Infrastructure Sector: Capex Cycles, Order Books, and Capital Flows

The infrastructure sector is one of the most policy-driven and capital-intensive segments of the Indian equity market. Earnings cycles in infrastructure companies are closely linked to government capital expenditure, order inflows, project execution, commodity costs, and balance-sheet strength. Institutional capital flows into infrastructure stocks are typically driven by capex cycles, order book growth, and margin expansion phases.

Infrastructure companies operate across roads, railways, power, defence, urban infrastructure, and industrial engineering projects. Their earnings visibility is determined by order books, execution timelines, working capital cycles, and financing conditions.

Sector: Infrastructure

Core Segments: Roads, Railways, Power, Defence, Urban Infra, EPC

Primary Drivers: Government capex, order inflows, execution cycles, commodity prices

Table of Contents

- Sector Structure

- How Infrastructure Companies Generate Earnings

- Government Capex Cycles

- Public vs Private Capex

- Order Book Dynamics

- Execution Cycles and Revenue Recognition

- Working Capital Cycles

- Balance Sheet Cycles

- Segment Breakdown

- Roads and Highways

- Railways and Metro Projects

- Power and Transmission

- Defence Infrastructure

- Urban Infrastructure

- Industrial EPC

- Commodity Prices and Margin Cycles

- Capital-Flow Cycles in Infrastructure Stocks

- Interest Rates and Infrastructure

- Valuation Cycles

- Competitive Landscape

- Institutional Positioning

- Recent Earnings Trends

- Medium-Term Growth Drivers

- Key Risks to the Sector

- Outlook for FY26–FY29

Infrastructure Sector: Structure

The infrastructure sector primarily consists of engineering, procurement, and construction (EPC) companies and project developers. These companies execute projects across multiple industries, often under government contracts.

The sector includes:

- Road and highway developers

- Railway and metro contractors

- Power generation and transmission companies

- Defence infrastructure providers

- Urban infrastructure developers

- Industrial EPC contractors

How Infrastructure Companies Generate Earnings

Infrastructure companies generate revenue through project execution and contract-based payments.

Key earnings drivers include:

- Order inflows

- Order book size

- Execution pace

- Project margins

- Working capital cycles

Revenue visibility is determined by the order book relative to annual revenue.

Government Capex Cycles

The infrastructure sector is heavily dependent on government capital expenditure cycles. Public capex acts as the primary demand driver for infrastructure companies.

Capex Expansion Phase

- Large infrastructure budget allocations

- Increased project tendering

- Strong order inflows

Execution Phase

- Projects move from tendering to execution

- Revenue growth accelerates

- Margins stabilize or expand

Capex Slowdown Phase

- Reduced tendering activity

- Lower order inflows

- Slower earnings growth

Public vs Private Capex

Infrastructure demand is driven by both public and private capital expenditure.

Public Capex

- Government roads and rail projects

- Urban infrastructure programs

- Defence and power investments

Private Capex

- Industrial projects

- Energy and manufacturing capacity additions

- Commercial real estate and logistics

Public capex typically leads the cycle, with private capex following during economic expansions.

Infrastructure Sector: Order Book Dynamics

The order book is the most important indicator of future revenue for infrastructure companies.

Order books provide:

- Multi-year revenue visibility

- Execution pipelines

- Cash-flow predictability

A strong order book typically indicates sustained revenue growth over the next three to five years.

Execution Cycles and Revenue Recognition

Infrastructure companies recognize revenue based on project execution milestones.

Execution depends on:

- Land acquisition

- Regulatory approvals

- Raw material availability

- Labour supply

- Weather conditions

Delays in any of these factors can impact revenue recognition.

Working Capital Cycles

Working capital management is critical in infrastructure companies.

Companies must fund:

- Project mobilization costs

- Raw material purchases

- Labour expenses

Delayed payments from clients increase working capital requirements and impact profitability.

Balance Sheet Cycles

Infrastructure companies typically operate with higher debt levels due to capital-intensive operations.

Debt cycles follow capex cycles:

- Debt increases during project expansion

- Debt reduces during execution and cash-flow phases

Segment Breakdown

Roads and Highways

The roads sector is driven by national highway construction programs and toll road development.

Key drivers:

- Highway expansion projects

- Hybrid annuity models

- Toll road concessions

Railways and Metro Projects

Railway and metro infrastructure is a major component of public capex.

Key drivers:

- Freight corridor projects

- Metro rail expansions

- Station modernization

Power and Transmission

Power infrastructure includes generation, transmission, and distribution projects.

Key drivers:

- Renewable energy expansion

- Transmission network growth

- Grid modernization

Defence Infrastructure

Defence infrastructure includes:

- Shipyards

- Aircraft facilities

- Defence manufacturing plants

Urban Infrastructure

Urban infrastructure projects include:

- Water supply systems

- Sewage treatment plants

- Smart city projects

Industrial EPC

Industrial EPC companies execute projects for:

- Manufacturing plants

- Refineries

- Chemical facilities

Commodity Prices and Margin Cycles

Infrastructure margins are sensitive to commodity price movements.

Key inputs include:

- Steel

- Cement

- Fuel

Rising commodity prices compress margins, while stable input costs support profitability.

Infrastructure Sector: Capital-Flow Cycles in Infrastructure Stocks

Institutional capital flows into infrastructure stocks during two major phases:

Capex Expansion Phase

When government spending increases, investors allocate capital to infrastructure companies.

Execution and Earnings Phase

As projects move into execution, earnings growth attracts additional capital.

Interest Rates and Infrastructure

Interest rates significantly impact infrastructure companies.

- Lower rates reduce financing costs.

- Higher rates increase project costs.

Valuation Cycles

Infrastructure stocks typically trade at:

- Premium valuations during capex upcycles

- Discounted valuations during capex slowdowns

Competitive Landscape

The infrastructure sector includes large-cap and mid-tier companies.

Key players include:

- Larsen & Toubro

- IRB Infrastructure

- NBCC

- Rail Vikas Nigam

- KNR Constructions

Institutional Positioning

Institutional investors allocate capital to infrastructure stocks during:

- Government capex expansions

- Strong order inflow cycles

- Margin expansion phases

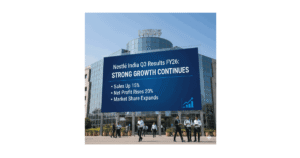

Recent Earnings Trends

Recent earnings across the infrastructure sector reflect:

- Strong order inflows

- Improving execution pipelines

- Stable margins

Medium-Term Growth Drivers

- Government infrastructure spending

- Railway modernization

- Defence capex

- Renewable energy projects

- Urban infrastructure programs

- Private industrial capex recovery

Key Risks to the Sector

- Project execution delays

- Commodity price volatility

- Working capital stress

- Interest rate increases

Outlook for FY26–FY29

The medium-term outlook for the infrastructure sector remains supported by strong government capex plans, rising order inflows, and multi-year project pipelines.

Companies with strong balance sheets, large order books, and efficient execution capabilities are expected to benefit the most from the ongoing capex cycle.