Zuari Agro Chemicals Full Detail Analysis 2025–2026: Market Structure, Earnings & Risk Context

Zuari Agro Chemicals Full Detail Analysis 2025–2026: Market Structure, Earnings & Risk Context

Zuari Agro Chemicals Limited operates in India’s fertiliser and agri-inputs ecosystem. This page documents observed price behaviour, disclosed financial performance, valuation context, and sector-level drivers based on publicly available information. All references are informational in nature and do not constitute investment advice.

📊Zuari Agro Chemicals full detail analysis: Company Overview & Business Exposure

Zuari Agro Chemicals is an integrated fertiliser manufacturer under the Adventz Group, with operations across urea, DAP, NPK complexes, and specialty fertilisers. The company has a strong footprint in western and southern India and benefits from government subsidy mechanisms that support domestic fertiliser availability.

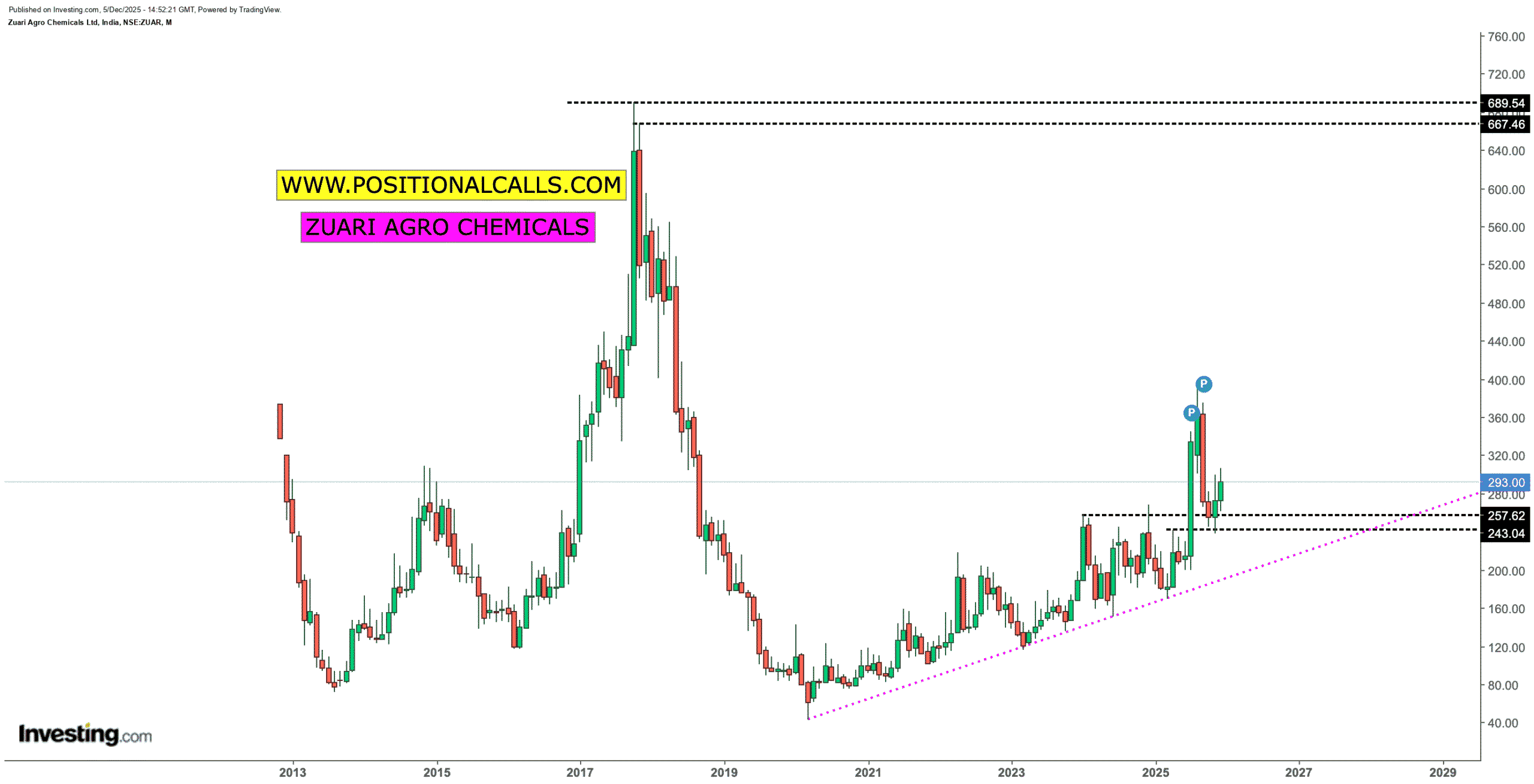

📊 Market Profile Snapshot (Observed)

- Trading Range (Dec 2025): ₹260–₹290

- Market Capitalisation: ~₹1,100 crore

- Book Value per Share: ~₹422–₹441

- P/E (TTM): ~1.15x

- P/B: ~0.63x

The valuation reflects both earnings cyclicality and working-capital sensitivity typical of fertiliser businesses.

📊 Earnings Snapshot — Q2 FY26 (Disclosed)

- Revenue: ₹1,422.63 crore (+26.65% YoY)

- Net Profit: ₹840.36 crore (vs ₹93.42 crore YoY)

- Operating Margin: ~12.21%

- EPS: ₹191.68

The sharp improvement reflects higher realisations, seasonal demand strength, and improved capacity utilisation.

📊 Revenue Momentum & Return Metrics

- QoQ revenue growth: ~14%

- ROCE: ~12.7–20.8% (recent periods)

- ROE: ~9%, trending upward

- Operating margins: In line with sector norms

🌾 Fertiliser Sector Context (Structural)

India’s fertiliser demand remains structurally supported by population growth, food security priorities, and government subsidy frameworks. Market size is projected to grow at ~6% CAGR through the next decade, with consumption exceeding 65 million metric tonnes annually.

Domestic producers benefit from policy support, import substitution initiatives, and favourable monsoon cycles, while remaining exposed to global commodity price volatility.

📊 Valuation Context & Peer Comparison

Zuari trades at a significant discount to larger fertiliser peers on P/E and P/B metrics. This discount reflects smaller scale, earnings cyclicality, and working-capital exposure rather than balance-sheet stress.

⚠️ Risk & Stress Factors

- Fertiliser price volatility and margin swings

- Monsoon dependency impacting volume demand

- Policy and subsidy timing risk

- Working capital intensity and receivable cycles

- Small-cap liquidity and sentiment risk

📌 Zuari Agro Chemicals full detail analysis: Institutional Context & Information Scope

This page serves as a market reference summarising Zuari Agro Chemicals’ financial disclosures, sector positioning, and valuation context during the 2025–2026 period. All data is sourced from publicly available information. No forward-looking assurance, recommendation, or solicitation is implied.

READ MORE: Tata Motors Q3 Results Analysis: Measured Institutional View on What Changed

Zuari Agro Chemicals full detail analysis: Institutional Context, Interpretation & Data Scope

This analysis is intended to provide a structured overview of Zuari Agro Chemicals Limited using publicly available financial disclosures, historical operating data, and sector-level information relevant to the Indian fertiliser industry during the 2025–2026 period. All numerical references, valuation metrics, and price observations included on this page reflect past or currently observable conditions and are presented to help readers understand how earnings cycles, policy frameworks, and sector dynamics interact over time.

The fertiliser sector is inherently cyclical and policy-influenced, with performance dependent on variables such as monsoon patterns, global commodity prices, subsidy mechanisms, and working-capital cycles. As a result, short-term financial performance can diverge materially from long-term averages. Any discussion of valuation or price structure on this page should therefore be interpreted within the broader context of industry cyclicality rather than as a directional forecast.

This page is designed as a reference document, not as an investment guide. It does not attempt to predict future prices, recommend entry or exit points, or estimate returns. Readers are encouraged to supplement this analysis with official company filings, exchange disclosures, and independent research when forming their own views. The purpose of this content is to enhance understanding of Zuari Agro Chemicals’ business model, financial profile, and sector exposure, while clearly outlining the risks inherent in the fertiliser industry and small-cap equities.

Disclaimer: This content is for educational and informational purposes only and does not constitute investment advice.