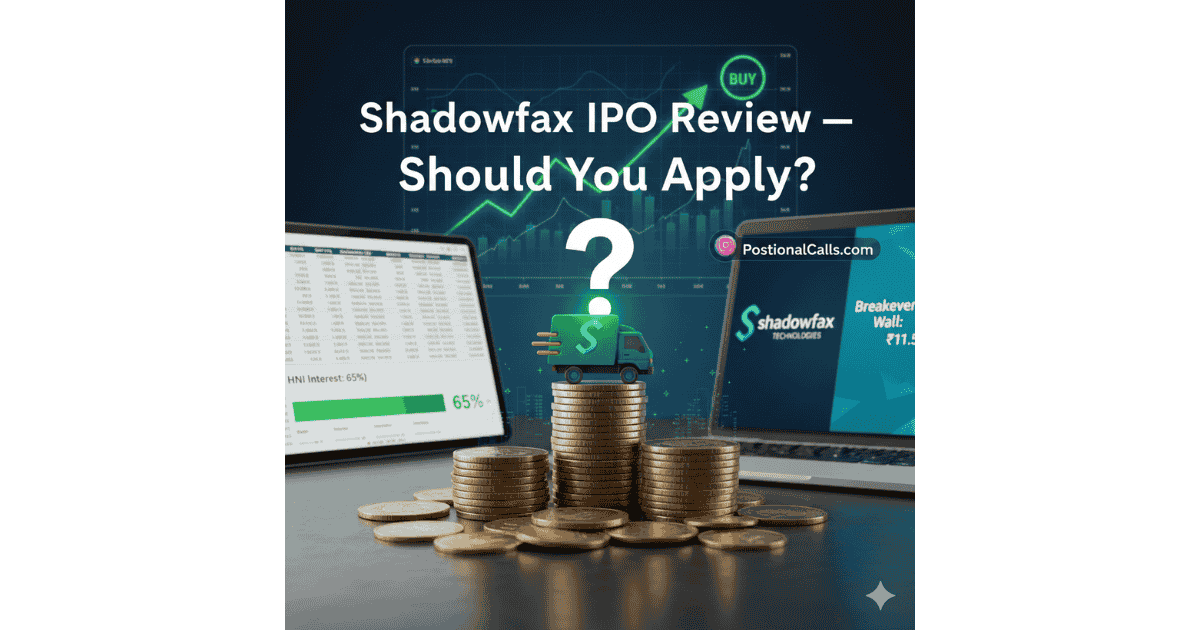

Shadowfax IPO Review :

The analysis reviews Shadowfax’s operational performance and market position, highlighting key financial metrics and growth potential. Furthermore, it assesses the competitive landscape and regulatory considerations that may impact the company’s future trajectory. Investors should think about the risks and rewards of the IPO before deciding whether or not to take part. This Shadowfax IPO Review provides a balanced view of the company’s fundamentals, risks, valuation, and listing prospects to help investors decide whether to apply.

Shadowfax IPO Review : Company Snapshot

Shadowfax Technologies is a technology-enabled last-mile logistics platform with a pan-India delivery network and strong partnerships with major e-commerce and quick-commerce players.

Shadowfax IPO Review: Bull Case — Why Apply?

- AI-driven logistics and routing technology

- Deep integration with major e-commerce platforms

- Expanding presence in quick commerce

- Improving profitability trend over last two years

Shadowfax IPO Review : Bear Case — Key Risks

- High client concentration (~49% revenue from top client)

- Thin operating margins

- Intense competition from Delhivery, Blue Dart, and Ecom Express

- Sensitivity to fuel and labor costs

Shadowfax IPO Review: Valuation View

| Company | P/E | EBITDA Margin |

|---|---|---|

| Shadowfax | ~953x | 1.96% |

| Delhivery | ~195x | 4.9% |

| Blue Dart | ~50x | 16.2% |

Verdict: Shadowfax appears richly valued compared to peers. Investors should primarily apply for listing gains rather than long-term valuation comfort.

Shadowfax IPO Review: Who Should Apply?

| Investor Type | Recommendation | Reason |

|---|---|---|

| Retail | Apply (Speculative) | For listing gains if GMP remains above ₹15 |

| sNII (Small HNI) | Selective | Use HNI Breakeven Wall as risk filter |

| bNII (Big HNI) | Cautious | Avoid heavy leverage unless GMP is very strong |

HNI Breakeven Wall (PositionalCalls Signal)

Breakeven Threshold: ₹11.50

Current Signal: 🟢 STABLE If GMP stays above ₹12, the probability of positive listing remains high.

Related Pages

Disclaimer: IPO investments are subject to market risks. This page is for educational purposes only and does not constitute financial advice.

READ MORE: Shadowfax IPO — Live GMP, Subscription, Allotment & Listing Analysis