Nifty Metal Looking Weak:

As the Indian stock market navigates through various economic challenges, the Nifty Metal Index has recently shown signs of weakness. Investors and traders alike are eager to understand the underlying factors contributing to this trend, as well as what it means for future investments. This blog delves into the current state of the Nifty Metal Index, highlighting the reasons behind its decline and offering insights for potential strategies moving forward.

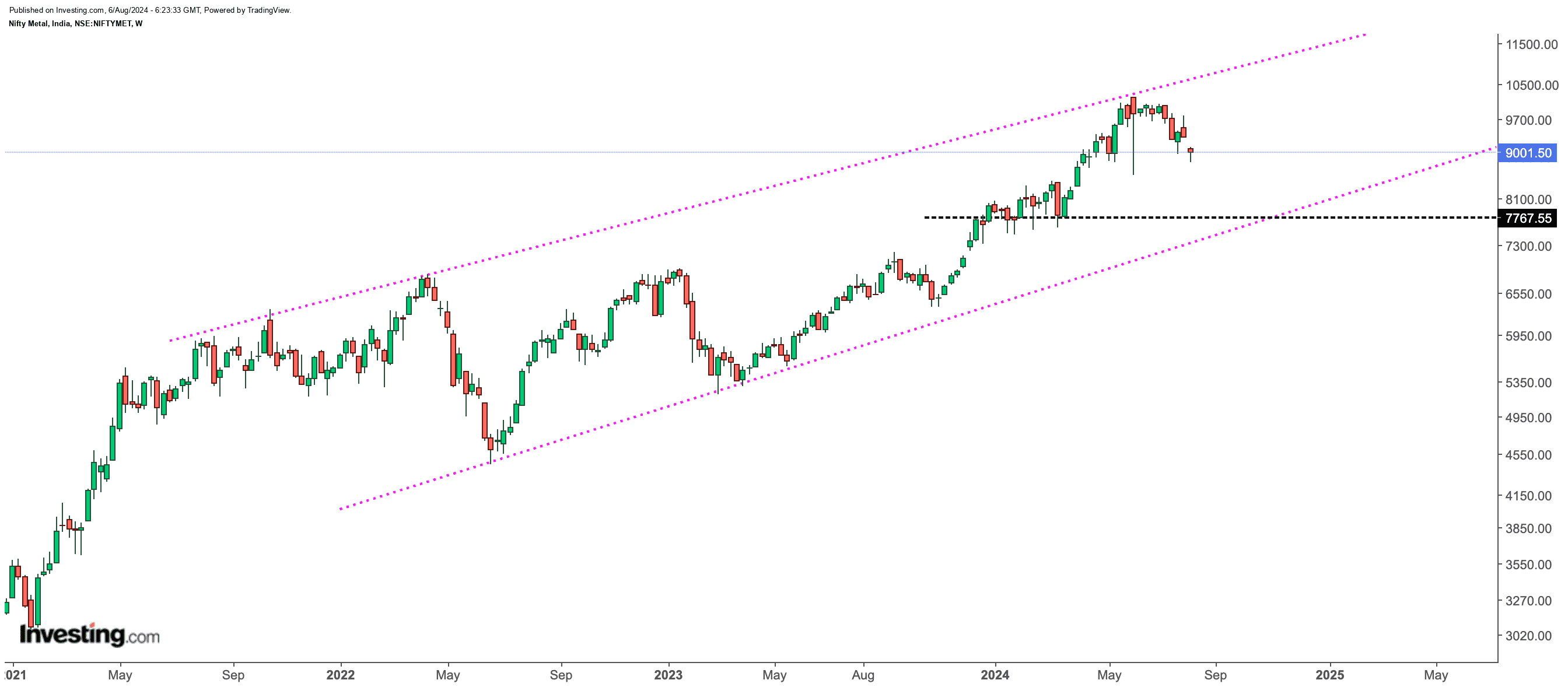

NIFTY METAL LOOKING WEAK NOW TRADING AT 9000-9010

SUPPORT 8000 – 7800

RESISTANCE 10100 – 10200

VIEW: SWING TO SHORT TERM

Nifty Metal Looking Weak: Current Performance

As of the latest trading sessions, the Nifty Metal Index has been experiencing a short-term downtrend, currently hovering around 9011. This marks a notable decline from its previous highs, with resistance levels at 10100 and 10200. A decisive close above these resistance levels is crucial for any potential recovery. Until then, the prevailing sentiment suggests a cautious approach for traders.

Nifty Metal Looking Weak: Key Factors Contributing

- The ongoing global economic slowdown has had a significant impact on demand for metals. Concerns about reduced industrial activity and construction projects have led to a decline in metal prices, affecting the overall performance of the Nifty Metal Index.

- Rising energy costs:

Increased energy prices have pressured metal producers, leading to higher operational costs. This has resulted in squeezed profit margins for many companies within the index, further contributing to the bearish sentiment. - Geopolitical Tensions:

Geopolitical issues, particularly in regions like Eastern Europe and South-east Asia, have disrupted supply chains and created uncertainty in the metal markets. These disruptions have caused prices to fluctuate, making investors wary. - Interest Rate Hikes:

The Reserve Bank of India’s monetary policy, which includes interest rate hikes to combat inflation, has created a challenging environment for capital-intensive industries like metals. Higher borrowing costs can deter investments and slow down growth.

Nifty Metal Looking Weak: Technical Analysis

Technically speaking, the Nifty Metal Index is currently in a bearish trend. Key observations include:

- Resistance Levels:

The index faces significant resistance at 10100 and 10200. We remain cautious until we breach these levels. - Support Levels:

Traders should watch for support around 7,800 and 8000, with if the downtrend continues. A breach of these support levels could signal further declines. - Volume Trends:

Recent trading volumes indicate increased selling pressure, suggesting that market participants are reacting to the broader economic concerns.

Nifty Metal Looking Weak: Investment Strategies Moving Forward

Given the current state of the Nifty Metal Index, investors should consider the following strategies:

- Sell on Rallies:

It may be prudent to adopt a sell-on-rise strategy when the index is in a downtrend. This involves selling positions during minor upward movements until a clear reversal signal emerges. - Focus on Quality Stocks:

Investors should concentrate on fundamentally strong companies in the metal sector that have robust balance sheets and can withstand economic pressures. Companies with low debt levels and strong cash flows are likely to perform better during downturns. - Monitor Economic Indicators:

Monitoring global economic indicators, particularly those associated with industrial activity and construction, can offer valuable insights into potential recoveries in the metal sector. - Risk Management:

Implementing strict risk management strategies is crucial. Setting stop-loss orders can help protect investments from significant downturns.

READMORE: Unicommerce eSolutions IPO: A Game-Changing Opportunity for Investors

Conclusion

The Nifty Metal Index is currently facing a challenging environment, with several factors contributing to its weakness. While the outlook remains cautious, investors should remain vigilant and adapt their strategies accordingly. By focusing on quality stocks and employing effective risk management, it is possible to navigate through these turbulent times. As always, thorough research and analysis are essential before making investment decisions. For the latest updates and expert insights on the stock market, stay tuned to Positional Calls, your trusted source for market analysis and investment strategies.