Buy Recommendation for Nifty Consumer Durables Index: 2025 Sector Analysis & Key Stocks:

Educational disclosure:

This page presents sector-level analysis based on publicly available information. It is not investment advice and does not constitute a recommendation to buy or sell securities.

Index Reference Context (Non-Advisory):

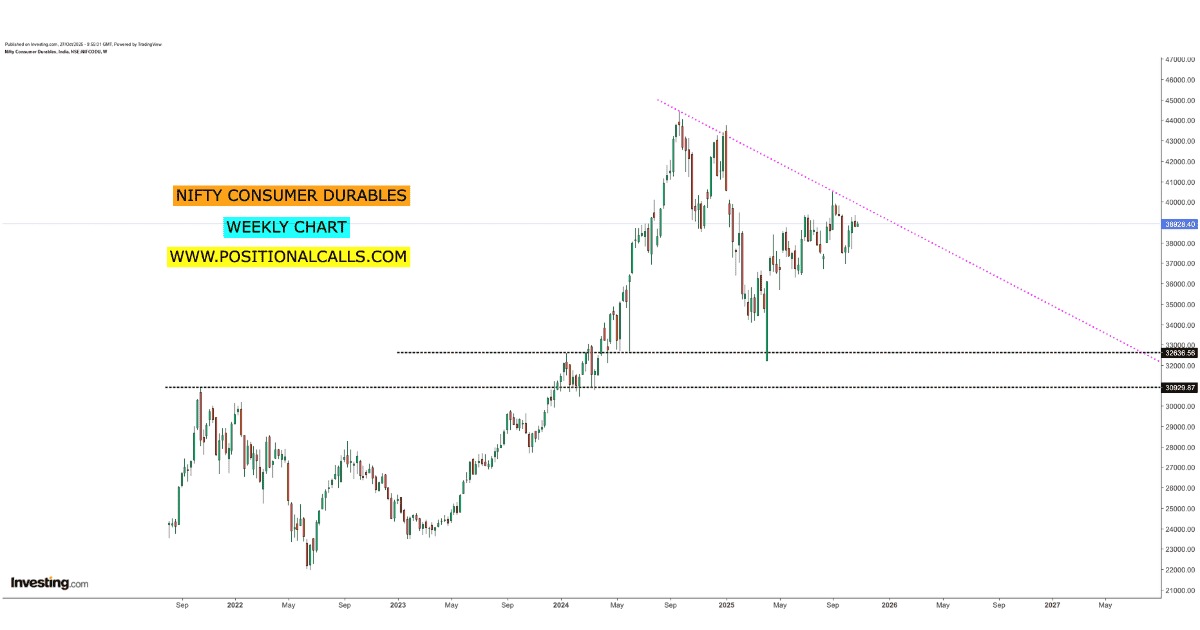

The sector tracked via Market participants continues to monitor this index for structural consumption trends in India.

Buy Recommendation for Nifty Consumer Durables Index: Introduction

The Consumer Durables sector represents one of the most structurally resilient segments of the Indian equity market. Rising disposable incomes, urbanisation, premiumisation, and aspirational consumption have positioned this sector as a long-term compounder rather than a purely cyclical play.

The Nifty Consumer Durables Index tracks leading companies across jewellery, electricals, appliances, cooling solutions, and lifestyle products—making it a key proxy for discretionary household spending.

Why the Nifty Consumer Durables Index Matters in 2025

Consumer durables differ from fast-moving consumer goods due to higher ticket sizes and replacement-driven demand. Despite this, the sector has demonstrated consistent resilience due to:

- Brand stickiness:

Established brands command pricing power - Replacement demand:

Air-conditioners, appliances, and electronics follow multi-year replacement cycles - Premiumization:

Shift toward higher-margin, feature-rich products - Urban & semi-urban expansion:

Penetration beyond Tier-1 cities

Key Constituents Driving the Index

Titan remains a dominant force across jewellery, watches, and eyewear. Its leadership in organised jewellery and continued retail expansion underpin long-term earnings visibility.

- Strong brand moat via Tanishq

- Consistent double-digit revenue growth over cycles

- High return ratios relative to peers

Voltas is closely linked to India’s cooling demand cycle. Rising temperatures, urban housing growth, and energy-efficient product adoption support long-term demand.

- Leadership in room air-conditioners

- Expansion into premium and smart cooling solutions

- Improving scale benefits

Havells represents electricals, cables, and appliances with a strong focus on design, branding, and distribution reach.

- Innovation-led product launches

- Pan-India retail network

- Consistent margin discipline

Whirlpool benefits from global technology transfer while catering to Indian price sensitivity and energy-efficiency norms.

- Appliance replacement demand

- Focus on energy-efficient products

- Urban and semi-urban penetration

Blue Star operates across commercial and residential cooling solutions, benefiting from infrastructure, climate, and lifestyle shifts.

- Strong commercial refrigeration presence

- Expanding residential portfolio

- Stable balance-sheet profile

Sector Performance & Data-Driven Observations

During 2025, the Nifty Consumer Durables Index outperformed several cyclical sectors, supported by domestic demand recovery and premium product mix.

- Index returns discussed in the ~18–22% annualised range

- Improving earnings visibility across major constituents

- Sector valuation supported by ROCE and brand moats

Institutional note: Consumer durables often trade at premium multiples due to earnings durability rather than short-term growth.

Buy Recommendation for Nifty Consumer Durables Index: Strategic Considerations for Sector Exposure

- Diversification:

Spread exposure across multiple index constituents - Earnings tracking:

Monitor quarterly margins, volume growth, and commentary - Policy tailwinds:

Energy-efficiency regulations and consumer incentives - Technical overlays:

Sector rotation, RSI, and relative strength vs Nifty 50

Buy Recommendation for Nifty Consumer Durables Index: Common Questions (FAQ)

Is the Consumer Durables sector suitable for long-term investors?

Historically, yes—due to brand power, replacement demand, and rising consumption.

What risks should investors monitor?

Demand slowdown, raw material cost inflation, and valuation compression during macro stress.

Does the sector depend heavily on economic cycles?

Less than capital goods, but more than FMCG, making it a hybrid cyclical-structural segment.

Authoritative External Reference

For official index methodology and data, refer to: NSE India – Consumer Durables Index

Related Internal Read

Game Changers Texfab IPO 2025: Full Analysis & Market Context

Conclusion

The Nifty Consumer Durables Index remains a structural representation of India’s aspirational consumption story. With leading companies demonstrating pricing power, innovation, and balance-sheet strength, the sector continues to attract long-term capital allocation interest.

Investors and market participants should focus on earnings quality, brand sustainability, and macro demand indicators rather than short-term price movements.