Bajaj Auto Buy Recommendation 2025: Market Structure, Earnings & Risk Analysis

Bajaj Auto Share Price Context 2025–2026: Market Structure, Earnings & Risk Framework

Bajaj Auto is a large-cap automobile manufacturer with significant exposure to exports, premium motorcycles, three-wheelers, and electric mobility. This page documents observed price behaviour, disclosed financial performance, sector positioning, and structural risk factors based on publicly available data. All references are informational in nature and do not constitute investment advice.

📊Bajaj Auto Buy Recommendation 2025:Business & Sector Positioning (Observed)

- Global leader in three-wheelers with dominant domestic market share.

- Exports contribute a material portion of volumes, providing diversification beyond domestic demand.

- Premium motorcycle portfolio and international partnerships support margin resilience.

- Electric mobility initiatives (Chetak EV, e-mobility) represent an emerging growth segment.

📊Bajaj Auto Q3 results analysis: Earnings Snapshot — Q3 FY25 (Latest Disclosed)

- Total Income: ₹16,310 crore (+19.6% YoY)

- EBIT: ₹3,920 crore (+23.1% YoY)

- Net Profit: ₹2,122 crore (+53.2% YoY)

- EBIT Margin: ~24.0%

- Net Margin: ~13.0%

The earnings profile reflects operating leverage benefits, export mix stability, and improved product realisation.

📊 Trailing Twelve Month (TTM) Financial Context

- Revenue: ~₹54,680 crore

- Net Profit: ~₹8,330 crore

- EPS: ~₹298

- ROCE: ~28%

- ROE: ~23%

Capital efficiency metrics remain among the strongest within the listed auto universe.

📊 Valuation Reference (Dec 2025)

- Price Range Observed: ₹9,100–₹9,250

- P/E (TTM): ~30.5x

- P/B: ~7.2x

- Dividend Yield: ~2.3%

- Market Capitalisation: ~₹2.54 lakh crore

The valuation reflects premium positioning supported by margins, exports, and balance sheet strength.

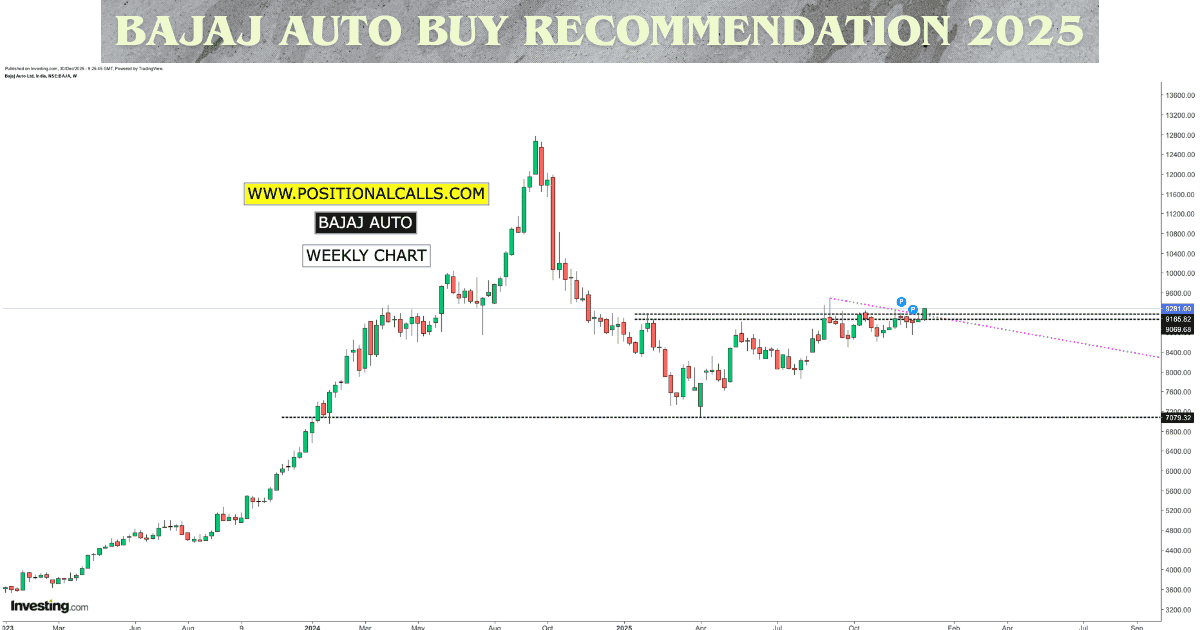

📉 Price Structure & Technical Context (Observed)

- Intermediate Support Zone: ₹8,900–₹8,950

- Structural Support Zone: ₹8,400–₹8,500

- Supply Zone: ₹9,400–₹9,500

- Upper Reference Zone: ₹9,800–₹10,000

Price action remains above major moving averages, indicating a constructive intermediate structure, subject to broader market conditions.

📊 Technical Indicators (Non-Predictive)

- Trend: Price above 50, 100, and 200-day averages

- RSI: ~60–65 (positive momentum, not extended)

- MACD: Positive crossover

- Volume: Higher participation on upward price movement

📊Bajaj Auto Buy Recommendation 2025: Sales Performance Snapshot

- Domestic two-wheeler volumes show gradual recovery.

- Export volumes provide earnings stability.

- Three-wheeler and EV segments remain incremental contributors.

⚠️ Risk & Stress Framework

- Domestic demand cyclicality

- Competitive pressure in premium motorcycles

- Electric vehicle execution risk

- Currency and global macro exposure

- Valuation sensitivity to earnings variance

📌 Institutional Context & Information Scope

This page is designed as a market reference document capturing observed price structure, financial disclosures, and sector context for Bajaj Auto during the 2025–2026 period. All figures are sourced from publicly available information. No forward-looking assurance or investment recommendation is implied.

READ MORE: Tech Mahindra Share Price Target 2026: Market Structure, Q3 Results & Risk Analysis

Institutional Context & Interpretation Framework

This page is designed to present a consolidated view of Bajaj Auto’s publicly available financial disclosures, observed price structure, and sector positioning during the 2025–2026 period. All figures, price zones, and indicators referenced are historical or observational in nature and are included to help readers understand how earnings performance, valuation, and market structure interact over time. No forward-looking certainty, performance guarantee, or investment recommendation is implied. Readers should treat this analysis as a reference document for market understanding rather than as guidance for trading, investing, or portfolio allocation decisions.

Disclaimer: This content is for educational and informational purposes only and does not constitute investment advice.