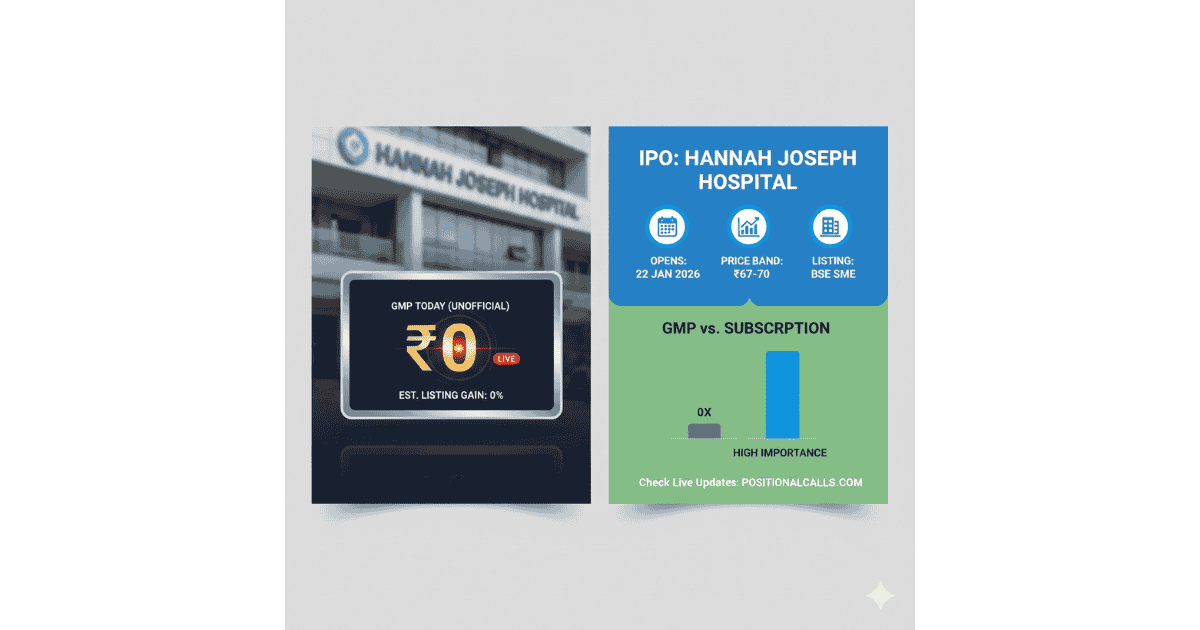

Hannah Joseph Hospital IPO GMP Today, Review & Verdict

GMP Today

Min Investment

Price Band

₹67 – ₹70

₹67 – ₹70

Market Cap

📊 IPO Snapshot

| Issue Type | SME IPO – Fresh Issue |

| Issue Size | ₹39.90 Crore |

| Fresh Shares | ~5,70,000 Shares |

| Price Band | ₹67 – ₹70 |

| Lot Size | 2,000 Shares |

| Minimum Investment | ₹1,40,000 |

| Exchange | BSE SME |

| Registrar | Bigshare Services Pvt Ltd |

| Lead Manager | Beeline Capital Advisors Pvt Ltd |

| Post-IPO Market Cap | ₹145 – ₹155 Crore (Estimated) |

📅 IPO Timeline

| Opening Date | 22 Jan 2026 |

| Closing Date | 27 Jan 2026 |

| Allotment Date | 28 Jan 2026 |

| Refund Date | 29 Jan 2026 |

| Demat Credit | 30 Jan 2026 |

| Listing Date | 30 Jan 2026 (Expected) |

📊 Subscription Status (Live)

| Category | Subscription | Shares Offered | Shares Bid |

|---|---|---|---|

| Retail | 0.04x | 1,99,500 | 7,980 |

| NII / HNI | 0.24x | 85,500 | 20,520 |

| QIB | 0.00x | 2,85,000 | 0 |

| Total | 0.07x | 5,70,000 | 28,500 |

🏥 Company Overview

Hannah Joseph Hospital operates a multi-specialty healthcare facility offering surgery, diagnostics, ICU, emergency care, and outpatient services. Revenue growth depends on patient volumes, occupancy rates, and operational efficiency.

💰 Use of IPO Proceeds

- Hospital infrastructure expansion

- Medical equipment purchase

- Working capital

- Debt repayment

👥 Shareholding Structure

| Pre-IPO Promoter Holding | 100% |

| Post-IPO Promoter Holding (Est.) | ~73% – 75% |

| Public Shareholding | ~25% – 27% |

💰 Financial Performance (₹ Cr)

| Year | Revenue | PAT | EBITDA Margin |

|---|---|---|---|

| FY2023 | 52.3 | 2.14 | 21.4% |

| FY2024 | 64.8 | 3.06 | 22.6% |

| FY2025 | 78.9 | 4.12 | 23.8% |

📊 Balance Sheet Snapshot (FY25)

| Total Assets | ₹142 Cr |

| Net Worth | ₹56 Cr |

| Total Debt | ₹41 Cr |

💵 Cash Flow Snapshot (FY25)

| Operating Cash Flow | ₹6.1 Cr |

| Investing Cash Flow | -₹4.6 Cr |

| Financing Cash Flow | ₹3.2 Cr |

📊 Valuation Metrics

| EPS (Post IPO) | ₹4.7 – ₹5.0 |

| P/E Ratio | ~14x – 15x |

| ROE | 22% – 24% |

| Debt to Equity | 0.70 – 0.80 |

🎯 Listing Scenario Model

| Bear Case | ₹65 – ₹69 |

| Base Case | ₹70 – ₹74 |

| Bull Case | ₹75 – ₹82 |

⚖️ Risk vs Reward Matrix

| Listing Gain Probability | 25% – 40% |

| Flat Listing Probability | 40% – 50% |

| Loss Probability | 15% – 25% |

🏁 Final Verdict

Hannah Joseph Hospital IPO shows weak early demand and nil GMP. Fundamentals are stable but SME liquidity risk and low subscription limit listing upside unless final-day momentum improves.

- Listing traders: Apply selectively

- High-risk investors: Small exposure only

- Conservative investors: Avoid

⚠️ GMP is unofficial and speculative. It can change rapidly.

Subscription quality matters more than GMP in SME IPOs.

Disclaimer: Educational content only. IPO investments involve market risks. Consult a SEBI-registered advisor before investing.