4 Key IPOs Set to Launch This Week:

Investing in Initial Public Offerings (IPOs) can be a lucrative opportunity for investors looking to capitalise on emerging companies. Major players in various industries are among the notable IPOs set to launch this week. Here is a detailed analysis of the four IPOs scheduled for this week, along with insights into their potential market impact.

4 Key IPOs Set to Launch This Week: Overview of Upcoming IPOs

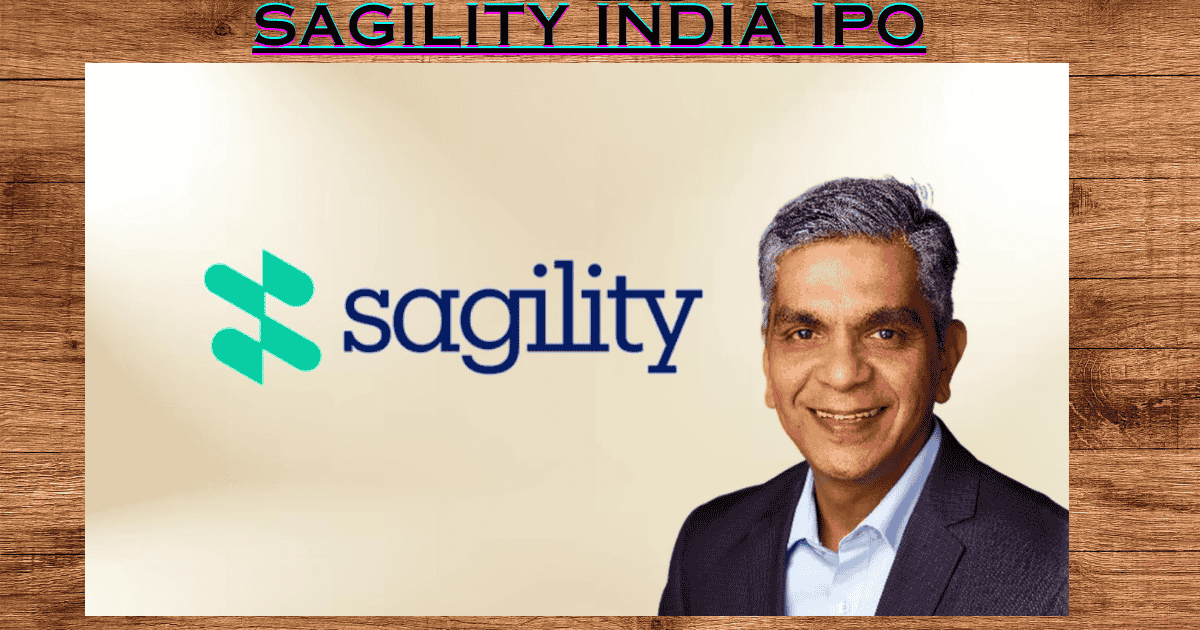

1. Sagility India IPO

- Opening Date:

November 5 - Closing Date:

November 7 - Issue Size:

₹2,107 crore - Price Band:

₹28-30 per share - Details:

This IPO consists entirely of an offer-for-sale of 70.2 crore equity shares by the promoter, Sagility BV. The company operates in the healthcare sector, providing technology and services that cater to healthcare providers.

2. Swiggy IPO

- Opening Date:

November 6 - Closing Date:

November 8 - Issue Size:

₹11,327 crore - Price Band:

₹371-390 per share - Details:

A significant player in the food delivery market, Swiggy’s IPO includes a fresh issuance of equity shares worth ₹4,499 crore and an offer-for-sale of 17.5 crore shares worth ₹6,828.4 crore. We highly anticipate this IPO given its established market presence and growth trajectory.

3. ACME Solar Holdings IPO

- Opening Date:

November 6 - Closing Date:

November 8 - Issue Size:

₹2,900 crore - Price Band:

₹275-289 per share - Details:

This IPO features a mix of fresh issues and an offer-for-sale by the promoter. ACME Solar is involved in renewable energy, particularly solar power projects, which positions it well in the growing green energy sector.

4. Niva Bupa Health Insurance IPO

- Opening Date:

November 7 - Closing Date:

November 11 - Issue Size:

₹2,200 crore - Details:

This offering includes a fresh issue of₹800 crore and an offer-for-sale of₹1,400 crore by its promoters. Niva Bupa is a key player in the health insurance market, making this IPO relevant given the increasing demand for health coverage.

Why Invest in These IPOs?

Investing in these IPOs can be attractive for several reasons:

- Growth Potential:

Companies like Swiggy and ACME Solar are positioned in rapidly expanding markets—food delivery and renewable energy—both of which are expected to see significant growth in the coming years. - Market Sentiment:

The general opinion of IPOs is still favorable, especially when they have strong business models and financial performance. - Diversification:

These offerings provide opportunities to diversify portfolios across different sectors such as technology, food services, renewable energy, and healthcare.

READ MORE: Swiggy IPO: A Golden Opportunity in India’s Food Tech Revolution

Conclusion

As these four IPOs prepare to hit the market this week, investors should conduct thorough research and consider their investment strategies carefully. Each company presents unique opportunities aligned with current market trends and consumer demands. By staying informed and proactive, investors can make educated decisions that align with their financial goals.