy security and renewable transition. Investments in power transmission, renewable energy, and oil & gas infrastructure continue.

- Renewable energy capacity expansion.

- Power grid and transmission investments.

- Oil and gas infrastructure support.

- PSU capex-driven growth.

PSU companies in energy, power, and oil sectors typically benefit from government capex cycles and policy support.

Banking and Financials

The banking sector benefits indirectly from higher infrastructure spending and credit demand. Increased capital expenditure typically drives loan growth across corporate and infrastructure segments.

- Higher credit demand from infrastructure projects.

- Improved asset quality in corporate loan books.

- PSU bank profitability supported by credit growth.

- Financial sector stability reinforced.

Banking stocks often act as a proxy for economic growth, and infrastructure-led budgets tend to support credit cycles across the sector.

Budget 2026 sector winners and losers: Consumption and Rural Demand

Budget 2026 maintains a balanced approach toward consumption, with targeted rural spending and social sector schemes.

- Rural infrastructure programs continue.

- Selective subsidy rationalisation.

- Focus on employment and skill development.

- Stable consumption demand outlook.

Consumption-linked sectors may see moderate support compared to capex-driven industries, depending on allocation growth and rural income trends.

IT and Services

The IT and services sectors are less directly impacted by budget allocations but benefit from macroeconomic stability and digital infrastructure investments.

- Digital infrastructure initiatives support IT services demand.

- Government technology adoption increases spending.

- Services sector benefits from economic growth.

Institutional positioning in IT stocks is more influenced by global demand cycles rather than domestic budget allocations.

Capital-Flow Impact

Budget-driven capital flows typically favor sectors receiving higher allocations or policy support. Infrastructure, railways, defence, and capital goods sectors are likely to attract stronger institutional interest following capex-heavy budgets.

- Infrastructure and capital goods benefit from order visibility.

- PSU companies attract re-rating flows.

- Banking sector benefits from credit growth.

- Consumption sectors may see selective allocation.

Institutional capital allocation often rotates toward sectors with stronger earnings visibility driven by government spending cycles.

Valuation Context

- Order book visibility in infrastructure sectors.

- Credit growth in banking and financials.

- Government capex intensity.

- PSU re-rating trends.

- Fiscal deficit trajectory.

Sectors benefiting directly from budget allocations often experience valuation re-rating, especially when earnings visibility improves due to long-term government spending commitments.

Key Risks

- Slower-than-expected capex execution.

- Fiscal deficit pressures.

- Commodity price volatility affecting infrastructure costs.

- Global economic slowdown impacting demand.

- Policy implementation delays.

Outlook

The Budget 2026 sector winners and losers analysis suggests continued leadership of infrastructure, railways, defence, and capital goods sectors in the current economic cycle. The government’s capex-led strategy is expected to support earnings growth across these industries, while consumption and discretionary sectors may see more moderate allocation-driven growth.

From an institutional perspective, capital flows are likely to remain concentrated in sectors with strong policy support, order visibility, and earnings momentum.

Related Earnings and Sector Posts

Official Sources