KICL Share Buy Recommendation 2025: Full Detail Analysis, Targets & Risks

Educational Disclosure: This page presents an informational analysis of publicly available data and market context related to Kalyani Investment Company Limited (KICL). It is not investment advice and does not constitute a recommendation to buy or sell any security.

Kalyani Investment Company Limited (NSE: KICL, BSE: 533302) has attracted attention in 2025 due to its structure as a holding company within the Bharat Forge Group. This page provides a structured review of KICL’s business model, price behaviour context, financials, valuation, and risk framework.

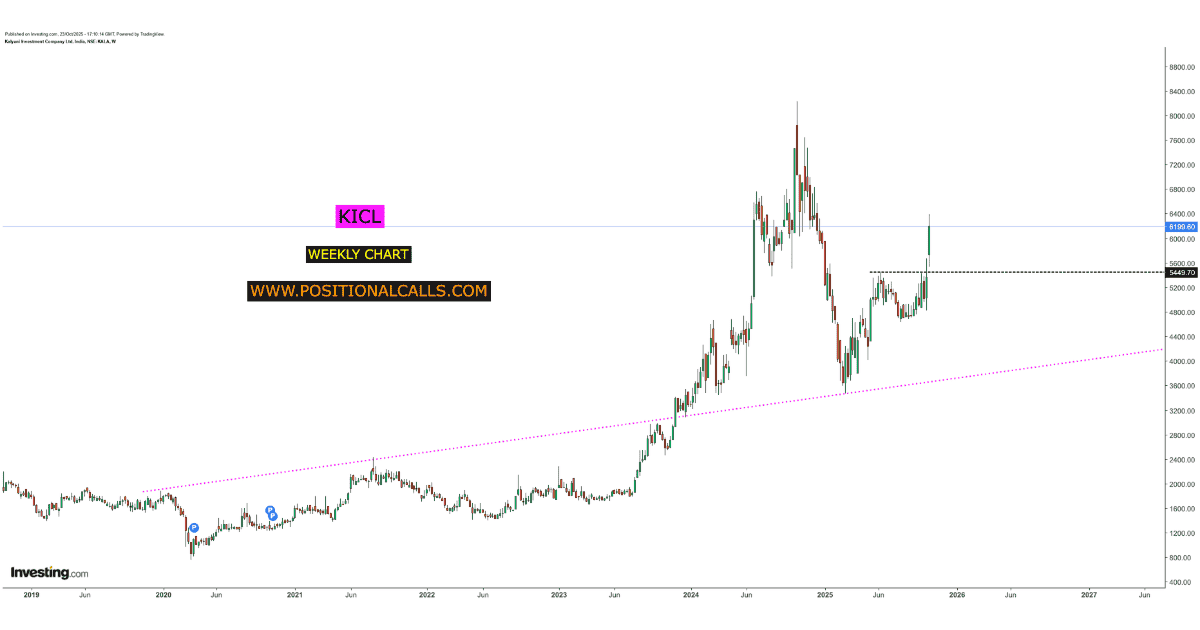

Market Structure & Observed Price Reference

As of late 2025, KICL has been observed trading near the ₹6,100 region, with historical structural support zones around ₹4,600–₹4,000. These levels are derived from past price behaviour and are presented for contextual understanding only.

KICL Share Buy Recommendation 2025: Company Overview

Kalyani Investment Company Limited operates primarily as an investment holding company with a diversified portfolio across group subsidiaries and selective external investments. Its performance is influenced by the broader industrial and capital-market ecosystem of the Bharat Forge Group.

- Promoter holding:

~74.97% (September 2025) - Industry:

Asset Management & Financial Services - Market Capitalisation:

~₹20.94 billion - P/E Ratio:

~29.27x (TTM) - EPS:

~₹58.81

KICL Share Buy Recommendation 2025 : Financial Performance Snapshot

Recent quarterly results indicate revenue growth alongside short-term profitability volatility, largely influenced by associate company performance.

| Metric | Q1 FY2025 | YoY Change |

|---|---|---|

| Total Income | ₹57.82 crore | +20% |

| Profit After Tax | ₹20.76 crore | -30% |

| EPS | ₹4.76 | Down from ₹6.80 |

- Gross Margin:

100% - Operating Margin:

~93.67% - Profit Margin:

Above 90%

These metrics reflect operational efficiency despite short-term profit variability.

KICL Share Buy Recommendation 2025: Valuation & Market Context

KICL’s valuation reflects holding-company dynamics rather than operating-company multiples. P/E and P/B ratios should be interpreted alongside portfolio composition and long-term capital allocation efficiency.

Growth Drivers & Structural Opportunities

- Value characteristics:

Lower relative P/B compared to peers suggests structural undervaluation. - Portfolio exposure:

Stakes in group and associate companies provide long-term optionality. - Promoter alignment:

High promoter holding (~75%) indicates long-term confidence. - Macro tailwinds:

Manufacturing and NBFC capital-market expansion supports underlying asset value.

Risk Considerations

- Associate company volatility: Earnings can fluctuate due to subsidiary performance.

- Liquidity constraints: Lower volumes may amplify price swings.

- Value unlocking risk: Holding-company discounts may persist without catalysts.

KICL Share Buy Recommendation 2025: Long-Term Structural Perspective on KICL

From a long-term capital allocation perspective, Kalyani Investment Company Limited operates differently from typical operating companies. Its performance is not driven by quarterly sales cycles but by the underlying value creation of its investment portfolio and dividend income from group companies.

Historically, investment holding companies often trade at a discount to their intrinsic value due to lower liquidity, complex structures, and delayed value unlocking. However, during favourable market phases, such entities tend to see sharp re-rating when portfolio companies perform well or when dividend visibility improves.

KICL’s association with the Bharat Forge Group provides indirect exposure to India’s manufacturing, defence, and capital goods growth themes. Over longer investment horizons, this linkage can help reduce downside volatility while offering optional upside tied to group-level expansion and capital efficiency.

Investors analysing KICL should therefore focus less on short-term price movements and more on balance sheet strength, portfolio quality, promoter ownership stability, and consistency in financial disclosures. These factors play a decisive role in determining whether valuation gaps narrow over time.

Viewed through this lens, KICL fits the profile of a structural holding-company investment rather than a short-term trading vehicle, making patience and disciplined monitoring essential for long-term participants.

Observed Technical Context

Recent price behaviour indicates stability above short-term moving averages. These observations describe historical trends and should not be interpreted as future predictions.

Short-Term vs Medium-Term Framework

| Horizon | Observed Behaviour | Context |

|---|---|---|

| Short-Term | Positive momentum | Above ₹4,600 zone |

| Medium-Term | Range stability | ₹4,000–₹4,600 structure |

| Long-Term | Portfolio optionality | Bharat Forge ecosystem |

Authoritative External Reference:

BSE India – KICL Stock Page

Related Internal Read:

Buy Recommendation for Nifty Consumer Durables: Index Outlook, Top Stocks & 2025 Growth Drivers

Conclusion

Kalyani Investment Company Limited offers a structured view into holding-company investing within India’s capital markets. Its portfolio composition, promoter alignment, and macro exposure provide long-term optionality for value-oriented investors.

This content is provided for educational purposes only and does not constitute investment or trading advice.