Pharma Sector Outlook 2026: 5 Positive Drivers Powering Exports, Margins, and Specialty Growth

Pharma Sector Outlook 2026 indicates a stable-to-positive growth phase driven by export demand, specialty drug pipelines, and improving margins across major pharmaceutical companies. The sector continues to benefit from global healthcare demand, currency tailwinds, and structural shifts toward complex generics and specialty therapies.

Institutional investors are closely tracking US market trends, regulatory approvals, product launches, and margin expansion across leading pharma companies. The sector remains a key defensive allocation with long-term structural growth drivers.

Pharma Sector Snapshot FY26

| Metric | Trend | Sector Impact |

|---|---|---|

| US Generics Demand | Stable | Revenue visibility |

| Specialty Drug Launches | Rising pipeline | Margin expansion |

| API and CDMO Demand | Growing | Export opportunities |

| Currency Trend | Stable to supportive | Export earnings tailwind |

Source: Company filings, industry data, and regulatory disclosures

Table of Contents

- Key Sector Highlights

- Global Demand Drivers

- US Generics Market Outlook

- Specialty and Complex Generics Growth

- API and CDMO Opportunity

- Domestic Pharma Market Trends

- Margin Outlook

- Valuation and Institutional Positioning

- Capital-Flow Impact

- Key Risks to the Sector

- Outlook for 2026

- Institutional Strategy View

- Internal Links

- External Links

Pharma Sector Outlook 2026: Key Sector Highlights

- Stable export demand supporting revenue growth.

- Specialty drug pipelines driving margin expansion.

- API and CDMO businesses gaining traction.

- Currency trends supporting export earnings.

- Defensive sector attracting institutional capital.

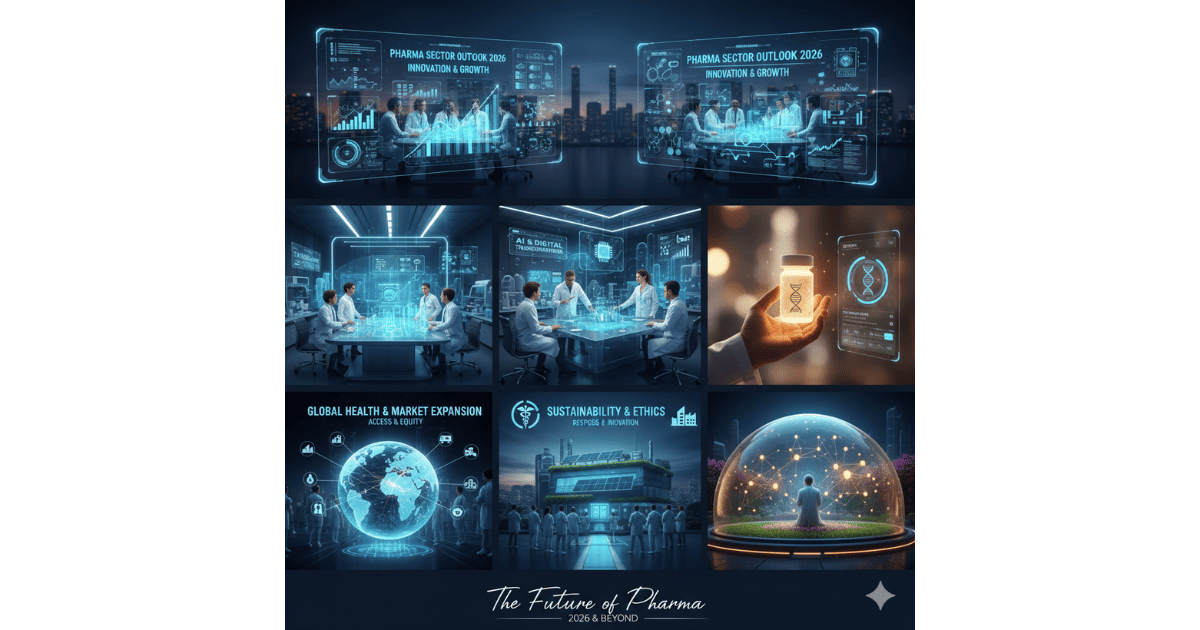

Pharma Sector Outlook 2026: Global Demand Drivers

The pharmaceutical sector is supported by structural global healthcare demand, aging populations, and rising chronic disease prevalence. Indian pharma companies continue to benefit from strong export markets, particularly in the United States and Europe.

Currency stability and global healthcare spending trends remain key factors influencing sector earnings.

Pharma Sector Outlook 2026: US Generics Market Outlook

The US generics market remains the largest export destination for Indian pharmaceutical companies. Stable pricing conditions and consistent demand are supporting revenue visibility.

Regulatory approvals and product launches remain key catalysts for growth in this segment.

Specialty and Complex Generics Growth

Indian pharma companies are increasingly focusing on complex generics, biosimilars, and specialty drugs. These products offer higher margins and longer product lifecycles compared to standard generics.

API and CDMO Opportunity

Active pharmaceutical ingredient (API) and contract development and manufacturing (CDMO) segments are witnessing strong global demand. Supply-chain diversification and localization trends are benefiting Indian manufacturers.

Domestic Pharma Market Trends

The domestic pharmaceutical market continues to grow steadily, supported by rising healthcare spending, improved access to medicines, and expansion in chronic therapies.

Margin Outlook

Operating margins are expected to improve as companies launch higher-value products and benefit from stable input costs. Specialty drugs and CDMO contracts are key margin drivers.

Valuation and Institutional Positioning

The pharma sector remains a defensive allocation for institutional investors, offering stable earnings visibility and export-driven growth. Valuations remain attractive compared to global peers in certain segments.

Capital-Flow Impact

| Segment | Outlook | Capital Direction |

|---|---|---|

| US Generics Players | Stable demand | Core allocations |

| Specialty Pharma | Higher margin growth | Selective inflows |

| API & CDMO | Structural export growth | Long-term allocations |

Institutional theme: Pharma remains a defensive sector with structural export and specialty growth drivers.

Key Risks to the Sector

- Regulatory actions or warning letters.

- Pricing pressure in US generics.

- Currency volatility.

- Delay in specialty product launches.

Outlook for 2026

The pharma sector is expected to deliver stable growth in FY26, supported by export demand, specialty drug launches, and improving margins. Defensive sector positioning may continue to attract institutional capital.

Institutional Strategy View

Institutional investors are likely to maintain selective exposure to pharma stocks, focusing on companies with strong regulatory track records, specialty pipelines, and export-driven earnings.