Shayona Engineering IPO GMP Today

⚡ LIVE IPO UPDATE (25 January 2026)

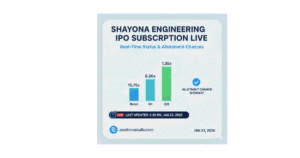

• Shayona Engineering IPO continues to witness selective investor interest with stronger participation from NII/HNI investors.

• Grey Market Premium (GMP) remains at ₹0, reflecting cautious sentiment in the SME market.

• Retail demand is improving slowly but remains moderate due to high ticket size.

• SME IPOs historically see maximum bidding on the final day.

Market Insight: If overall subscription crosses 4x–7x by closing day, listing sentiment may improve. Otherwise, listing gains are likely to remain flat or limited.

📌 Shayona Engineering IPO Snapshot

| Parameter | Details |

|---|---|

| Company Name | Shayona Engineering Limited |

| Issue Type | SME IPO – 100% Fresh Issue |

| Issue Size | ₹14.86 Crore |

| Total Shares Offered | 10,32,000 Shares |

| Price Band | ₹140 – ₹144 per share |

| Lot Size | 1,000 Shares |

| Minimum Investment | ₹2,88,000 (2 Lots) |

| IPO Open Date | 22 January 2026 |

| IPO Close Date | 27 January 2026 |

| Listing Date (Expected) | 30 January 2026 |

| Exchange | BSE SME |

| Registrar | KFin Technologies Limited |

| Lead Manager | Horizon Management Private Limited |

| Post-IPO Market Capitalisation | ₹95–110 Crore (Estimated) |

📊 GMP Overview Dashboard (25 Jan 2026)

| Metric | Today | Yesterday | Change | Interpretation |

|---|---|---|---|---|

| GMP (₹) | ₹0 | ₹0 | – | Neutral |

| Kostak (₹) | ₹0 | ₹0 | – | No Activity |

| Subject to Sauda (₹) | ₹0 | ₹0 | – | Stable |

| Estimated Listing Price | ₹140 – ₹145 | ₹140 – ₹145 | – | Near Issue Price |

| Expected Premium | 0% to +3% | 0% to +3% | – | Flat to Mild Gain |

📈 GMP Trend Table

| Day | Date | IPO Price | GMP (₹) | Estimated Listing Price |

|---|---|---|---|---|

| Today | 25 Jan 2026 | ₹144 | ₹0 | ₹140 – ₹145 |

| Day -1 | 24 Jan 2026 | ₹144 | ₹0 | ₹140 – ₹145 |

| Day -2 | 23 Jan 2026 | ₹144 | ₹0 | ₹140 – ₹145 |

| Day -3 | 22 Jan 2026 | ₹144 | ₹0 | ₹140 – ₹145 |

📊 GMP vs Subscription Matrix (SME Reality Model)

| Overall Subscription | Typical GMP Range | Likely Listing Sentiment |

|---|---|---|

| < 3x | ₹0 to -₹10 | Flat / Discount Listing |

| 3x – 10x | ₹0 to ₹15 | Flat to Mild Premium |

| 10x – 30x | ₹15 to ₹35 | Moderate Premium |

| 30x+ | ₹40+ | Strong Bullish Listing |

📊 Listing Scenario Table

| Scenario | GMP Range | Likely Listing Price | Investor Strategy |

|---|---|---|---|

| Bullish | ₹30+ | ₹160 – ₹190 | Hold / Partial Profit Booking |

| Neutral | ₹0 to ₹15 | ₹138 – ₹150 | Wait & Watch |

| Bearish | Negative | ₹120 – ₹138 | Avoid / Exit |

📊 Key Valuation & Financial Ratios (Approx)

| Metric | Value |

|---|---|

| EPS (FY25) | ₹8.9 – ₹9.8 (Approx) |

| Post-IPO P/E | ~14.5x – 16.5x |

| ROE | ~17% – 20% |

| Debt-to-Equity Ratio | ~1.6x – 1.9x |

| P/B Ratio | ~1.8x – 2.2x |

📊 Risk Reality Check

| Risk | Reason | Investor Implication |

|---|---|---|

| Flat GMP | Muted SME sentiment | Limited listing upside |

| High Debt | Capital-intensive business | Pressure on margins |

| Customer Concentration | Limited major clients | Earnings volatility risk |

| SME Liquidity Risk | Low trading volumes | Higher volatility post-listing |

📌 Live Subscription: 👉 Live Subscription Status

🔹 FAQs

Q1: Is Shayona Engineering IPO GMP reliable?

A: GMP is an unofficial indicator of short-term sentiment and should not be used as the sole investment decision factor.

Q2: What is the price band and lot size?

A: Price band is ₹140–₹144. Minimum application is 2 lots (2,000 shares) worth ₹2.88 lakh.

Q3: When is the listing date?

A: Expected listing date is 30 January 2026 on BSE SME.

🔹 FINAL TAKEAWAY (UPDATED)

The Shayona Engineering IPO GMP today remains at ₹0, indicating cautious grey market sentiment. While the company shows improving revenue and profitability, high leverage and SME liquidity risks are limiting speculative demand. The decisive factor will be final-day subscription momentum.

DISCLAIMER: IPO investments involve market risks. Grey Market Premium (GMP) is unofficial and speculative. This content is for educational purposes only and does not constitute investment advice. Please consult a SEBI-registered advisor before investing.

READ MORE: Shayona Engineering IPO Analysis — Business, Valuation, Risks & Final Verdict