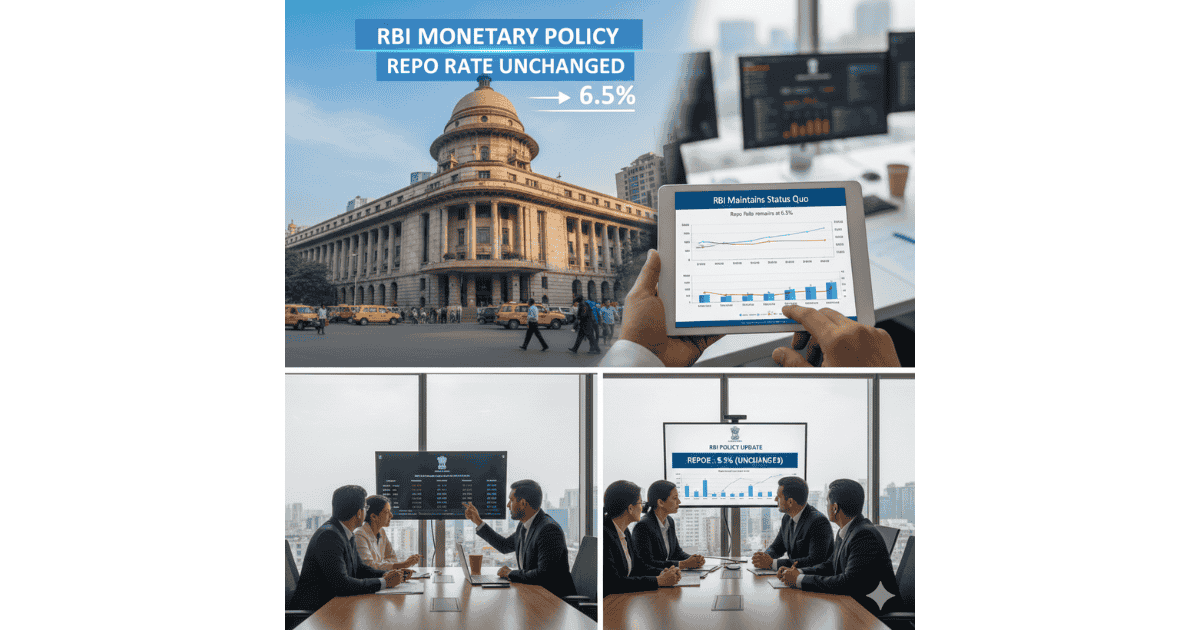

RBI Repo Rate Unchanged; NBFC Exemption and Cyber Fraud Norms Proposed

RBI repo rate unchanged in the latest monetary policy review, as the central bank maintained its current stance while proposing regulatory relief for smaller NBFCs and introducing draft norms to combat cyber frauds across the financial system.

LIVE MARKET DESK – RBI POLICY UPDATE

- Event: RBI keeps repo rate unchanged in latest policy review.

- Capital Impact: Stable rate environment supports credit growth and lending sentiment.

- Sector Effect: Positive for banks, NBFCs, housing finance; neutral to cautious for fintech due to cyber norms.

- Key Numbers: Repo rate unchanged; NBFC exemption threshold at ₹1,000 crore assets.

- Market Sentiment: Neutral to mildly positive as policy stability supports valuations.

- Immediate Outlook: Credit-sensitive sectors likely to remain stable; focus shifts to growth and inflation data.

RBI Repo Rate Unchanged: Decision and Regulatory Proposals

The Reserve Bank of India maintained the repo rate at its current level, signaling policy stability amid a balanced inflation and growth outlook. The central bank refrained from any rate changes, indicating comfort with the current macroeconomic trajectory.

Alongside the rate decision, the RBI proposed a regulatory exemption for smaller non-banking financial companies (NBFCs) with assets below ₹1,000 crore. The move is aimed at reducing compliance burdens and enabling smaller lenders to expand credit penetration in underserved markets.

The central bank also released draft norms focused on cyber fraud prevention. These measures are intended to strengthen the digital financial ecosystem and improve systemic resilience as online transactions continue to grow.

Source: Reserve Bank of India policy statement.

Capital Flow Direction After RBI Policy

- Positive: Banking and NBFC stocks benefit from stable interest rate expectations.

- Positive: Smaller NBFCs may attract investor interest due to regulatory relief.

- Neutral: Fintech firms face higher compliance costs but gain long-term trust benefits.

- Caution: Short-term margin pressure possible from increased cybersecurity spending.

- Banking sector – stable rate environment supports credit growth.

- Small and mid-sized NBFCs – potential regulatory relief.

- Microfinance lenders – improved operating flexibility.

- Fintech companies – higher cybersecurity compliance costs.

- Financial firms with weak digital infrastructure – upgrade expenses likely.

Market Reaction

Equity markets typically interpret a stable policy stance as supportive for valuations, particularly in credit-dependent sectors. Banking, housing finance, auto financing, and infrastructure-linked businesses tend to benefit from predictable borrowing costs.

Institutional sentiment remains neutral to positive, with investors focusing on growth trends and credit demand rather than immediate rate changes.

Key Institutional Takeaways

- Stable rate environment supports credit-sensitive sectors and equity valuations.

- NBFC exemption proposal may boost lending growth among smaller financial institutions.

- Cyber fraud norms increase compliance focus across banks, fintech, and digital payments ecosystem.

RBI Repo Rate Unchanged: Forward Outlook

The unchanged repo rate suggests the RBI is comfortable with current inflation trends and growth momentum. Markets will now track upcoming inflation data, credit growth trends, and global interest rate movements for further policy cues.

Regulatory changes for NBFCs could support financial inclusion and credit expansion, while cyber fraud norms are expected to strengthen long-term trust in India’s digital financial system.

Key Policy Metrics

| Metric | Status |

|---|---|

| Repo Rate | Unchanged |

| Policy Stance | Stable |

| NBFC Exemption Threshold | ₹1,000 crore assets |

| Cyber Fraud Norms | Draft guidelines issued |

Frequently Asked Questions

Why did the RBI keep the repo rate unchanged?

The central bank maintained rates to support stable growth while inflation trends remain manageable.

Which sectors benefit from a stable repo rate?

Banking, NBFCs, housing finance, auto financing, and infrastructure-linked sectors typically benefit from predictable borrowing costs.

What is the NBFC exemption proposal?

The RBI proposed regulatory relief for NBFCs with assets below ₹1,000 crore to reduce compliance burdens.

How do cyber fraud norms impact financial firms?

Banks, fintech companies, and payment platforms may need to increase cybersecurity investments to meet new compliance standards.

Related Institutional Developments

- Latest IPO and market analysis

- Recent banking sector developments

- Macro policy and credit growth trends