Buy Symphony:

Due to the increasing demand for more energy-efficient cooling solutions, Symphony Limited has become a market leader in the air cooler sector. In order to help those interested in making the most of the growing consumer durables market in India, this blog explores the reasons why investing in Symphony shares could be lucrative.

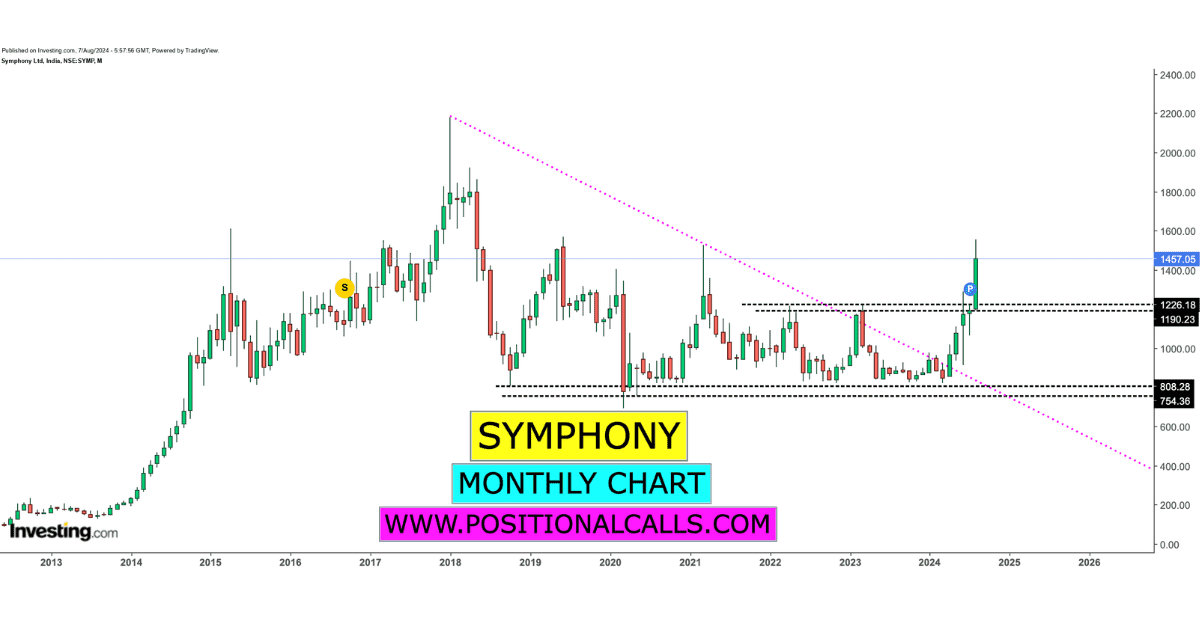

BUY SYMPHONY STOCK IN DIPS NOW 1440-1450

SUPPORT 1090

TARGET 2100+

VIEW: SHORT TO LONG TERM

Buy Symphony: Company Overview

Symphony Limited, one of the most well-known air cooler manufacturers, primarily supplies goods to the industrial, commercial, and residential markets. Since its founding in 1988, the business has expanded to become the world’s biggest producer of air coolers. The company distributes its products widely across more than sixty nations. Symphony has been able to maintain its competitive advantage in the market thanks to its commitment to both innovation and quality.

Buy Symphony: Excellent financial performance

♣Symphony consistently produces industry-leading revenue reports. In the latest fiscal year, the company reported ₹11.32 billion in revenue. Company profits have risen in recent years. Climate change and rising temperatures are driving demand for energy-efficient cooling solutions.

♣The company’s 10.15% profit margin and 19.76% return on equity (ROE) demonstrate its profitability. These numbers show that Symphony is controlling costs to maximise profitability and revenue.

♣Symphony’s stock has a 54.12 P/E ratio, higher than the industry average of 93.91. Several valuation metrics are appealing. Despite its higher valuation, investors still value the stock due to its strong fundamentals and growth potential.

Buy Symphony: Market dominance and competitive advantage

♥Symphony offers personal, desert, and commercial air coolers. Because of its wide range of products, the company can meet a variety of consumer needs and preferences, expanding its market.

♥The company’s Indian distribution network includes over 30,000 dealers and 1,000 distributors. Symphony’s broad reach makes its products accessible to customers, boosting sales.

♥Symphony prioritises innovation and R&D to improve its products. Advanced cooling technologies and energy-efficient models help the company compete in a tough market.

Buy Symphony: Development Potential

Air coolers will be in high demand as temperatures rise and more people move to cities. Symphony is a beneficial investment because it can capitalise on this trend.

♥The company is actively seeking ways to expand its product line and enter new markets. This calculated market share growth may lead to increased revenue in the future.

♥Environmental management activities Symphony prioritises sustainability and energy efficiency to keep its products compliant with the global green movement. Environmental concerns guide their product design. Environmentalists may base their purchases on sustainability.

Buy Symphony: The Methodology Test

Technically, Symphony’s shares show promising signs, including:

♦Support and Resistance Levels:

The stock has established support at ₹820 and resistance at ₹1,290. A breakout above this resistance level could signal a bullish trend, making it a favorable investment.

Symphony’s stock is above its 200-day and 50-day moving averages, indicating momentum. The stock price may rise due to this pattern.

♦Volume patterns suggest investors are interested in Symphony as trade volume rises. The strong correlation between rising prices and market trading causes people to be optimistic.

♦Financial investment advice

The following factors, according to our thorough business research, support the acquisition of Symphony Limited:

♦The company’s strong financial performance, reasonable valuation, and growth potential make it a worthy investment. The company’s growth potential and attractiveness serve as solid foundations.

♦Market Demand:

Symphony’s strategic initiatives and rising demand for energy-efficient cooling solutions position it for growth.

♦Technical Signs of Rising Technical analysis supports a bullish outlook with rising prices and trading volumes.

READMORE: Nifty Metal Looking Weak: Analysing the Current Trends and Future Outlook

Buy Symphony: Final Thoughts:

Symphony Limited may benefit from diversifiers. This stock has a solid financial foundation, room to grow, and favourable technical indicators for the coming months.

Before investing, investors should research and assess their risk tolerance. Visit Positional Calls for market updates. They provide accurate stock market data. This provides more information and advice.