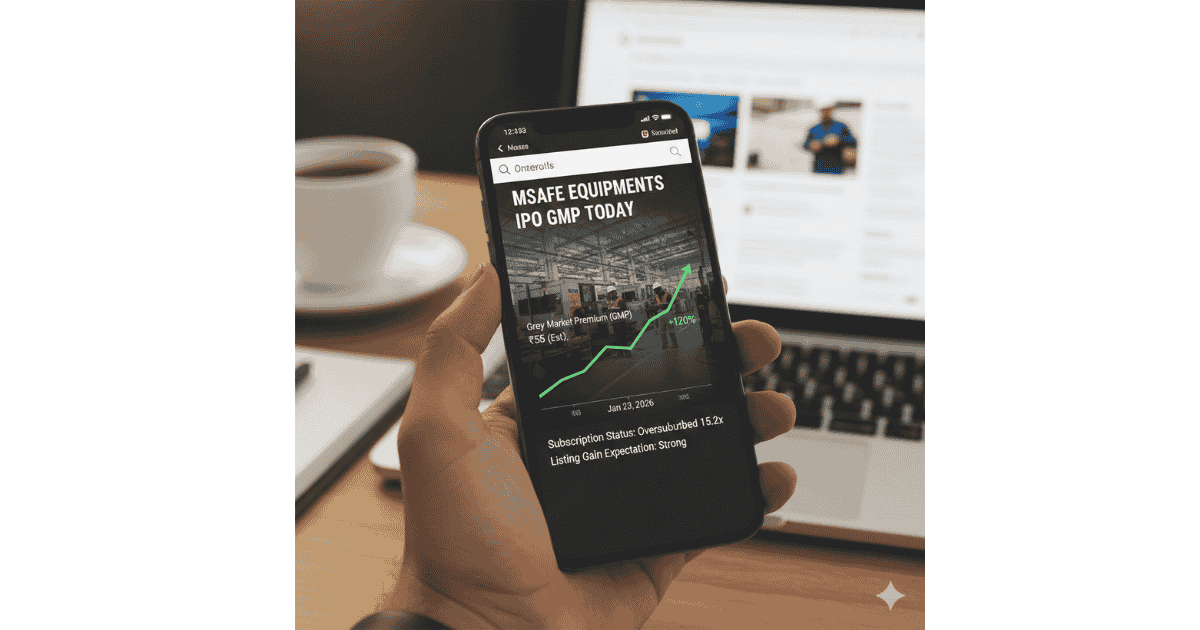

Msafe Equipments IPO GMP Today, Review, Price, Subscription & Listing Gain

Last Updated:

GMP Today

Min Investment

Price Band

₹70 – ₹75

₹70 – ₹75

Market Cap

🚨 Latest Update — Msafe Equipments IPO (Market Intelligence)

Updated Signal (Jan 2026):

• GMP remains stable at ₹28 – ₹35, indicating sustained SME demand.

• Investor interest is gradually strengthening ahead of IPO opening.

• SME IPO sentiment in the market remains cautiously bullish.

• Market participants expect moderate listing gains with volatility risk.

• GMP remains stable at ₹28 – ₹35, indicating sustained SME demand.

• Investor interest is gradually strengthening ahead of IPO opening.

• SME IPO sentiment in the market remains cautiously bullish.

• Market participants expect moderate listing gains with volatility risk.

Investor Sentiment Shift: Neutral ➝ Moderately Positive

Market Reaction: Pricing indicates balanced optimism rather than aggressive hype.

Current Sentiment: 🟢 Positive with High SME Risk ⚠️

⚡ PositionalCalls Quick Insight:

Msafe Equipments IPO reflects a typical SME pattern where GMP stability and improving sentiment signal moderate listing potential rather than explosive gains.

Msafe Equipments IPO reflects a typical SME pattern where GMP stability and improving sentiment signal moderate listing potential rather than explosive gains.

📊 Msafe Equipments IPO Key Data

| Topic | Details |

|---|---|

| IPO Name | Msafe Equipments IPO |

| Exchange | NSE SME |

| Issue Type | Fresh Issue + OFS |

| Issue Size | ₹42.50 Cr |

| Fresh Issue | ₹36.00 Cr |

| OFS | ₹6.50 Cr |

| Price Band | ₹70 – ₹75 |

| Lot Size | 1600 Shares |

| Minimum Investment | ₹1,20,000 |

| Post-IPO Market Cap | ₹75 – ₹85 Cr (Estimated) |

| GMP Today | ₹28 – ₹35 |

| Expected Listing Gain | 18% – 40% |

| Market Sentiment | Moderately Bullish 📈 |

| SME Risk Level | High |

📅 IPO Timeline

| Event | Date |

|---|---|

| IPO Opening | Feb 2026 (Expected) |

| IPO Closing | Feb 2026 (Expected) |

| Allotment | T+2 / T+3 |

| Refund | T+1 |

| Listing | Within 5–7 days |

📊 Issue Structure (SME Allocation)

| Category | Allocation |

|---|---|

| QIB | Up to 50% |

| NII / HNI | Up to 15% |

| Retail | Minimum 35% |

| Market Maker | ~5% |

🏭 Business Overview

Msafe Equipments manufactures industrial safety and engineering equipment for infrastructure, power, manufacturing, and construction sectors. The company benefits from rising industrial capex but faces scalability and margin challenges typical of SME engineering businesses.

📊 Financial Performance (₹ Cr)

| Year | Revenue | EBITDA | PAT |

|---|---|---|---|

| FY2023 | 54.20 | 6.10 | 3.42 |

| FY2024 | 61.80 | 7.35 | 3.88 |

| FY2025 | 66.40 | 8.10 | 4.52 |

📈 Growth Metrics

Revenue CAGR (FY23–FY25): ~10.6%

PAT CAGR (FY23–FY25): ~14.8%

EBITDA Margin: 11% – 12%

PAT CAGR (FY23–FY25): ~14.8%

EBITDA Margin: 11% – 12%

💸 Valuation Metrics

| Metric | Value |

|---|---|

| EPS (Post IPO) | ₹5.2 – ₹5.6 |

| P/E Ratio | 13x – 15x |

| ROE | 18% – 22% |

| ROCE | 20% – 24% |

📈 GMP Trend

| Date | GMP | Listing Estimate |

|---|---|---|

| Jan 2026 | ₹28 – ₹35 | ₹90 – ₹105 |

| Earlier | ₹18 – ₹22 | ₹82 – ₹95 |

🤖 PositionalCalls AI Insight

Msafe Equipments IPO shows a gradual improvement in sentiment rather than a sharp speculative surge. AI models indicate a higher probability of moderate listing gains compared to extreme upside scenarios.

🔮 Listing Scenario Outlook

🟢 Positive Scenario (35%): Strong subscription + stable GMP may drive higher listing gains.

🟡 Base Scenario (45%): Moderate listing gains with volatility.

🔴 Risk Scenario (20%): Weak sentiment may limit upside.

🟡 Base Scenario (45%): Moderate listing gains with volatility.

🔴 Risk Scenario (20%): Weak sentiment may limit upside.

⚖️ Risk vs Opportunity Insight

Opportunities

- Growing industrial demand

- Improving profitability trend

- Supportive SME IPO sentiment

- Reasonable valuation metrics

Risks

- High SME liquidity risk

- Moderate leverage

- Dependence on capex cycle

- Volatile post-listing movement

🏆 Final IPO Verdict

PositionalCalls Verdict: Apply with Caution ⚠️

Listing Gain Probability: 50% – 65%

Overall IPO Score: 6.6 / 10

Listing Gain Probability: 50% – 65%

Overall IPO Score: 6.6 / 10

Best suited for short-term listing traders and high-risk investors. Not ideal for conservative long-term investors.

👉 This article is continuously updated by PositionalCalls Market Intelligence System based on live GMP trends, investor sentiment, and SME market signals.

Disclaimer: IPO investments involve market risks. GMP is unofficial and speculative. This content is for educational purposes only.