TEAMLEASE STOCK ANALYSIS

TEAMLEASE STOCK ANALYSIS

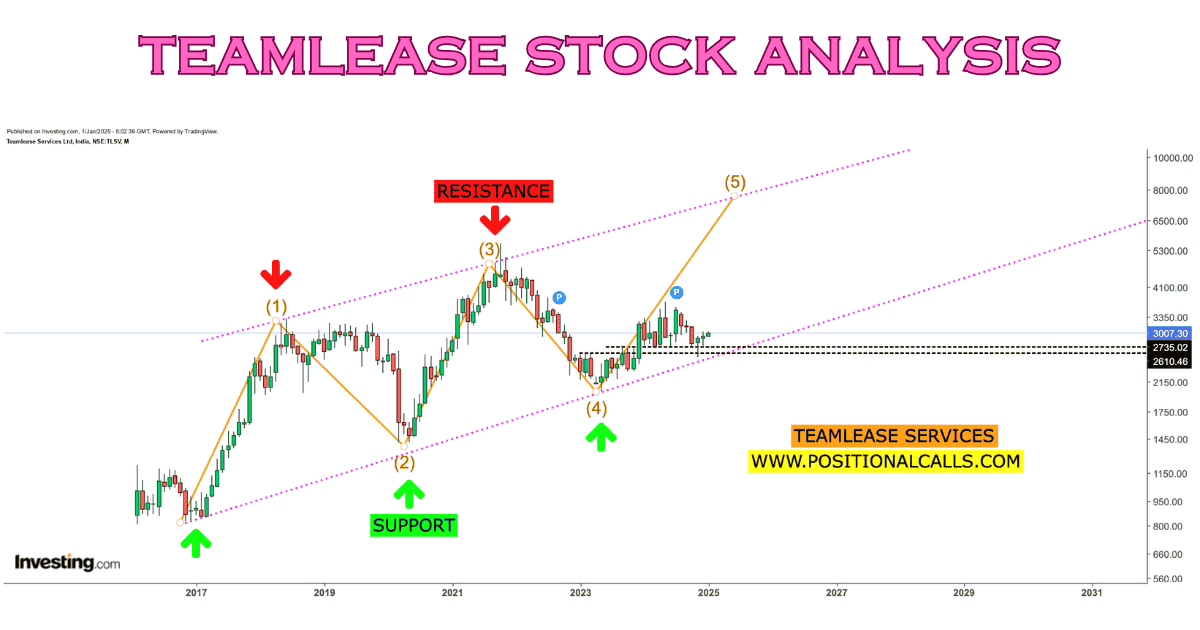

TEAMLEASE LOOKS GOOD NOW TRADING BETWEEN: 3000 – 3010

SUPPORT: 2300

TARGET Expecting: 5500, 7500+

ONLY FOR SHORT TO LONG TERM TeamLease Stock Analysis: A Comprehensive Fundamental and Technical Analysis

Investing in the stock market requires a thorough understanding of the companies you choose to invest in. TeamLease Services Ltd., a leading player in the staffing and human resource solutions sector in India, presents an intriguing opportunity for investors. This blog provides an in-depth analysis of TeamLease, focusing on both fundamental and technical aspects, to support a strong buy recommendation.

TeamLease Stock Analysis: Overview

Founded in 2002, TeamLease has positioned itself as a major player in the Indian staffing industry. The company offers a wide range of services, including temporary staffing, payroll management, and compliance outsourcing. With operations across 17 locations in India, TeamLease aims to effectively bridge the gap between job seekers and employers.

TeamLease Stock Analysis: Current Market Position

As of January 2025, TeamLease’s stock is trading at approximately ₹2,878.65. Despite recent market fluctuations, the company maintains a solid market capitalization of around ₹4,871.95 crore. Rising demand for skilled labor across various sectors such as IT, healthcare, and manufacturing is driving significant growth in the staffing industry.

Team Lease Stock Analysis: Key Financial Metrics

- Market Capitalization:

₹4,871.95 crore - P/E Ratio:

46.82 - EPS (Earnings Per Share):

₹61.93 - Return on Equity (ROE):

14.05% - Current Ratio:

1.16 - Debt to Equity Ratio:

Low (indicating financial stability)

These metrics reflect a company that is not only growing but also managing its resources effectively.

TeamLease Stock Analysis: Fundamental Analysis

Revenue Growth

TeamLease has demonstrated robust revenue growth over recent quarters. In Q2 FY2025, the company reported revenues of ₹28.1 billion, marking a 24% increase compared to the same quarter last year. This growth exceeded analyst estimates by 2.1%. Looking ahead, analysts forecast revenue growth at approximately 16% per annum over the next three years, driven by increasing demand for staffing solutions across various sectors.

Profitability Metrics

While revenue growth is promising, it is essential to consider profitability as well. The net income for Q2 FY2025 was ₹245.8 million, reflecting a decrease of 9.9% from the previous year. The profit margin stood at 0.9%, down from 1.2% in Q2 FY2024. This decline indicates that while revenues are increasing, cost management remains crucial for sustaining profitability.

TeamLease Stock Analysis: Future Growth Prospects

TeamLease is forecasted to grow earnings by 28% per annum and revenue by 16% per annum over the next three years.

We expect the following factors to support this growth:

- Expanding Service Offerings:

TeamLease is continually enhancing its service portfolio to meet evolving market demands. - Strategic Acquisitions:

The company has made strategic acquisitions that bolster its market position and expand its capabilities.

Technical Analysis

To complement our fundamental analysis, we will examine key technical indicators that can provide insights into TeamLease’s stock performance.

Price Trends

The stock price of TeamLease has experienced fluctuations but has shown resilience in maintaining levels above ₹2,800 amidst broader market volatility. Analyzing historical price movements can provide insight into potential future trends.

- Support Levels:

The stock has shown strong support around ₹2,750. - Resistance Levels:

We observed resistance in the vicinity of 3,000.

Moving Averages

Using moving averages can help identify trends.

- 50-Day Moving Average (MA):

Currently around ₹2,850, indicating short-term bullish sentiment. - 200-Day Moving Average (MA):

Positioned at approximately ₹2,700 suggests long-term stability.

The crossover of these moving averages could signal potential buy or sell opportunities.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements.

- An RSI below 30 indicates that a stock may be oversold (a potential buy signal).

- An RSI above 70 suggests overbought conditions (potential sell signal).

Currently, TeamLease’s RSI hovers around 55, indicating neutral momentum without extreme conditions.

Risks to Consider

While the outlook for TeamLease appears positive, investors should be aware of certain risks:

- High Valuation:

The elevated P/E ratio may pose a risk if the company fails to meet growth expectations. - Market Competition:

The staffing industry is competitive, with several players vying for market share. - Economic Fluctuations:

Economic downturns can impact hiring trends and demand for staffing services.

Read More: Leo Dry Fruits and Spices IPO: A Golden Opportunity for Investors in 2025

Conclusion: A Strong Buy Recommendation

In conclusion, TeamLease Services Ltd. offers a compelling buy recommendation for investors seeking exposure to the growing staffing industry in India. TeamLease is a fantastic company to invest in because it is expected to have strong revenue growth, is working on strategic plans to offer more services, and has positive technical indicators that point to possible upward momentum.Investors should conduct thorough research and consider their risk tolerance before making investment decisions. Overall, combining favorable market dynamics with solid financial fundamentals makes TeamLease an excellent option for those looking to invest in India’s staffing sector.

TEAMLEASE STOCK ANALYSIS

TEAMLEASE STOCK ANALYSIS