Mayur Uniquoters Stock Analysis:

Since the stock market is always changing, investors look for promising investments with high returns. You can collaborate with textile giant Mayur Uniquoters Ltd. (MAYURUNIQ). Read this blog post to learn why Mayur Uniquoters is a worthy buy for long-term or short-term investors.

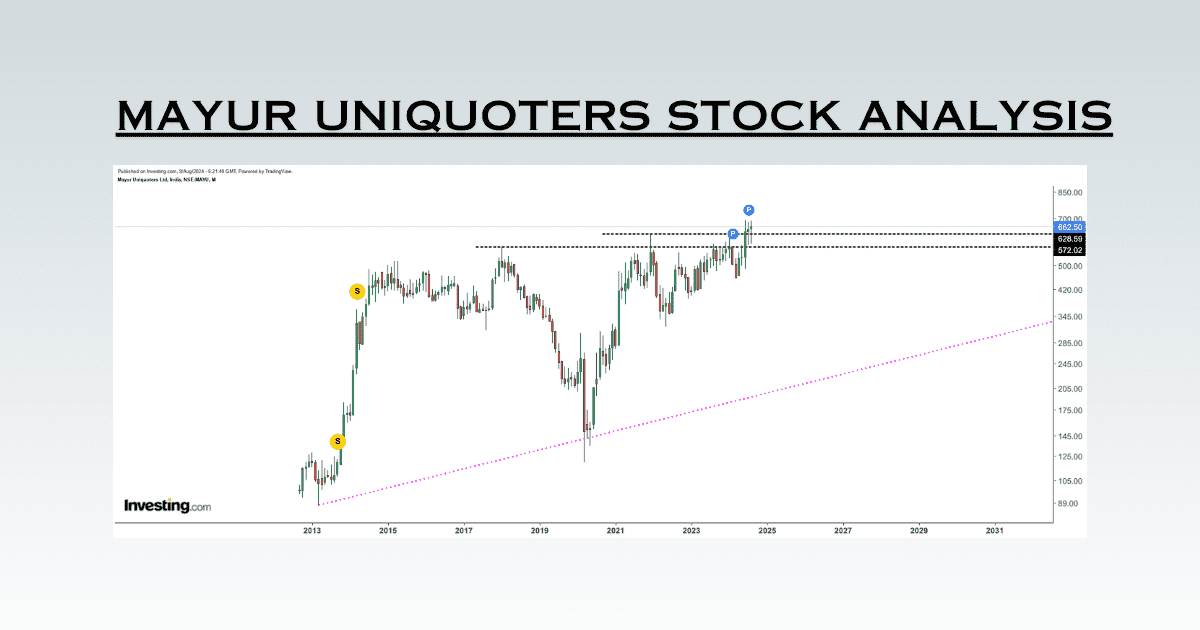

BUY MAYUR UNIQUOTERS IN DIPS NOW TRADING BETWEEN 660 – 665

SUPPORT 500

TARGET 850 900+

VIEW: SWING TO SHORT TERM

Mayur Uniquoters Stock Analysis: Company Overview

Mayur Uniquoters Ltd. is well-known for its innovative products. Strong market presence and synthetic leather production make the company famous. The company has become a major textile player and deserves this designation. The company provides services to many industries, including automotive, furniture, and fashion.

Mayur Uniquoters Stock Analysis: Current Market Performance

Recent data indicates that Mayur Uniquoters’ shares are currently trading at approximately ₹634.15. For long-term investors, analysts recommend a strong buy. For the duration of this recommendation, the stop loss is ₹543.06. The company’s stock, fluctuating between ₹700 and ₹455, shows flexibility. Given the current situation, the company’s revenue has enormous potential.

Mayur Uniquoters Stock Analysis: Important Financial Indices

P/E Ratio:

The current price-to-earnings (P/E) ratio is 21.04, which is competitive within the industry. This suggests that the stock’s valuation aligns reasonably with its earnings..

Per Share Earnings (EPS):

Mayur Uniquoters is an appealing investment choice for investors searching for income through capital appreciation, as evidenced by its EPS of ₹27.86.

Market Capitalization:

The company’s market capitalisation is roughly ₹2,577.16 crores, indicating both the confidence of potential investors and the company’s strong market position.

Income from Dividends:

With a dividend yield of 0.51%, Mayur Uniquoters provides a modest return on investment, appealing to income-focused investors.

Mayur Uniquoters Stock Analysis: Technical Analysis

Mayur Uniquoters’ bullish technical indicators fall into these categories:

EMAs of 50 and 100 days:

The stock is trading above both the 50-day and 100-day exponential moving averages, indicating positive momentum in the short to mid-term.

MACD:

Although the MACD line is below the signal line, it is essential to monitor this closely as it can indicate potential reversals in momentum.

RSI:

The RSI is below 30, indicating a potential oversold condition in the stock, which presents an opportunity for investors to buy. Investors can now profit.

Mayur Uniquoters Stock Analysis: Potential for Growth

Current Market Trends:

We anticipate growth in the textile industry due to the increasing use of synthetic leather. Because of its location, Mayur Uniquoters can capitalize on this trend.

Innovation and Diversification:

The company is continuously innovating and diversifying its product and offerings, which can lead to increased market share and revenue growth.

Solid financial status:

With a low debt-to-equity ratio of 0.0311, Mayur Uniquoters maintains a strong balance sheet, allowing it to invest in growth opportunities without significant financial risk.

READMORE: Capitalize on Growth: A Buy Recommendation for Venkey’s (India) Shares

Conclusion

In conclusion, long-term traders and investors will find Mayur Uniquoters Ltd. appealing. This is useful for trading professionals. The stock should grow soon because of its strong fundamentals, favorable market trends, and bullish technical indicators. If you want to improve your investment portfolio, consider adding Mayur Uniquoters. This deserves consideration.

You should invest now to capitalise on Mayur Uniquoters’ potential and stay competitive in the stock market. For stock recommendations and more, visit Positional Calls.