Gold and Silver Market Outlook: Institutional Perspective

Macro drivers, policy signals, and market structure are shaping precious metals.

Gold and silver remain among the most closely watched global commodities, reflecting a complex interaction between inflation trends, interest rates, currency movements, and risk sentiment. This hub provides an institutional overview of how gold and silver markets behave across economic cycles, without offering trading or investment recommendations.

Role of Gold and Silver in Global Markets: Gold and Silver Market Outlook:

- Gold: Traditionally viewed as a monetary metal and store of value during periods of economic uncertainty.

- Silver: Functions as both a precious metal and an industrial commodity, linking it to manufacturing cycles.

- Both metals are sensitive to real interest rates, inflation expectations, and currency strength.

Key Drivers Influencing Gold and Silver Prices

| Driver | Institutional Interpretation |

|---|---|

| Inflation Trends | Persistent inflation can support demand for non-yielding assets |

| Interest Rates | Rising real rates generally pressure precious metals |

| US Dollar Movement | Dollar strength or weakness influences global pricing |

| Industrial Demand | More relevant for silver due to manufacturing usage |

| Central Bank Activity | Gold purchases signal reserve diversification trends |

Gold and Silver Market Outlook: Macro-Economic Context

Gold and silver markets often reflect broader macroeconomic shifts, including changes in global liquidity, geopolitical developments, and monetary policy alignment across major economies. Institutional participants typically assess these metals as part of a broader asset allocation and risk management framework.

Global Liquidity and Risk Sentiment Influence

Gold and silver prices are influenced not only by inflation and interest rate expectations but also by broader global liquidity conditions and shifts in investor risk appetite. Periods of accommodative monetary policy, slowing economic growth, or heightened financial uncertainty often increase attention toward precious metals as portfolio hedges. In contrast, phases of tightening liquidity and rising real interest rates can reduce the relative attractiveness of non-yielding assets such as gold and silver.

Institutional participants typically assess gold and silver within a diversified asset allocation framework, evaluating correlations with equities, bonds, and currencies rather than in isolation. Changes in geopolitical risk, financial stability concerns, and cross-border capital flows can amplify short-term price volatility while reinforcing the long-term relevance of precious metals in global markets. This interaction between liquidity, risk sentiment, and macroeconomic conditions remains a key factor shaping gold and silver market behaviour over time.

Gold vs Silver: Structural Differences

| Aspect | Gold | Silver |

|---|---|---|

| Primary Role | Monetary / Store of value | Precious + Industrial metal |

| Volatility | Relatively lower | Relatively higher |

| Policy Sensitivity | High (rates, reserves) | Moderate (growth + policy) |

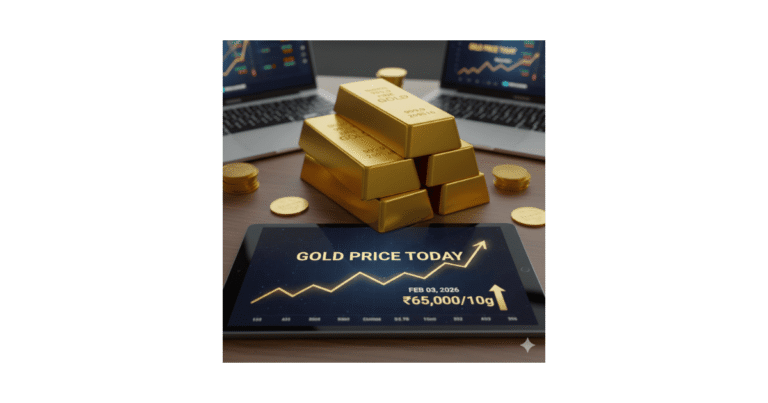

Gold and Silver Market Outlook: Ongoing Market Coverage

This hub connects to the latest gold price and silver price updates, covering inflation data, central bank commentary, currency movements, and global macroeconomic events influencing precious metals.

Gold and Silver Market Outlook: What to Watch Going Forward

- Inflation and employment data from major economies

- Central bank policy statements and reserve disclosures

- Movements in global bond yields and currencies

- Industrial demand trends affecting silver

Disclaimer

This hub page is for informational and educational purposes only. It does not constitute investment advice or a recommendation. Readers should rely on official data sources and professional guidance when making financial decisions.