Energy & PSU Sector Outlook 2026: Post-Budget Capital-Flow and Earnings Cycles

India’s Energy and PSU sector enters FY26 with a structurally supportive policy environment, stable commodity prices, and strong dividend visibility. Following Budget 2026, institutional capital allocation toward oil, gas, coal, and power PSUs continues to be driven by fiscal alignment, energy-security priorities, and high cash-flow generation. As global macro conditions remain uncertain, the PSU energy complex has increasingly become a defensive capital-flow destination within the Indian equity market.

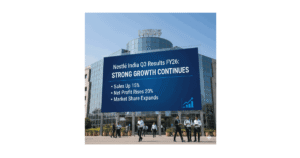

• Nifty CPSE Index: Stable to positive post-budget

• Brent crude range: Mid-$70s to low-$80s

• PSU dividend yields: Among the highest in large-cap India

• Government capex focus: Infrastructure, power, and energy security

Table of Contents

- Budget 2026: Structural Signals for PSU Energy

- Institutional Capital-Flow Drivers

- Upstream Oil Earnings Cycle

- Downstream Refining and Marketing Cycle

- Power PSU Earnings Framework

- Coal and Thermal Supply Chain Dynamics

- Dividend Cycles and Fiscal Alignment

- Valuation Gap vs Private Peers

- Global Macro and Commodity Linkages

- Sector Capital Rotation Patterns

- Key Sector Risks

- FY26 Institutional Outlook

Budget 2026: Structural Signals for PSU Energy

Budget 2026 maintained continuity in fiscal and infrastructure priorities, reinforcing the structural importance of energy PSUs in India’s macroeconomic framework. While the budget did not introduce disruptive tax changes or major subsidy expansions, it delivered a policy environment characterized by stability and predictable cash flows for public-sector energy companies.

Three key structural signals emerged from the budget:

- Continued emphasis on infrastructure-led growth, supporting power and energy demand.

- Stable subsidy and tax frameworks for oil, coal, and power companies.

- Ongoing focus on domestic energy production and energy security.

For institutional investors, policy stability is often more valuable than aggressive reform. The absence of unexpected fiscal burdens allows PSU energy companies to maintain strong earnings visibility and predictable dividend distributions.

Energy & PSU Sector Outlook 2026: Institutional Capital-Flow Drivers

Institutional allocation toward PSU energy stocks is shaped by three core drivers: dividend yield, fiscal alignment, and commodity-cycle support. Over the past two years, these factors have led to sustained inflows into PSU stocks, particularly from domestic institutional investors and yield-focused global funds.

1. Dividend Yield as a Primary Allocation Driver

PSU energy companies typically offer dividend yields significantly above the broader market. In an environment where global interest rates remain elevated compared to the ultra-low-rate period of 2020–2021, yield-oriented capital continues to favor high-dividend sectors.

This dynamic has created a structural “yield bid” for PSU energy stocks, particularly during market corrections.

2. Fiscal Alignment Between Government and PSUs

Dividend payouts from energy PSUs contribute directly to government revenues. This creates a structural alignment between the fiscal objectives of the government and the profitability of PSU energy companies.

As a result, strong PSU earnings often translate into higher dividends, reinforcing the sector’s appeal to institutional investors.

3. Commodity Cycle Stability

Stable crude oil and coal prices have reduced volatility in PSU earnings. This stability has improved earnings visibility, making the sector more attractive for long-term capital allocation.

Energy & PSU Sector Outlook 2026: Upstream Oil Earnings Cycle

Upstream oil PSUs operate in a commodity-linked earnings cycle primarily driven by crude oil prices, production volumes, and currency movements.

Key Earnings Drivers

- Global crude oil prices

- Domestic production levels

- Exchange-rate movements

- Government fiscal policies

When crude prices remain within a stable range, upstream companies generate strong operating cash flows. These cash flows typically translate into high dividend payouts, which are a key component of the sector’s capital-flow dynamics.

Energy & PSU Sector Outlook 2026: Downstream Refining and Marketing Cycle

Downstream oil companies operate under a different earnings framework, driven primarily by refining margins, marketing spreads, and inventory gains or losses.

Refining Margin Dynamics

Refining margins depend on global demand for petroleum products, refinery utilization rates, and product-crack spreads. Strong refining margins can lead to sharp earnings upgrades for downstream PSUs.

Marketing Spread Stability

Stable retail fuel pricing policies allow downstream companies to maintain predictable marketing margins. Sudden government interventions, however, can compress these spreads and affect profitability.

Power PSU Earnings Framework

Power sector PSUs operate under regulated return models, which provide relatively stable earnings visibility compared with commodity-linked sectors.

Core Drivers of Power PSU Earnings

- Regulated return frameworks

- Capacity-addition cycles

- Plant load factors

- Coal supply availability

- Renewable energy investments

Budget-driven infrastructure spending typically leads to higher electricity demand. This improves plant load factors and enhances earnings visibility for thermal power PSUs.

Coal and Thermal Supply Chain Dynamics

Coal remains the backbone of India’s power sector. Coal-producing PSUs operate in a volume-driven earnings cycle influenced by power demand, production growth, and pricing realizations.

Core Earnings Variables

- Coal production growth

- Average realizations per tonne

- Linkage demand from power utilities

- Transportation and logistics efficiency

As infrastructure spending increases, power demand tends to rise. This indirectly supports coal volumes and improves earnings stability for coal-producing PSUs.

Dividend Cycles and Fiscal Alignment

One of the defining characteristics of PSU energy companies is their strong dividend payout cycles. These dividends serve two purposes:

- Provide stable income to shareholders

- Contribute directly to government fiscal revenues

In periods of strong commodity prices, PSU energy companies typically increase dividend payouts. This creates a self-reinforcing capital-flow cycle:

- Higher commodity prices → higher PSU profits

- Higher profits → larger dividend payouts

- Larger dividends → increased institutional demand

- Increased demand → higher stock prices

Budget-driven fiscal discipline further encourages consistent dividend payouts from profitable PSUs.

Valuation Gap vs Private Peers

Historically, PSU energy companies have traded at significant valuation discounts compared with private-sector peers. However, this valuation gap has narrowed in recent years due to improved earnings visibility and higher institutional participation.

Key Valuation Drivers

- Dividend yield advantage

- Stable cash flows

- Policy continuity

- Commodity price trends

Despite the re-rating, many PSU energy stocks continue to trade at lower price-to-earnings multiples compared with private-sector companies with similar earnings profiles.

Global Macro and Commodity Linkages

PSU energy earnings are closely linked to global commodity cycles. Three major macro factors influence the sector:

1. Global Oil Demand

Economic growth in major economies affects global oil demand, influencing crude prices and upstream earnings.

2. Interest-Rate Cycles

Higher global interest rates tend to favor high-dividend sectors such as PSU energy, as investors seek stable income streams.

3. Currency Movements

The rupee-dollar exchange rate impacts both upstream realizations and downstream import costs.

Sector Capital Rotation Patterns

Over the past two years, institutional capital has rotated into PSU energy stocks during three specific market conditions:

- Periods of global uncertainty

- High interest-rate environments

- Commodity up-cycles

Conversely, capital tends to rotate out of PSU energy stocks when:

- Growth sectors outperform

- Commodity prices decline sharply

- Policy risks increase

Budget 2026’s emphasis on fiscal discipline and infrastructure spending supports continued allocation toward the sector.

Key Sector Risks

Despite strong structural drivers, the PSU energy sector faces several risks that could influence capital flows.

- Sharp decline in crude oil or coal prices

- Government intervention in fuel pricing

- Lower-than-expected dividend payouts

- Global economic slowdown

- Accelerated renewable-energy transition

FY26 Institutional Outlook

The Energy & PSU sector enters FY26 with supportive macro conditions, stable commodity prices, and strong dividend visibility. Institutional flows are likely to remain linked to dividend payouts, earnings stability, and policy continuity.

Key structural supports include:

- High dividend yields across PSU energy companies

- Strong balance sheets and cash-flow generation

- Government focus on energy security

- Infrastructure-led demand growth

While near-term performance may fluctuate with commodity cycles, PSU energy stocks are likely to remain a core defensive allocation theme for institutional investors during FY26.