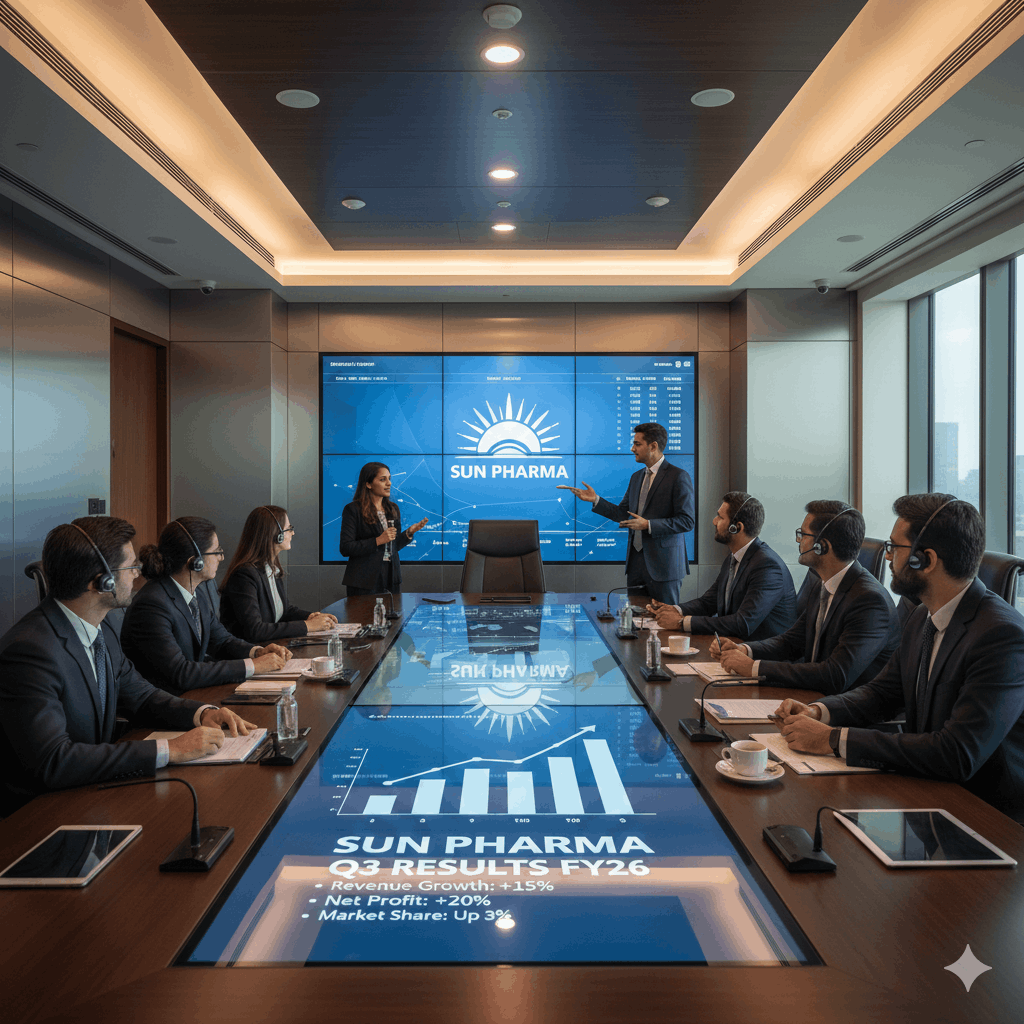

Sun Pharma Q3 Results FY26: Net Profit at ₹2,523 Crore; Revenue at ₹12,146 Crore

Sun Pharmaceutical Industries reported its Q3 Results FY26 with steady revenue growth and margin expansion, supported by continued strength in specialty products and stable performance across domestic and international formulations. The quarter reflects the company’s strategic shift toward high-margin specialty therapies, improved product mix, and operational efficiencies across global markets.

Quarter: Q3 FY26

Revenue: ₹12,146 crore

Net Profit: ₹2,523 crore

EBITDA: ₹3,478 crore

EBITDA Margin: 28.6%

Table of Contents

- Key Highlights

- Financial Performance

- Profitability and Margin Trends

- Segment Performance

- Geographic Revenue Mix

- Specialty Business Growth

- India Formulations Performance

- US Generics Environment

- Operational Drivers

- Cost Structure and Margin Dynamics

- R&D Investments and Product Pipeline

- Capital Allocation and Cash Flow

- Industry Demand Environment

- Global Pharma Cycles

- Capital-Flow Impact

- Valuation Context

- Institutional Positioning

- Risks to Outlook

- Medium-Term Growth Drivers

- Outlook for FY26–FY27

Key Highlights

- Revenue at ₹12,146 crore in Q3 FY26.

- Net profit at ₹2,523 crore.

- EBITDA at ₹3,478 crore.

- EBITDA margin expanded to 28.6%.

- Specialty segment continues to drive margin expansion.

Financial Performance

| Metric | Q3 FY26 | Q3 FY25 | Change |

|---|---|---|---|

| Revenue | ₹12,146 crore | ₹11,232 crore | +8.1% |

| Net Profit | ₹2,523 crore | ₹2,278 crore | +10.8% |

| EBITDA | ₹3,478 crore | ₹3,061 crore | +13.6% |

| EBITDA Margin | 28.6% | 27.3% | +1.3 ppt |

The company delivered steady revenue growth and improved profitability, driven by specialty products and stable performance in domestic and emerging markets.

Profitability and Margin Trends

EBITDA margins expanded to 28.6% during the quarter, reflecting a favorable product mix and operational efficiencies. Margin expansion was primarily driven by higher contribution from specialty products and stable raw material costs.

Pharmaceutical companies typically experience margin cycles driven by product launches, pricing dynamics, and raw material cost movements. In Sun Pharma’s case, the shift toward specialty products has structurally improved margins over the past few years.

Sun Pharma Q3 Results FY26: Segment Performance

Sun Pharma operates across several segments:

- Specialty therapies

- India branded formulations

- US generics

- Rest-of-world markets

- Active pharmaceutical ingredients (APIs)

Among these, specialty therapies and India formulations remain the primary margin drivers.

Sun Pharma Q3 Results FY26: Geographic Revenue Mix

- US: Largest revenue contributor

- India: Second-largest market

- Rest of World: Emerging market growth driver

The company’s diversified geographic exposure reduces dependence on any single market and provides stability across economic cycles.

Sun Pharma Q3 Results FY26: Specialty Business Growth

The specialty segment remains the most important growth driver for Sun Pharma.

Specialty products typically offer:

- Higher margins than generics

- Lower competitive intensity

- Longer product life cycles

Dermatology and ophthalmology therapies continue to contribute significantly to profitability.

India Formulations Performance

The domestic business delivered steady growth during the quarter, supported by:

- Strong chronic therapy demand

- Distribution expansion

- Improved product mix

India formulations remain one of the highest-margin segments for the company.

Sun Pharma Q3 Results FY26: US Generics Environment

The US generics market continues to face structural pricing pressure due to:

- High competition

- Buyer consolidation

- Regulatory pressures

However, Sun Pharma’s diversified portfolio and focus on specialty therapies help mitigate these pressures.

Sun Pharma Q3 Results FY26: Operational Drivers

Key drivers of performance during the quarter included:

- Growth in specialty portfolio

- Stable India formulations demand

- Operational efficiency improvements

- Improved product mix

Cost Structure and Margin Dynamics

Margins improved due to:

- Higher share of specialty products

- Operational efficiencies

- Stable input costs

Pharma margins are influenced by:

- Product mix

- Pricing environment

- R&D investments

- Regulatory costs

R&D Investments and Product Pipeline

Sun Pharma continues to invest in research and development to strengthen its specialty pipeline.

R&D investments are focused on:

- Specialty therapies

- Complex generics

- New product launches

Strong R&D pipelines are critical for long-term growth in the pharmaceutical sector.

Capital Allocation and Cash Flow

Strong operating cash flows allow the company to:

- Invest in specialty R&D

- Maintain financial flexibility

- Pursue strategic acquisitions

Industry Demand Environment

The global pharmaceutical industry is driven by structural demand factors such as:

- Ageing populations

- Rising chronic disease prevalence

- Increasing healthcare spending

These structural drivers provide long-term demand visibility for pharmaceutical companies.

Global Pharma Cycles

Pharma demand is less cyclical than most industries, but profitability is influenced by:

- Drug pricing trends

- Regulatory approvals

- Patent expiries

- Product launches

Capital-Flow Impact

Pharma stocks often attract institutional capital during:

- Defensive market phases

- Global growth uncertainty

- Healthcare demand cycles

Sun Pharma remains a core allocation in healthcare portfolios.

Valuation Context

Sun Pharma typically trades at a premium within the pharma sector due to:

- Strong specialty portfolio

- High margin profile

- Global presence

- Stable cash flows

Institutional Positioning

Institutional investors allocate capital to pharma companies based on:

- Defensive earnings profile

- Global revenue exposure

- Margin stability

Sun Pharma is one of the largest pharmaceutical holdings in institutional portfolios.

Risks to Outlook

- US generics pricing pressure

- Regulatory risks

- Currency fluctuations

- Delayed product approvals

Medium-Term Growth Drivers

- Specialty product launches

- Chronic therapy growth

- Expansion in emerging markets

- New product approvals

Outlook for FY26–FY27

The company’s medium-term outlook remains supported by specialty portfolio expansion, stable India formulations demand, and new product launches.

Specialty therapies are expected to remain the primary margin and growth driver over the next few years.