Lambodhara Stock: A Strategic Investment Opportunity

In the ever-evolving landscape of the stock market, identifying promising investment opportunities is crucial for building a robust portfolio. One such opportunity lies in Lambodhara Textiles Ltd., a company that has shown significant potential for growth and profitability. This blog presents a comprehensive buy recommendation for LAMBODHARA, backed by both fundamental and technical analyses.

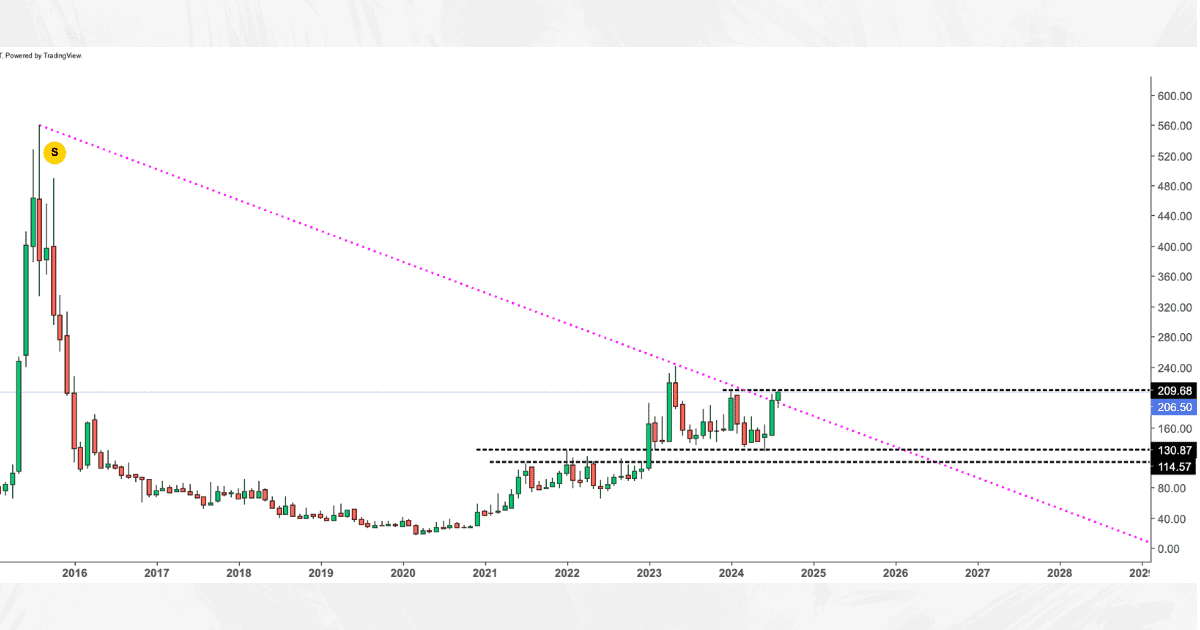

LAMBODHARA STOCK LOOKS GOOD NOW TRADING BETWEEN 200-210

SUPPORT:135

TARGET:400+

VIEW: GOOD FOR SHORT TO LONG TERM

Lambodhara Stock: Company Overview

Lambodhara Textiles Ltd. operates in the textile industry, focusing on the production and distribution of high-quality textile products. With a commitment to innovation and sustainability, the company has established a strong brand presence in a competitive market. As consumer preferences shift towards quality and sustainability, Lambodhara is well-positioned to capitalise on these trends.

Lambodhara Stock: Fundamental Analysis

- Financial Health:

- Market Capitalisation:

According to the most recent data, Lambodhara Textiles has a market cap of approximately ₹147 crore, indicating a small-cap stock with growth potential. - Earnings Per Share (EPS): The company’s EPS stands at ₹4.44, showcasing its ability to generate profits for shareholders.

- Price-to-Earnings (P/E) Ratio: With a P/E ratio of 31.80, Lambodhara is trading at a reasonable valuation compared to its industry peers, which have an average P/E of 40.16. This suggests a potential undervaluation of the stock’s earnings.

- Market Capitalisation:

- Profitability Metrics:

- Lambodhara’s return on equity (ROE) is 4.16%, indicating effective equity capital management.

- Dividend Yield:

The company pays a 0.35% dividend yield, providing investors with additional income.

- Debt Management:

- Lambodhara’s balance sheet is healthy, with a debt-to-equity ratio of 0.51, indicating prudent financial management and lower financial risk.

- Lambodhara’s balance sheet is healthy, with a debt-to-equity ratio of 0.51, indicating prudent financial management and lower financial risk.

- Growth Prospects:

- Expansion Plans:

The company is actively exploring opportunities to expand its product line and market reach, which could drive revenue growth in the coming years. - Sustainability Initiatives:

As sustainability becomes a key focus in the textile industry, Lambodhara’s commitment to eco-friendly practices positions it favorably among environmentally conscious consumers.

- Expansion Plans:

Lambodhara Stock: Technical Analysis

- Price Trends:

- Support and Resistance Levels: Currently, LAMBODHARA is trading near its support level of Rs 135. A breakout above the resistance level of Rs 210 could signal a bullish trend, making it an opportune time to invest.

- Moving Averages:

- The stock is currently trading above its 50-day and 200-day moving averages, indicating positive momentum. This trend suggests that the stock may continue to rise in the near term.

- Volume Analysis:

- Recent trading volumes have increased, indicating heightened investor interest. A surge in volume often precedes significant price movements, reinforcing the bullish outlook.

- Technical Indicators:

- Relative Strength Index (RSI):

The Daily RSI is currently at 70+, suggesting that the stock is neither overbought nor oversold, indicating a healthy trading environment. - MACD:

The Moving Average Convergence Divergence (MACD) shows a bullish crossover, which is a strong signal for potential upward price movement.

- Relative Strength Index (RSI):

Lambodhara Stock: Investment Recommendation

Based on Lambodhara Textiles Ltd.’s comprehensive analysis, we recommend a purchase for the following reasons:

- Strong Fundamentals:

The company’s solid financial performance, reasonable valuation, and growth prospects make it an attractive investment opportunity. - Positive Technical Indicators:

The technical analysis supports a bullish outlook, with favorable price trends and increasing trading volumes. - Market Potential:

With expansion plans and a commitment to sustainability, Lambodhara is well-positioned to capitalise on emerging market opportunities.

READMORE: Brainbees Solutions IPO: Your Path to Profitable E-Commerce Investments

Conclusion

In conclusion, Lambodhara Textiles Ltd. presents a compelling buy opportunity for investors looking to enhance their portfolios. With a strong foundation of financial health, growth potential, and favourable technical indicators, this stock is poised for success in the coming months. As always, investors should conduct their research and consider their risk tolerance before making investment decisions. For more insights and recommendations, stay updated with the latest market news and analysis at Positional Calls, your trusted source for stock market expertise.