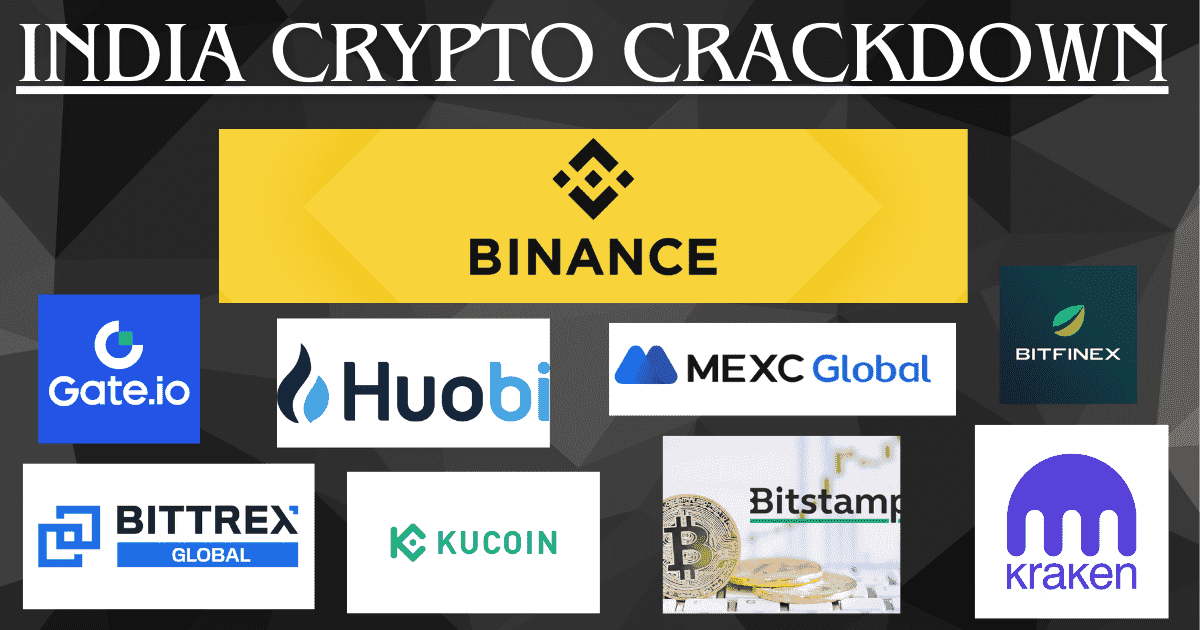

India Crypto Crackdown: The Indian government has fired a shot across the bow of the burgeoning cryptocurrency industry by requesting the Ministry of Information and Technology (MeitY) to block the URLs of nine offshore crypto exchanges, including industry giant Binance. This move, spearheaded by the Financial Intelligence Unit (FIU), marks a significant escalation in India’s ongoing regulatory dance with crypto.

List of Affected Exchanges:

- Binance

- KuCoin

- Huobi

- Kraken

- Gate.io

- Bittrex

- Bitstamp

- MEXC Global

India Crypto Crackdown: A Crack in the Facade Exposes Regulatory Fault Lines

India’s crypto landscape has existed in a state of limbo for years. While the Supreme Court struck down the Reserve Bank of India’s (RBI) blanket ban on crypto transactions in 2020, the government has since refused to embrace the nascent asset class. This latest action, however, suggests a shift towards a more proactive stance, driven by concerns about:

- Money laundering and tax evasion:

The FIU fears that offshore platforms like Binance, with their lax KYC/AML protocols, could be used for illicit financial activity. - Investor protection:

These exchanges’ lack of regulatory oversight leaves Indian investors vulnerable to scams and market manipulation. - Foreign exchange outflow:

The government is concerned about the potential for capital flight through crypto transactions.

India Crypto Crackdown: The Battle Lines Are Drawn – Binance, Offshore Exchanges Face FIU Blockade

The FIU’s request has sparked a heated debate within the Indian crypto community. Proponents argue that it stifles innovation and hinders the growth of a promising industry. They point to the potential benefits of blockchain technology, such as increased financial inclusion and efficiency, and argue for a more nuanced approach to regulation.

Critics, however, welcome the government’s move. They believe that it is necessary to protect investors and combat financial crime. They also argue that India needs to develop its regulatory framework for crypto before fully embracing the technology.

Read More: Buy Gold for the Bullish Ride: Set Your Sights on 65500 and Beyond!

India Crypto Crackdown: The Road Ahead is Bumpy, But Innovation Paves the Way

The ultimate fate of India’s crypto market remains uncertain. Whether the government will follow through with the URL ban, and if so, what form it will take, is still up in the air. However, one thing is clear: the Indian government is no longer content to sit on the sidelines regarding crypto.