Buy CGCL in 2025: Capri Global Capital Share Price Analysis, Targets & Risk View

Educational Disclosure: This page is an analytical and educational review based on publicly available financial data and observed market structure. It does not constitute investment advice or a solicitation to buy or sell securities.

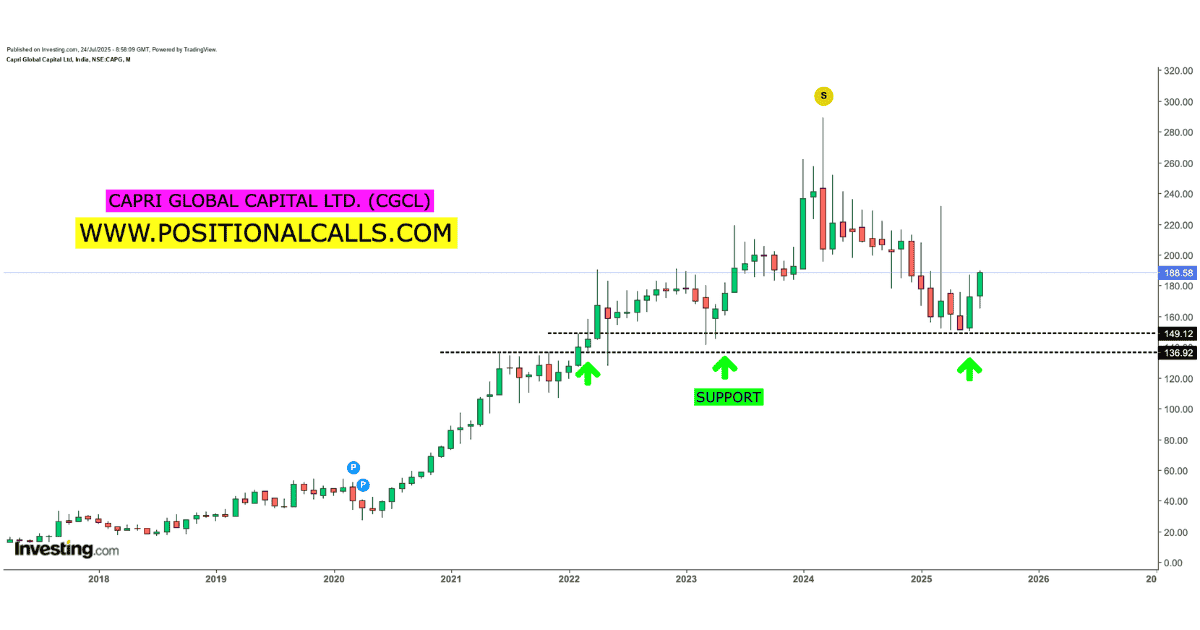

CGCL Market Snapshot (Observed Levels)

Stock:

Capri Global Capital Limited (CGCL)

Observed Price Range:

₹180 – ₹185

Structural Support Zone:

₹150 – ₹160

Observed Upside Reference:

₹290

Time Horizon:

Short-term to Medium-term (contextual view)

Buy CGCL in 2025: Company Overview: Capri Global Capital Limited

Capri Global Capital Limited (CGCL) is an Indian NBFC focused on gold loans, MSME lending, housing finance, and construction finance. The company operates with a diversified lending model aimed at under-penetrated credit segments, supported by rapid branch expansion and technology-driven collection systems.

- Market Capitalisation:

~₹17,500 crore - Branch Network:

1,100+ branches across India - Core Segments:

Gold Loans, MSME Loans, Housing Finance

Buy CGCL in 2025: Why CGCL Is Closely Watched in 2025

1. Strong AUM Expansion

- AUM growth ~46% YoY

- Gold loan segment growth exceeding 100% YoY

- Geographic diversification reducing concentration risk

2. Asset Quality & Risk Controls

- Collection efficiency ~99%

- Loan-to-Value (LTV) maintained near ~71%

- Low delinquency profile relative to sector peers

3. Analyst & Market Sentiment

- Broad analyst coverage remains constructive

- Medium-term technical structure remains supportive above long-term averages

Buy CGCL in 2025: Technical Structure (Non-Predictive)

Observed price behaviour shows CGCL trading above its long-term moving averages, indicating accumulation support. Momentum indicators such as MACD and long-term moving averages remain positive, while short-term volatility should be expected.

- Support Reference:

₹150–₹160 - Resistance Reference:

₹290

Key Risks to Monitor

- High price volatility relative to benchmark indices

- Rising cost of funds impacting margins

- Promoter holding reduction (to be tracked)

- Regulatory changes affecting NBFC lending norms

🔹 Additional Context: Business Model Strength of CGCL

Capri Global Capital Limited operates with a diversified NBFC business model that reduces dependence on any single lending vertical. Unlike mono-line lenders, CGCL distributes its exposure across gold loans, MSME financing, affordable housing loans, and construction finance. This diversification helps cushion earnings during cyclical slowdowns in individual segments and improves balance-sheet resilience over time.

The company’s focus on under-served and under-banked borrowers provides access to higher-yield opportunities, while internal risk controls aim to contain asset-quality deterioration. This combination of yield optimization and credit discipline is a key reason CGCL continues to attract market attention despite operating in a competitive NBFC environment.

🔹 Funding Profile and Balance Sheet Considerations

CGCL’s funding mix consists of bank borrowings, market instruments, and structured financing, allowing flexibility across interest-rate cycles. While rising funding costs remain an industry-wide concern for NBFCs, CGCL has demonstrated an ability to partially offset margin pressure through scale benefits, operating leverage, and selective repricing of loan products.

Investors tracking the stock should monitor trends in cost of funds, net interest margin (NIM), and incremental borrowing rates, as these metrics directly influence profitability sustainability over the medium term.

🔹 Regulatory Landscape and Compliance Position

The NBFC sector in India operates under evolving regulatory oversight from the Reserve Bank of India. CGCL’s business expansion has remained aligned with regulatory norms related to capital adequacy, provisioning, and loan-to-value ratios, particularly in the gold loan segment.

Regulatory compliance is a critical variable for long-term stability, and CGCL’s ability to adapt its lending practices in response to policy changes will play a key role in determining future growth consistency.

🔹 Medium-Term Growth Visibility

Management guidance and publicly stated objectives indicate an emphasis on controlled but scalable growth. The targeted expansion of branches, coupled with digital onboarding and collection systems, is designed to improve operational efficiency while maintaining asset quality.

If execution remains disciplined, CGCL’s medium-term growth trajectory could remain structurally intact, supported by demand from MSMEs, housing finance needs, and secured lending products such as gold loans.

🔹 Investor Suitability Framework

CGCL may be suitable for investors who:

Are comfortable with moderate to high volatility

Prefer growth-oriented NBFC exposure

Track quarterly fundamentals and regulatory signals

Maintain a medium-term to long-term investment horizon

Conversely, risk-averse investors seeking low-volatility or defensive assets may find CGCL unsuitable due to sector sensitivity and price fluctuations.

🔹 Final Perspective (System-Aligned)

Capri Global Capital Limited represents a growing NBFC platform operating at the intersection of credit expansion and financial inclusion. Observed price behaviour, balance-sheet growth, and business diversification explain why CGCL remains on investor watchlists in 2025.

However, outcomes will continue to depend on execution discipline, funding conditions, regulatory stability, and broader credit-cycle dynamics. Investors should rely on continuous monitoring of disclosures rather than short-term price movements when forming independent views.

Buy CGCL in 2025: Long-Term Business Direction

CGCL has articulated an AUM expansion roadmap toward ₹50,000 crore by FY28. Execution discipline, funding cost management, and asset quality will remain critical variables influencing long-term outcomes.

Conclusion

Capri Global Capital Limited represents a high-growth NBFC with expanding reach, improving operating metrics, and strong market attention in 2025. While volatility remains elevated, structural growth drivers and disciplined risk management position CGCL as a closely tracked stock across short- to medium-term investment frameworks.

Readers are advised to track quarterly disclosures, funding costs, and regulatory developments before forming independent decisions.

This content is strictly informational and educational.

READ MORE: Subros Share Buy Recommendation 2025: In-Depth Analysis & Long-Term Investment Insights