Tech Mahindra share price target 2026:

Tech Mahindra (TECHM): A High-Yield Investment Opportunity? 📈

Tech Mahindra is showing a powerful technical setup, emerging as a top pick for portfolio diversification in the IT sector. With the company’s aggressive focus on GenAI and margin expansion, it’s a strong candidate for your long-term wealth creation strategy.

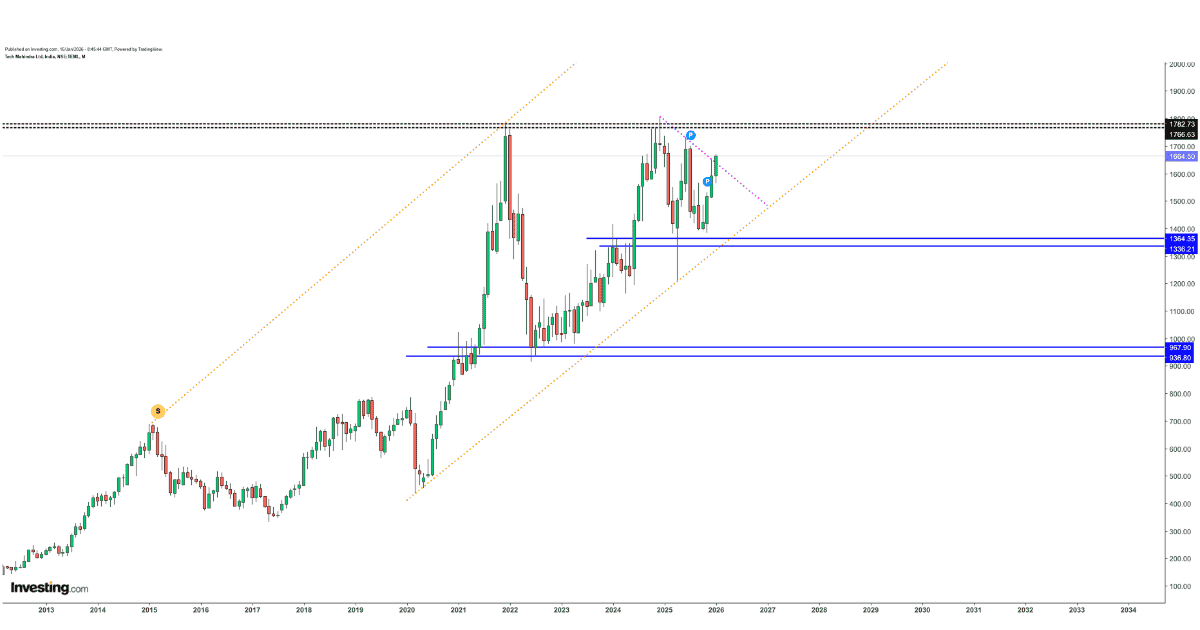

📊 Technical Snapshot:

Current Market Price (CMP):

1670Strong Support Zone:

1400 (Crucial for Risk Management)Bullish Target:

2100++ (Capital Appreciation potential)Investment Horizon:

3-4 Quarters (Short to Long Term)

💡 Expert View:

The stock is currently positioned for a significant breakout. Given its low debt-to-equity ratio and robust dividend yield, $TECHM remains a “Value Buy” for investors looking to optimize their stock market returns.

The 2026 Financial Snap (Live Q3 Data)

| Metric | Value (Jan 16, 2026) | Trend |

| Current Market Price (CMP) | ₹1,634 | 🟢 Bullish (+4.3%) |

| Q3 Net Profit | ₹1,425 Cr | 📈 Up 27% YoY |

| EBIT Margin | 12.7% | 🔼 7-Quarter High |

| Dividend Yield | 2.83% |

The “Smart Money” Entry Zone

- Investors eyeing Tech Mahindra’s share price target for 2026 should keep an eye on the market’s reaction after earnings reports. Although the stock’s surge to ₹1,634 today is noteworthy, the most likely entry point is:

Accumulation Range:

₹1,560 – ₹1,595Stop Loss:

₹1,515 (based on daily closing prices)Time Horizon:

12 Months

Technical “War-Room” Setup

The daily chart reveals a significant surge, with Tech Mahindra shares breaking through the ₹1,610 resistance level. To achieve a target of ₹1,850 by 2026, the stock needs to hold above its 50-day Moving Average, currently at ₹1,558.

A helpful hint: Keep an eye on “Volume Confirmation.” Today’s trading session experienced three times the usual daily volume, a clear sign that institutional investors, often referred to as “Smart Money,” are actively purchasing shares.

Fundamental Catalyst Insights

- Is Tech Mahindra the IT stock to consider after its third-quarter performance?

Margin Gains:

Operating margins climbed to 12.7%, surpassing what analysts had predicted.Dividend Appeal:

Offering a dividend yield of 2.83%, TECHM presents a more secure option for those seeking income than TCS or Infosys.TMT Sector Resurgence:

The Telecom, Media, and Technology segment, which struggled in 2025, is now driving growth in 2026.

Competitor Battle

| Metric | Tech Mahindra (TECHM) | Infosys (INFY) | Wipro (WIPRO) |

| Market Cap | ₹1.59 Lakh Cr | ₹7.85 Lakh Cr | ₹2.84 Lakh Cr |

| P/E Ratio | 34.7x | 23.6x | 20.5x |

| Q3 Profit Var | +27% | +10.8% | +1.2% |

The “Wealth Trap” Risk Audit

The most significant threat to Tech Mahindra’s share price target for 2026 is the potential for a “Execution Lag.” Though the company’s recovery is apparent, a failure to achieve the 15% EBIT margin target by FY27 could trigger a decline in its valuation. To safeguard your investment, maintain the ₹1,515 stop-loss.

1-Year Mastery Forecast

Bull Case (₹1,850):

Driven by 5G deal wins and 14%+ margins.Bear Case (₹1,440):

Occurs if global tech spending slows or wage hikes bite.

Tech Mahindra Share Price Target 2026: The Final “Expert Verdict”

ACCUMULATE ON DIPS

Conviction Score: 9/10

Given Tech Mahindra’s impressive showing in Q3, it’s shaping up to be a prime candidate for significant gains in 2026. For the latest updates and additional positional recommendations, simply search “Positional Calls Tech Mahindra” on Google, or head over to our website.

Tech Mahindra Share Price Target 2026: The Master Legal Disclaimer

Disclaimer: Investment in the stock market involves risk. We are not SEBI-registered advisors. This content on www.positionalcalls.com is for educational purposes only.

READ MORE: Aritas Vinyl IPO 2026: The ₹2,82,000 Retail Entry, Solar Margin Pivot & 1-Year Forecast