![Rapid-Fleet-IPO-32-1 RBI Repo Rate Cut: Your Home Loan EMIs & Investment Returns Explained [June 6, 2025]](https://positionalcalls.com/wp-content/uploads/2025/06/Rapid-Fleet-IPO-32-1.png)

Breaking News:

The Reserve Bank of India (RBI) has today, June 6, 2025, announced a significant reduction in the benchmark repo rate by a substantial 50 basis points (bps) to 5.50%. This marks the third consecutive rate cut this year, bringing the cumulative reduction in 2025 to a full 100 basis points. The Monetary Policy Committee (MPC) also shifted its stance from ‘accommodative’ to ‘neutral,’ signaling a strategic pivot towards stimulating economic growth amidst easing inflationary pressures. This bold move has far-reaching implications for Indian businesses, individual borrowers, and investors, promising a new phase of monetary policy transmission.

RBI Repo Rate Cut: Understanding the Repo Rate and Its Profound Impact

For the uninitiated, the repo rate is the interest rate at which the Reserve Bank of India lends money to commercial banks. It serves as a crucial monetary policy tool, influencing the cost of funds for banks, which in turn impacts the lending and deposit rates they offer to their customers. A lower repo rate translates to cheaper borrowing for banks, enabling them to reduce interest rates on various loans, including home loans, car loans, and personal loans, thereby stimulating consumer spending and business investment. Conversely, a higher repo rate discourages borrowing and helps in taming inflation by reducing the money supply in the economy.

Today’s 50 bps cut, a larger-than-expected move by many market analysts, is a clear indication of the RBI’s commitment to supporting economic activity. This decision follows two earlier 25 bps cuts in February and April 2025, reflecting a proactive approach to bolster domestic demand and propel India’s GDP growth.

RBI Repo Rate Cut: Decoding the MPC’s Rationale: Growth Over Inflation?

The MPC’s decision to “frontload” this significant rate cut is rooted in a comprehensive assessment of India’s current macroeconomic landscape. Several key factors have influenced this strategic shift:

Easing Inflationary Pressures:

Retail inflation (CPI) has shown a consistent downward trend, easing to 3.16% in April from 3.34% in March, well within the RBI’s comfort zone of 2-4%. The central bank has even revised its inflation projection for FY26 downward to 3.7% from an earlier estimate of 4%. This sustained moderation in price levels has provided the central bank with considerable headroom to prioritize growth.

Need for Economic Stimulus:

While inflation is subdued, GDP growth has been falling short of desired levels, particularly due to global economic challenges and persistent uncertainties. The RBI’s move aims to inject much-needed momentum into the economy by making credit more affordable for both consumers and businesses. This is crucial for boosting aggregate demand and capital investment.

Global Economic Context:

Central banks globally are increasingly leaning towards rate cuts amid softening growth and heightened geopolitical risks, including US-China trade tensions that are dampening global demand. India’s monetary policy is increasingly taking cues from these global trends to ensure a competitive and stable financial environment.

Liquidity Management:

In a related but equally significant move, the RBI also announced a staggered 100 basis points cut in the Cash Reserve Ratio (CRR) to 3% for FY2026. This measure is designed to infuse substantial liquidity into the banking system, further supporting lending activities and ensuring smoother monetary policy transmission.

RBI Repo Rate Cut: The Ripple Effect: Who Benefits and Who Needs to Adapt?

The impact of this substantial repo rate cut will reverberate across various sectors of the Indian economy.

For Borrowers: A Breath of Fresh Air

This is unequivocally excellent news for borrowers. With the repo rate now at its lowest level in nearly three years, home loan EMIs, car loan EMIs, and other floating-rate personal and business loan installments are set to decrease significantly. Experts anticipate home loan rates could soon fall closer to the psychologically important sub-8% level, a phenomenon not seen since early 2022. For a ₹50 lakh home loan over 20 years, borrowers could save close to ₹1,960 on their monthly EMI, translating to substantial long-term savings of nearly ₹4.7 lakh over the loan tenure. Those who postponed home-buying decisions due to higher interest rates now have a compelling opportunity to enter the market.

RBI Repo Rate Cut: For Fixed Deposit Investors: A Re-evaluation is Imperative

While borrowers cheer, fixed deposit (FD) investors will need to revisit their investment strategies. As interest rates soften across the banking system, FD returns are likely to decline, possibly settling around or even below 7% per annum for many tenures. Banks have already been steadily decreasing FD interest rates, with some reports indicating a 30 to 70 basis point decline since February 2025.

For conservative investors who rely on FDs for stable income, this trend poses a significant challenge. Financial advisors are now recommending diversification. While FDs still offer capital preservation, exploring alternative avenues like short-duration debt mutual funds and target maturity funds is becoming increasingly attractive in this low-rate environment. Senior citizens, who typically enjoy an additional 25-50 basis points on FDs, should consider locking in current higher rates on longer tenures before further cuts are implemented.

RBI Repo Rate Cut: Impact on Financial Markets: A Mixed Bag, but Generally Positive

The immediate reaction in the financial markets has been largely positive. Benchmark indices have surged, with Nifty 50 crossing the 24,900 mark and BSE Sensex rising to 82,022.

Stock Market:

Lower interest rates generally bode well for the stock market. Reduced borrowing costs can boost corporate profits, encourage expansion, and increase investment appetite, leading to a bullish sentiment. Rate-sensitive sectors like banking, real estate, and auto are expected to be key beneficiaries.

Bond Market:

The bond market has seen a mixed reaction. While short-end yields have moved lower, longer-end yields are somewhat higher, as the prospects of further Open Market Operations (OMOs) have diminished. Corporate bonds in the 2-5 year segment are likely to perform well, with yields moving lower alongside spread compression.

Rupee Stability:

The RBI’s proactive stance on monetary policy, coupled with an easing inflation outlook, contributes to overall macroeconomic stability, which can support the Indian rupee’s valuation against major global currencies.

RBI Repo Rate Cut: Broader Economic Implications: Fueling Growth Engines

The cumulative 100 bps repo rate cut in 2025, culminating in today’s bold move, is expected to unleash a significant monetary stimulus across the economy.

Credit Growth:

The primary objective is to accelerate credit growth. Cheaper loans will encourage businesses, particularly MSMEs, to borrow for expansion, capital expenditure, and working capital needs, leading to increased production and employment.

Consumer Spending:

Reduced EMIs will leave more disposable income in the hands of consumers, stimulating discretionary spending and boosting consumption across various sectors. This increased demand is a crucial driver for economic growth.

Real Estate Revival:

The real estate sector is a direct beneficiary of lower home loan rates, which can significantly improve affordability and encourage new home purchases, leading to a much-needed revival in construction and ancillary industries.

Investment Climate:

A lower cost of capital makes India a more attractive destination for both domestic and foreign investment. This can lead to increased foreign direct investment (FDI) and portfolio investment, further strengthening the economy.

RBI Repo Rate Cut: Key Takeaways for Financial Decision-Making

Today’s RBI announcement is a watershed moment for India’s financial landscape in 2025. Here are the crucial takeaways for individuals and businesses:

Home Loan Refinancing:

If you have an existing home loan on a floating rate, your EMIs are likely to decrease. Consider exploring refinancing options to take full advantage of the lower rates.

New Borrowing Opportunities:

For those planning to take out loans for homes, vehicles, or personal needs, the current environment presents a highly favorable opportunity.

FD Investment Strategy:

Review your fixed deposit portfolio. While capital preservation remains a core tenet, explore diversified investment avenues like debt mutual funds for potentially higher returns in a declining interest rate scenario.

Equity Market Potential:

The lower interest rate regime can support a positive sentiment in the equity markets. Consider consulting with a financial advisor for strategic equity investments.

Business Expansion:

Businesses should assess the reduced cost of capital to explore expansion plans, invest in new projects, and enhance operational efficiency.

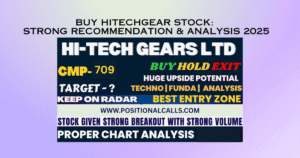

READ MORE: Buy HITECHGEAR Stock: Strong Recommendation & Analysis 2025

RBI Repo Rate Cut: The Road Ahead: Monitoring Global and Domestic Factors

While the RBI has made a decisive move, the path forward will continue to be influenced by both global and domestic factors. The central bank will closely monitor:

Global Commodity Prices:

Particularly crude oil, as fluctuations can quickly re-ignite inflationary pressures.

Geopolitical Developments:

Ongoing international conflicts and trade tensions can impact global supply chains and economic stability.

Monsoon Performance:

A good monsoon is crucial for agricultural output and, consequently, for food inflation and rural demand.

Fiscal Policy:

The government’s fiscal policies will also play a significant role in complementing monetary policy efforts to achieve sustained economic growth.

In conclusion, the RBI repo rate cut today is a strong signal of its commitment to fostering robust economic growth. This proactive measure, coupled with easing inflation, offers a compelling opportunity for credit expansion and investment across India. As the economy navigates both domestic aspirations and global uncertainties, prudent financial planning and informed decision-making will be paramount for individuals and businesses alike to capitalize on this evolving economic landscape.