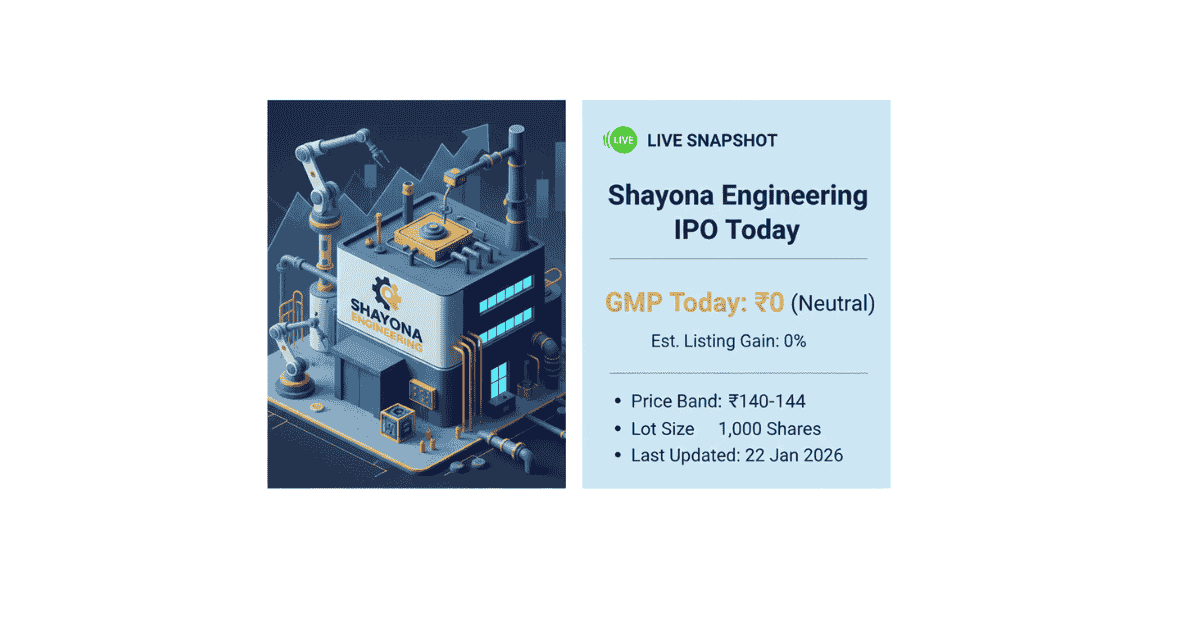

Shayona Engineering IPO – Complete Analysis, GMP, Subscription & Verdict

Last Updated: 6 Feb 2026 | IPO Period: 22–27 Jan 2026

⚡ LIVE IPO UPDATE

• Grey Market Premium (GMP) remains subdued at ₹0–₹1, indicating cautious listing expectations.

• Non-institutional investor (NII) participation continues to outpace retail demand.

• Retail subscription trend shows gradual improvement, though higher ticket size is limiting aggressive participation.

• As seen in many SME issues, subscription activity typically accelerates closer to the final stages.

Capital Flow Signal:

The muted GMP suggests limited speculative demand, while stronger NII interest reflects selective high-risk capital positioning rather than broad-based retail enthusiasm.

Market View:

Unless subscription momentum strengthens significantly, especially from institutional and retail segments, listing gains may remain constrained. Final allocation dynamics and broader market sentiment will be key triggers for post-listing performance.

📌 IPO Snapshot

| Issue Type | SME IPO – Fresh Issue |

| Issue Size | ₹14.86 Crore |

| Fresh Shares | ~10,32,000 Shares |

| Price Band | ₹140 – ₹144 |

| Lot Size | 1,000 Shares |

| Minimum Investment | ₹1,44,000 |

| Exchange | BSE SME |

| Registrar | Bigshare Services Pvt Ltd |

| Lead Manager | Horizon Management Pvt Ltd |

| Post-IPO Market Cap | ₹92 – ₹98 Crore (Estimated) |

📅 IPO Timeline

| Opening Date | 22 Jan 2026 |

| Closing Date | 27 Jan 2026 |

| Allotment Date | 28 Jan 2026 |

| Refund Date | 29 Jan 2026 |

| Demat Credit | 30 Jan 2026 |

| Listing Date | 30 Jan 2026 (Expected) |

📊 Subscription Status (Live)

| Category | Subscription | Sentiment |

|---|

| Retail | 0.31x | Weak |

| NII / HNI | 1.24x | Positive |

| QIB | 0.00x | Absent |

| Total | 0.59x | Selective |

🏭 Company Overview

Shayona Engineering is engaged in precision engineering, fabrication, piping solutions, and industrial manufacturing. The company supplies components to infrastructure, energy, and industrial sectors.

💰 Use of IPO Proceeds

| Plant & Machinery | ₹3.8 Cr |

| Working Capital | ₹4.2 Cr |

| Debt Repayment | ₹2.1 Cr |

| General Corporate | ₹4.7 Cr |

👥 Shareholding Structure

| Pre-IPO Promoter Holding | 87.29% |

| Post-IPO Promoter Holding (Est.) | ~64% – 67% |

| Public Shareholding | ~33% – 36% |

💰 Financial Performance (₹ Cr)

| Year | Revenue | PAT | EBITDA |

|---|

| FY2023 | 12.63 | 0.61 | 1.15 |

| FY2024 | 15.28 | 1.71 | 3.02 |

| FY2025 | 23.18 | 2.42 | 5.04 |

📊 Balance Sheet Snapshot (FY25)

| Total Assets | ₹32.6 Cr |

| Net Worth | ₹14.2 Cr |

| Total Debt | ₹12.8 Cr |

💵 Cash Flow Snapshot (FY25)

| Operating Cash Flow | ₹1.9 Cr |

| Investing Cash Flow | -₹2.4 Cr |

| Financing Cash Flow | ₹3.1 Cr |

📊 Key Valuation Metrics

| EPS (Post IPO) | ₹9.2 – ₹9.6 |

| P/E Ratio | ~15x – 16x |

| ROE | 26% – 30% |

| ROCE | 28% – 32% |

| Debt-to-Equity | 0.85 – 0.95 |

🏆 Peer Comparison

| Company | P/E | ROE |

|---|

| Shayona Engineering | 15–16x | 28% |

| Engineering SME Avg | 22–30x | 15–22% |

📈 GMP vs Subscription Model

| Subscription < 2x | Flat Listing Likely |

| 2x – 6x | Mild Premium (0–8%) |

| 6x – 15x | Moderate Premium (8–25%) |

| 15x+ | Strong Listing Rally |

🎯 Listing Scenario Model

| Bear Case | ₹135 – ₹140 |

| Base Case | ₹140 – ₹148 |

| Bull Case | ₹150 – ₹165 |

⚖️ Strengths & Risks

Strengths

- High revenue growth

- Improving margins

- Engineering sector tailwind

Risks

- SME liquidity risk

- Customer concentration

- High working capital dependency

📊 Analyst Conviction Score

| Business Quality | 7.2 / 10 |

| Growth Potential | 7.8 / 10 |

| Valuation Comfort | 6.4 / 10 |

| Listing Gain Probability | 30% – 45% |

| Overall Score | 6.8 / 10 |

🏁 Final Verdict

Shayona Engineering IPO is a high-risk SME issue with strong growth but muted grey market sentiment. Nil GMP and selective subscription indicate limited listing upside unless final-day demand improves sharply.

- Listing traders: Apply selectively

- High-risk investors: Small exposure only

- Conservative investors: Avoid

Disclaimer: Educational content only. IPO investments involve market risks. Consult a SEBI-registered advisor before investing.

About The Author

“Positional Calls Team provides data-driven positional stock calls, IPO analysis, and technical market insights with a focus on risk management and disciplined trading.”

Related